IMARC Group has recently released a new research study titled “United States Contact Lenses Market Size, Share, Trends and Forecast by Material, Design, Usage, Application, Distribution Channels, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

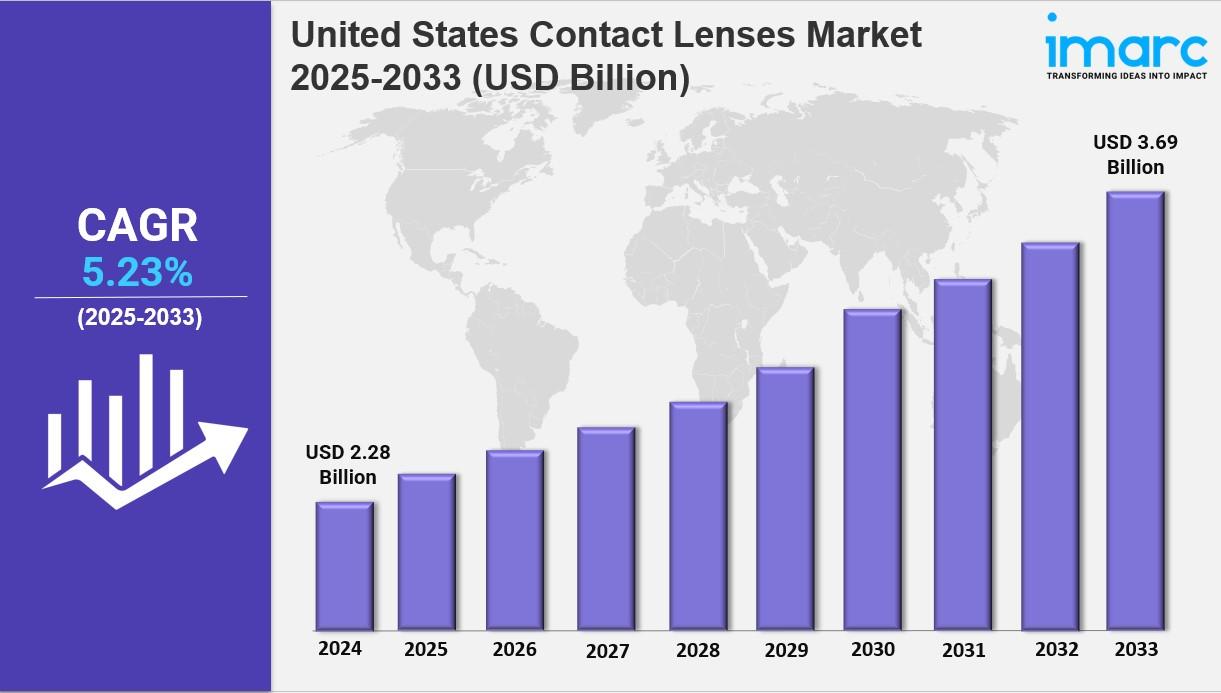

The United States contact lenses market size was valued at USD 2.28 Billion in 2024 and is projected to reach USD 3.69 Billion by 2033, growing at a CAGR of 5.23% between 2025 and 2033. This growth is fueled by rising vision disorders, increasing screen time causing eye strain, and advancements in lens technology such as silicone hydrogel and blue-light blocking lenses. The convenience of online shopping and innovation in daily disposable lenses also support market expansion.

Study Assumption Years

-

Base Year: 2024

-

Historical Year/Period: 2019-2024

-

Forecast Year/Period: 2025-2033

United States Contact Lenses Market Key Takeaways

-

Current Market Size: USD 2.28 Billion in 2024

-

CAGR: 5.23% during 2025-2033

-

Forecast Period: 2025-2033

-

The market is propelled by rising vision disorders like myopia, hyperopia, and astigmatism affecting millions, with about 12 million individuals aged 40+ experiencing vision impairment.

-

Increasing preference for disposable and daily wear lenses due to hygiene and convenience benefits drives demand.

-

Technological advancements in lens materials (e.g., silicone hydrogel) and designs (multifocal, blue-light blocking) enhance comfort and efficacy.

-

Growth in online retail channels and subscription-based services expands market accessibility.

-

Emerging smart contact lenses and environmentally sustainable lenses present new growth avenues.

Sample Request Link: https://www.imarcgroup.com/united-states-contact-lenses-market/requestsample

To get more information on this market, Request Sample

United States Contact Lenses Market Growth Factors

The U.S. contact lenses market growth is primarily influenced by the rising incidence of vision disorders such as myopia, hyperopia, and astigmatism. Approximately 12 million Americans aged 40 and older have vision impairment, with astigmatism affecting one in three, farsightedness impacting 14.2 million people (8.4% of those over 40), and nearsightedness affecting 34 million (23.9% over 40). Globally, over 2.2 billion people suffer from eye conditions, emphasizing the high demand for vision correction solutions in the U.S. Increasing screen time with digital devices causes eye strain and deterioration, further driving demand for corrective lenses, including contact lenses.

Advancements in lens technology, such as the use of silicone hydrogel materials providing enhanced oxygen permeability and moisture retention, have improved lens comfort for extended and daily wear users. Multifocal designs aid presbyopia patients, and innovations like blue-light filtering lenses address modern lifestyle needs. The rising demand for disposable and daily-wear lenses is supported by their superior hygiene profile, reducing infections and enhancing wearers' convenience. Increasing awareness of eye health and routine examinations also bolster market growth.

Emerging trends such as smart contact lenses incorporating health monitoring capabilities (e.g., glucose tracking for diabetics) and augmented reality features represent a new expansion frontier. Additionally, sustainability is gaining importance with initiatives like biodegradable and recyclable lenses from major manufacturers, reducing plastic waste. Programs like Bausch + Lomb's ONE by ONE and Biotrue recycling millions of lens-related items highlight this shift. The adoption of eco-friendly packaging also influences buyer choices. Furthermore, the rise of subscription-based and personalized lens services, propelled by e-commerce growth and AI-powered fitting tools, enhances user convenience and customization, supporting continued market growth.

United States Contact Lenses Market Segmentation

Analysis by Material:

-

Gas Permeable: Rigid lenses with high oxygen permeability, ideal for astigmatism and keratoconus, durable with reduced infection risk.

-

Silicone Hydrogel: Popular for breathability, moisture retention, suitable for extended and daily wear, recommended by professionals.

-

Hybrid: Combine soft and gas permeable lenses benefits, useful for irregular corneas, though higher cost limits adoption.

-

Others: Not specifically detailed.

Analysis by Design:

-

Spherical: Common for myopia and hyperopia, uniform curvature, available in daily to monthly disposables, affordable and easy to fit.

-

Toric: For astigmatism, designed for clear, stable vision with unique orientation, available in soft and gas permeable forms.

-

Multifocal: Designed for presbyopia, multiple prescription strengths per lens, available in soft and rigid types, favored by aging population.

-

Others: Not specified.

Analysis by Usage:

-

Daily Disposable: Single-use lenses offering hygiene and convenience, popular with sensitive eyes, fastest-growing segment.

-

Disposable: Bi-weekly or monthly replacement lenses balancing convenience and cost-effectiveness, popular across designs.

-

Frequently Replacement: Replace every 1-3 months, requiring cleaning, cost-effective with improved coatings.

-

Traditional: Long-term use lenses (6 months to a year), durable but require maintenance, suited for complex prescriptions.

Analysis by Application:

-

Corrective: For common refractive errors, available in various designs, largest application segment.

-

Therapeutic: Medical lenses for healing and protection, prescribed for corneal injuries and dry eye.

-

Cosmetic: Change eye appearance, prescription and non-prescription options, driven by beauty trends.

-

Prosthetic: Customized lenses for disfigured eyes, improving appearance and function.

-

Lifestyle-oriented: Lenses offering UV protection, blue-light filtering, and moisture retention, addressing digital strain.

Analysis by Distribution Channel:

-

E-commerce: Growing channel offering convenience, competitive pricing, and subscription models.

-

Eye Care Practitioners: Trusted channel for prescriptions and fitting, critical for specialty lenses.

-

Retail Stores: Immediate access via optical shops, pharmacies, offering eye exams and exclusive deals.

Regional Insights

The South region, including Texas, Florida, and Georgia, is the largest and fastest-growing contact lens market in the U.S. Fueled by warm climate demand for breathable and moisture-retaining lenses, urbanization, and an aging population, it benefits from a high profile of retail chains and e-commerce preferences. This region exemplifies the expanding access and growth drivers for contact lenses nationally.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=20461&flag=C

Recent Developments & News

-

October 14, 2024: Private equity groups Blackstone and TPG announced plans to jointly bid for Bausch + Lomb, valued at over USD13 Billion, marking a significant 2024 private equity buyout.

-

September 26, 2024: ZEISS Medical Technology launched the MICOR® 700, a handheld ultrasound-free lens removal device with patented NULEX technology, FDA-approved and unveiled at the 2024 AAO conference.

-

July 17, 2024: EssilorLuxottica acquired streetwear label Supreme from VF Corp. for USD 1.5 billion, enhancing its lifestyle portfolio including Ray-Ban and Oakley.

-

June 24, 2024: Johnson & Johnson, with Lions Clubs International Foundation, provided eye care to over 50 million students globally under its Sight For Kids program.

Key Players

-

Alcon Vision LLC

-

Bausch Health Companies Inc.

-

Essilor International SA

-

Hoya Corporation

-

Johnson & Johnson Vision Care Inc.

-

Menicon Co., Ltd.

-

SynergEyes Inc.

-

The Cooper Companies

-

Zeiss Group

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

Join our community to interact with posts!