IMARC Group, a leading market research company, has recently released a report titled “Orphan Drugs Market Size, Share, Trends and Forecast by Drug Type, Disease Type, Phase, Top Selling Drugs, Distribution Channel, and Region, 2025-2033”. The study provides a detailed analysis of the industry, including the global orphan drugs market report, growth, size, and industry growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

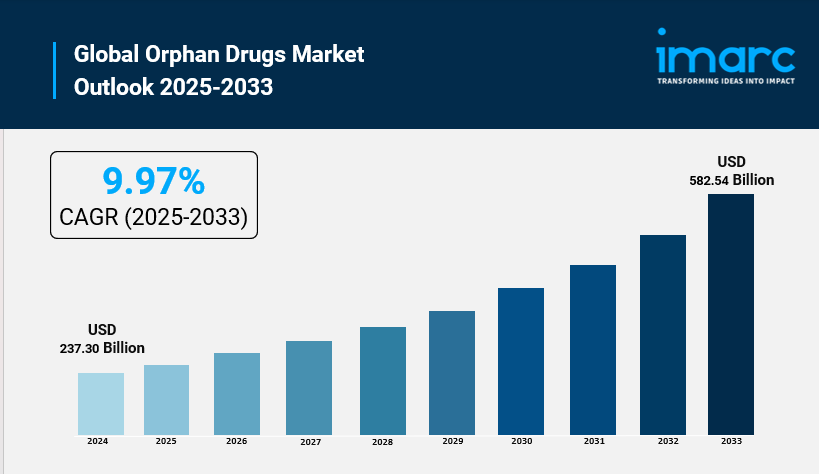

How Big Is the global orphan drugs market?

The global orphan drugs market size was valued at USD 237.30 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 582.54 Billion by 2033, exhibiting a CAGR of 9.97% from 2025-2033. North America currently dominates the market with 35.5% of the market share.

Increasing Prevalence of Rare Diseases and Rising Awareness

Rarity and occurrence of diseases world over due to which the market for drugs orphan has drastically grown. Almost all the need of targeted treatments has been dominated by the trend of medical research that keeps on identifying new genetic and rare disorders. Campaigns for raising awareness about rare diseases among people are being supported by governments and medical organizations, which not only help in better diagnosis but also in upgrading the patient’s registries. In 2025, increasing unmet medical needs and the urgency of giving effective therapeutic options to patients having limited alternatives is a major factor energizing the demand of orphan drugs. In addition, by the help of biotechnology and genomics, scientists have been able to make precision medicines that could target particular genetic mutations, and consequently, the orphan drug development gets its success rate. Pharmaceutical treatment infrastructures and diagnostic tools are providing more and more patients with access to health care services thereby the market for orphan drugs is booming not only in urban areas but also in the hinterlands.

Favorable Regulatory Policies and Incentives for Drug Developers

One of the reasons which have led to the market being identified as the top growth-oriented concentration area is the important role played by supportive government policies and regulations. The US FDA, EMA, and various other bodies based in different geographic locations are carriers of several incentives like tax credits, refund for application fees for new drugs, and longer exclusivity on the market which attract pharmaceutical firms to put more money in the rare disease research. These financial rewards do a significant job in enabling the drug producers to come up with more products despite high costs and risks in 2025. Besides, data submission, fast-tracking, and special status programs usually accelerate the process of getting the new product onboard. The synergy between regulatory agencies, patient support groups, and pharmaceutical companiesis turning out to be very beneficial for clinical trials and marketing efficiency. Whilst these encouraging instruments are indeed promoting innovations, they are also at the same time ensuring that the newest cures are obtainable by those patients who used to have very few or no options to choose from.

Growing Investment in Biopharmaceutical Research and Technological Advancements

Orphan drug development has been revolutionized by continuous innovative breakthroughs in biotechnology and a patient-tailored approach to medicine. Biopharmaceutical companies have also stepped up their commitment to the use of gene therapy, cell therapy, and biologics largely aiming at eventually curing the very root of the rare diseases rather than just providing relief to symptoms. In 2025, investors have become more willing to put money into research and development as the precision is greatly impacted and the number of steps that need highly specialized skills is considerably reduced thanks to the use of technologies such as CRISPR, AI-driven drug discovery, and big data analytics. The combination of a med school, a tiny startup of that branch, and the big pharmaceutical firm is very receptive to the idea of adapting quickly to market needs and thus, clinical trials will speed up considerably. Additionally, investors are more and more attracted to the potentials of niche markets that provide them with a steady long-run of profits. Financing and the use of technologies have not only opened up a new therapeutic pipeline but also turned the overall market into one that encourages long-term and patients improvements.

Orphan Drugs Market Trends 2025

The orphan drugs market is undergoing a great transformation as the use of personalized medicine and targeted therapeutics has increased significantly. The major change characterizing the industry in 2025 is the extensive utilization of advanced biotechnologies which include gene editing, RNA-based therapies, and monoclonal antibodies to treat complex rare disorders. Pharma companies are following the strategy of nailing down small patient pools but with high-value meds, the government pricing models and reimbursement programs are favorable for such an approach. The application of AI in drug discovery is also contributing to R&D processes becoming more efficient and success rates higher. What is more, global health organizations and pharmaceutical companies are now working together to ensure the availability of orphan drugs in low- and middle-income countries. Patient centric approaches such as decentralized clinical trials and digital monitoring tools have become quite popular too. The overall market is gearing towards more innovation, accessibility, and sustainability which shows a deep commitment to enhancing patients’ quality of life, who suffers from rare diseases.

Get your Sample of Orphan Drugs Market Insights for Free: https://www.imarcgroup.com/orphan-drugs-market/requestsample

Orphan Drugs Market Segmentation:

Analysis by Drug Type:

- Biological

- Non-Biological

Analysis by Disease Type:

- Oncology

- Hematology

- Neurology

- Cardiovascular

- Others

Analysis by Phase:

- Phase I

- Phase II

- Phase III

- Phase IV

Analysis by Top Selling Drugs:

- Revlimid

- Rituxan

- Copaxone

- Opdivo

- Keytruda

- Imbruvica

- Avonex

- Sensipar

- Soliris

- Other

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Stores

- Others

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Who are the key players operating in the industry?

The report covers the major market players including:

- Alexion Pharmaceuticals Inc.

- Amgen Inc.

- AstraZeneca

- Bayer AG

- Daiichi Sankyo Company Limited

- Genentech USA, Inc (F. Hoffmann-La Roche AG)

- GSK plc

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis Pharmaceuticals Corporation

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceuticals U.S.A., Inc

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=2382&flag=E

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Join our community to interact with posts!