IMARC Group has recently released a new research study titled “Canada Cloud Computing Market Size, Share, Trends and Forecast by Service, Workload, Deployment Mode, Organization Size, Vertical, and Region, 2026-2034” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

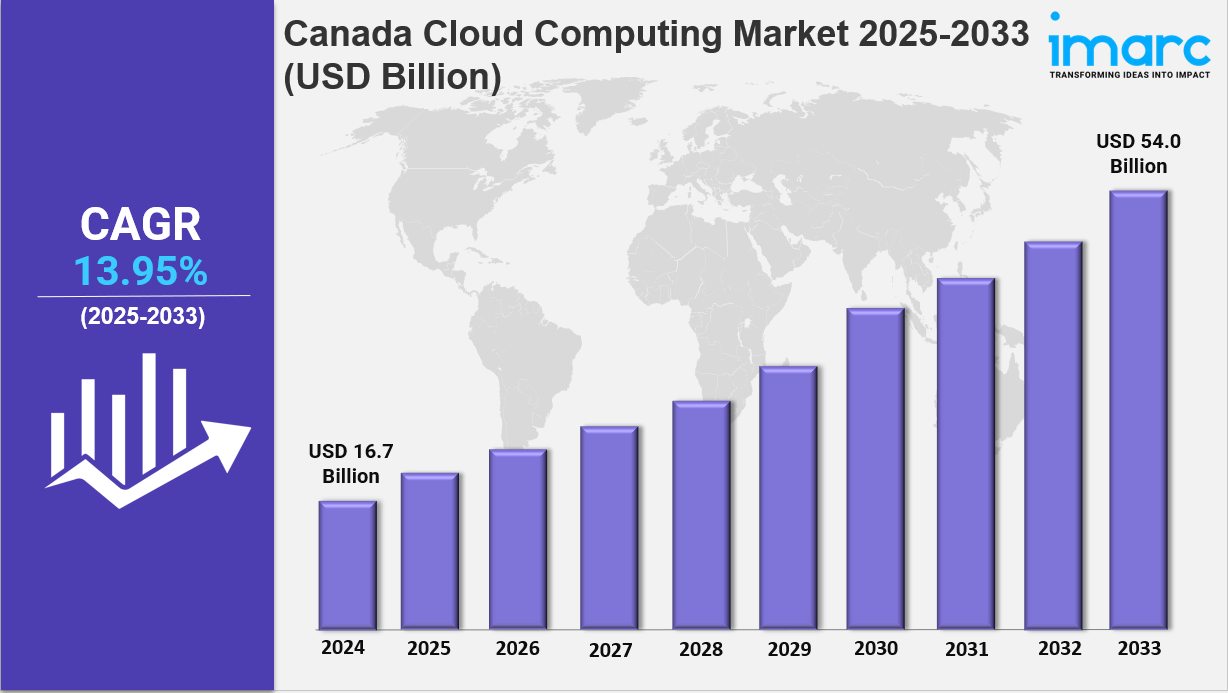

The Canada cloud computing market size was USD 16.7 Billion in 2025. It is projected to grow at a CAGR of 13.95% from 2026 to 2034, reaching USD 54.0 Billion by 2034. This growth is driven by hybrid and multi-cloud adoption, AI and machine learning integration, and significant investments in data centers. Key focuses include data security, compliance, edge computing, and sustainability, creating a positive market scenario across Canada.

Study Assumption Years

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

Canada Cloud Computing Market Key Takeaways

● Current Market Size: USD 16.7 Billion in 2025

● CAGR: 13.95% (2026-2034)

● Forecast Period: 2026-2034

● The market growth is propelled by rising digital transformation efforts across industries.

● Government mandates on data sovereignty and compliance enhance demand.

● Integration of AI, machine learning, and big data analytics drives technological advancement and adoption.

● Providers compete through niche infrastructure services, strategic alliances, and regulatory compliance.

● Growth opportunities lie in government cloud adoption, SMEs digitalization, and emerging technology integration.

Sample Request Link: https://www.imarcgroup.com/canada-cloud-computing-market/requestsample

Market Growth Factors

The Canada cloud computing market growth is chiefly driven by large-scale digital transformation initiatives across industries, where enterprises seek scalable and cost-effective solutions for enhanced remote working and operational efficiency. Government policies stressing data sovereignty and compliance further amplify market demand by ensuring data residency within national borders. Cybersecurity concerns and the need for uninterrupted business continuity also prompt increased cloud adoption.

AI, machine learning, and big data analytics integration represent critical technological drivers. Businesses increasingly leverage cloud-based AI/ML solutions for advanced data analytics, automation, and innovation in sectors such as healthcare, finance, and retail. This enables deeper data insights, improved decision-making, and tailored customer experiences, fostering long-term growth and operational excellence.

Significant investments in expanding cloud infrastructure and data centers across Canada respond to regulatory mandates like PIPEDA that require local data storage. Providers are establishing local data centers to ensure compliance, enable high-quality low-latency connections, and support real-time applications in sectors such as financial services, healthcare, and gaming. Infrastructure investments strengthen Canada's technology base, attract global cloud providers, create jobs, and promote scalability and reliability, positioning Canadian companies competitively in the global cloud market.

Market Segmentation

Service Insights:

● Infrastructure as a Service (IaaS): Cloud computing infrastructure resources provided remotely for flexible IT operations.

● Platform as a Service (PaaS): Cloud-based platforms enabling development, testing, and deployment of applications.

● Software as a Service (SaaS): Delivery of software applications over the internet on subscription basis.

Workload Insights:

● Application Development and Testing: Cloud resources used for creating and validating software applications.

● Analytics and Reporting: Cloud solutions for data analysis, visualization, and business reporting.

● Data Storage and Backup: Remote storage and backup of digital data leveraging cloud technologies.

● Integration and Orchestration: Services that ensure seamless connectivity and workflow automation across cloud applications.

● Resource Management: Tools and services managing cloud resource allocation and utilization.

● Others: Additional workloads not categorized under main segments.

Deployment Mode Insights:

● Public: Cloud services offered over the public internet accessible to multiple users.

● Private: Cloud infrastructure dedicated to a single organization.

● Hybrid: Combination of public and private cloud models allowing workload portability.

Organization Size Insights:

● Large Enterprise: Large-scale businesses utilizing cloud solutions for diverse IT needs.

● Small and Medium Enterprise: Smaller businesses adopting cloud to enhance agility and cost efficiency.

Vertical Insights:

● BFSI: Banking, Financial Services, and Insurance sector cloud adoption.

● IT and Telecom: Information technology and telecommunications industries leveraging cloud.

● Retail and Consumer Goods: Cloud use in retail operations and consumer product companies.

● Energy and Utilities: Utilities sector adopting cloud computing for operations and analytics.

● Healthcare: Medical and health-related cloud applications.

● Media and Entertainment: Content creation, distribution, and management through cloud.

● Government and Public Sector: Cloud adoption in public services and government institutions.

● Others: Other sectors using cloud computing services.

Regional Insights

Ontario, Quebec, Alberta, British Columbia, and Others form the major regional markets. Ontario, as a leading region, benefits from robust infrastructure investments, particularly data centers supporting compliance with regulations such as PIPEDA. These expansions enhance local cloud services’ performance and accessibility, driving adoption across industries and contributing significantly to Canada's cloud computing growth.

Recent Developments & News

● February 2025: Bell Canada launched an AI-driven network operations solution on Google Cloud, leveraging AI/ML for real-time monitoring to improve network performance and customer experience.

● January 2025: Oracle and Google Cloud announced plans for eight new cloud regions across multiple countries including Canada, enhancing multi-cloud services and disaster recovery.

● April 2024: IBM announced the opening of a new Cloud Multizone Region in Montreal, Quebec, aimed at supporting enterprises with generative AI, hybrid cloud, and regulated workloads while enhancing data sovereignty.

Key Players

● Bell Canada

● Google Cloud

● Backblaze

● AWS (Amazon Web Services)

● Oracle

● IBM

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!