The cosmetics market is a dynamic and rapidly evolving sector that encompasses a wide range of products, including skincare, makeup, haircare, and fragrance. The market is driven by increasing consumer awareness of personal grooming, beauty standards, and the growing influence of social media on beauty trends.

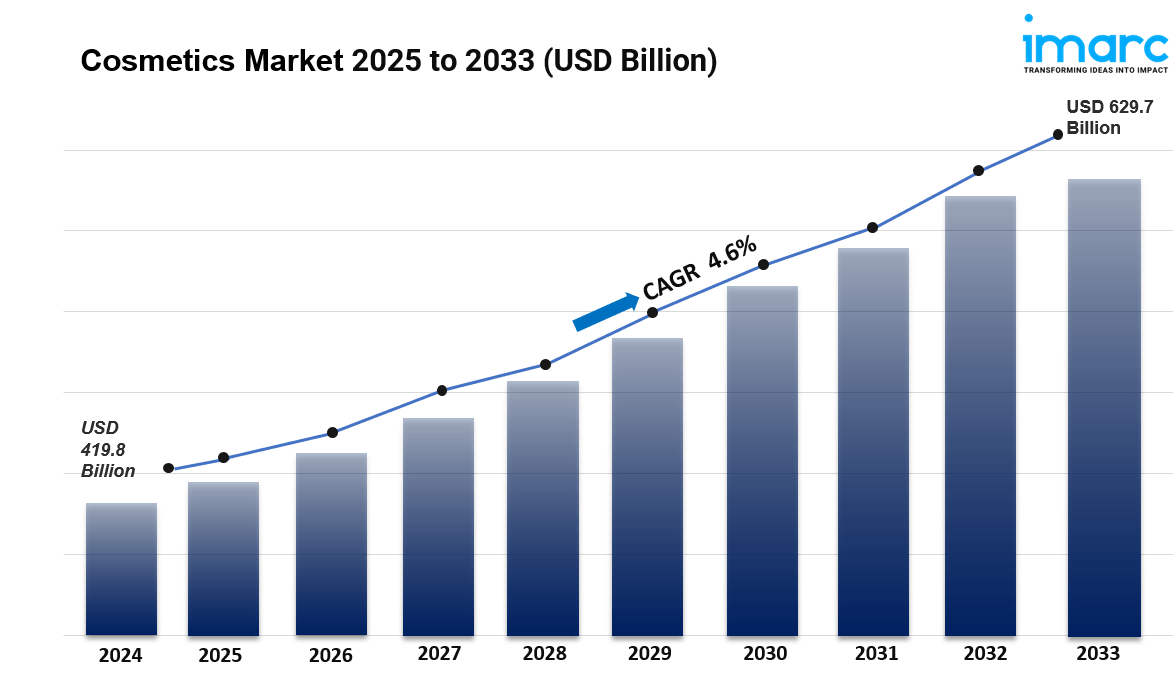

The global cosmetics market share was valued at USD 419.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 629.7 Billion by 2033, exhibiting a CAGR of 4.6% during 2025-2033. North America currently dominates the market. The growing emphasis on personal grooming, the introduction of advanced product variants, the escalating demand for vegan cosmetics, and the rising product availability on e-commerce platforms are some of the major factors propelling the market.

Key Trends

- Natural and Organic Products: There is a significant shift towards natural and organic cosmetics as consumers become more health-conscious and environmentally aware. Brands are focusing on clean beauty products that are free from harmful chemicals.

- Sustainability: Eco-friendly packaging and sustainable sourcing of ingredients are becoming essential for brands to attract environmentally conscious consumers. Brands are increasingly adopting sustainable practices throughout their supply chains.

- Digital Transformation: The rise of e-commerce and social media marketing has transformed how consumers discover and purchase cosmetics. Influencer marketing and online reviews play a crucial role in shaping consumer preferences.

- Customization: Personalized beauty solutions are gaining popularity, with brands offering customized products tailored to individual skin types and preferences. This trend is driven by advancements in technology and consumer demand for unique experiences.

- Men’s Grooming: The men’s grooming segment is experiencing rapid growth, with an increasing number of brands developing products specifically for male consumers. This includes skincare, haircare, and grooming products.

Market Dynamics

- Drivers:

- Growing disposable income and changing lifestyles.

- Increased awareness about skincare and beauty routines.

- Rising demand for innovative and multifunctional products.

- Challenges:

- Intense competition among established and emerging brands.

- Regulatory challenges regarding product safety and labeling.

- Fluctuations in raw material prices impacting production costs.

- Opportunities:

- Expansion into emerging markets with growing middle-class populations.

- Development of innovative products that cater to diverse consumer needs.

- Leveraging technology for better consumer engagement and product development.

The cosmetics market is poised for continued growth, driven by evolving consumer preferences and trends towards sustainability and personalization.

Request for a sample copy of this report: https://www.imarcgroup.com/cosmetics-market/requestsample

Segmental Analysis:

Analysis by Product Type:

- Skin and Sun Care Products

- Hair Care Products

- Deodorants and Fragrances

- Makeup and Color Cosmetics

- Others

Skin and sun care products lead the market as consumers become increasingly aware of proper skincare routines and sun protection importance. Leading brands are investing heavily in research to develop advanced sun protection formulations. The growing popularity of destination travel and beach vacations significantly contributes to demand in this segment.

Analysis by Category:

- Conventional

- Organic

Conventional products lead the market in 2024, benefiting from established consumer trust built over years. These products have well-developed distribution networks and are widely available and easily accessible. However, organic products are growing rapidly as consumers shift toward natural formulations.

Analysis by Gender:

- Men

- Women

- Unisex

Women dominate the market, with the segment accounting for over 62% of market share. The cosmetics market offers a vast array of products specifically targeted toward women, ranging from skincare and makeup to haircare and fragrances. The rising working-women population across the globe significantly contributes to growth in this segment. Brands are increasingly targeting women across light to deep skin tones to promote inclusivity—Lakme Cosmetics launched new lipstick shades specifically suitable for Indian skin tones, including Lakme Absolute Matte Revolution Lip Color in blushing red, cheek color-nude, and MP18 Plum Pick.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Online Stores

- Others

Supermarkets and hypermarkets lead the market in 2024, offering consumers the convenience of finding a wide range of products in one location. British supermarkets have been elevating their beauty offerings—Sainsbury introduced serum bars across 106 stores this summer. These retailers offer competitive pricing due to their ability to negotiate bulk purchasing and pass cost savings to consumers. However, online stores are experiencing the fastest growth, with e-commerce cosmetics sales increasing by 45% in 2023 according to industry data.

Analysis of Cosmetics Market by Regions

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

North America leads the market, driven by high smartphone penetration, a fitness-conscious population, and strong digital infrastructure. The region is home to a sizable consumer population with high disposable income, contributing to increased spending on cosmetic products.

Request Customization: https://www.imarcgroup.com/request?type=report&id=4418&flag=E

Leading Players of Cosmetics Market:

According to IMARC Group's latest analysis, prominent companies shaping the global cosmetics landscape include:

- Amway Corp.

- Avon Products Inc. (Natura & Co)

- Beiersdorf AG

- Henkel AG & Co. KGaA

- Kao Corporation

- L'Oréal SA

- Oriflame Cosmetics AG

- Revlon Inc.

- Shiseido Company Limited

- Skinfood Co. Ltd

- The Estée Lauder Companies Inc.

- The Procter & Gamble Company

- Unilever PLC

These leading providers are expanding their footprint through strategic partnerships, innovative product portfolios, and advanced digital platforms to meet growing consumer demands for personalized, sustainable, and technologically advanced beauty solutions.

Key Developments in Cosmetics Market:

- April 2022: Shiseido revealed Ulé, a new skincare brand that sources pesticide-free botanicals from local vertical farms. This launch reflects growing consumer demand for clean, sustainable ingredients and transparent sourcing practices.

- April 2023: The Body Shop launched its 'activist' product range in the Indian market. The new line strengthens the brand's sustainability commitment with a selection of skin products and color cosmetics, appealing to environmentally conscious consumers.

- June 2023: Rare Beauty by Selena Gomez launched at Sephora India, now available nationwide across all 26 Sephora stores and online at Sephora.nnnow.com. The brand emphasizes inclusive shade ranges and accessible luxury beauty.

- 2023: Nykaa, India's leading beauty and fashion destination, opened doors to the high-performing range of Natasha Moor Cosmetics, expanding its portfolio of international brands available to Indian consumers.

- 2023: Clarins launched UV Plus Multi-Protection Moisturizing Screen SPF 50 that protects against five pollutants encountered in everyday life: atmospheric pollution, blue light, pollen, photopollution, and indoor pollution. This innovation addresses modern urban environmental challenges.

- 2023: Derma Co introduced its Ultra-Light Zinc Mineral Sunscreen in India, providing dermatologist-backed sun protection suitable for tropical climates.

- 2023: Lakme Cosmetics launched new lipstick shades suitable for Indian skin tones, including Lakme Absolute Matte Revolution Lip Color in blushing red, cheek color-nude, and MP18 Plum Pick, promoting inclusivity in color cosmetics.

- Recent: L'Oréal Paris launched Glycolic Bright Day Cream with SPF 17, which aims to reduce dark spots and shield skin from harmful UV rays to unveil bright skin, targeting specific skincare concerns.

- Recent: L'Oréal Groupe launched Perso, a 6.5-inch beauty tech device that delivers personalized on-the-spot skincare and cosmetic formulas. It harnesses artificial intelligence and optimizes personalization over time as the system gathers more data about customers' skin and preferences.

- Recent: Sainsbury introduced serum bars across 106 stores, elevating the beauty offer in British supermarkets and transforming them into more credible beauty retail destinations for consumers.

- Ongoing: PROVEN Skincare launched a Regulation A+ offering to invest in the company's further AI innovation and talent, expand domestic and global marketing strategies for its existing product line, and invest in research and development of new product lines.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=4418&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Join our community to interact with posts!