IMARC Group has recently released a new research study titled “US Pharmaceutical Market Size, Share, Trends and Forecast by Prescription Type, Therapeutic Category, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

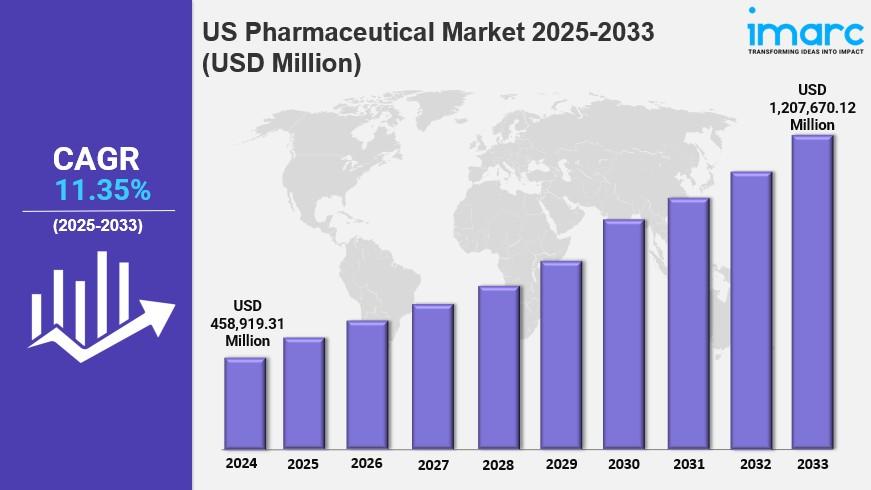

The US pharmaceutical market size reached USD 458,919.31 Million in 2024 and is projected to reach USD 1,207,670.12 Million by 2033, with a CAGR of 11.35% during 2025-2033. Growth is driven by aging demographics, digital transformation in pharmaceutical research and treatment, and expanding partnerships, which enhance innovation, efficiency, and competitiveness.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

US Pharmaceutical Market Key Takeaways

● Current Market Size: USD 458,919.31 Million in 2024

● CAGR: 11.35% (2025-2033)

● Forecast Period: 2025-2033

● The US has a rapidly aging population, with those aged 65+ expected to increase from 58 million in 2022 to 82 million by 2050, impacting pharmaceutical demand.

● Technological advancements including AI, machine learning, big data, and digital health therapies are transforming drug discovery and patient care.

● Strategic collaborations among pharmaceutical companies enhance research, manufacturing capabilities, and market access, accelerating product launches.

● Prescription drugs (branded and generics) alongside OTC drugs constitute the market segments.

● The market covers therapeutic categories such as antiallergics, cardiovascular, dermatological, respiratory, and others.

Sample Request Link: https://www.imarcgroup.com/us-pharmaceutical-market/requestsample

Market Growth Factors

The aging demographic in the US is a key factor contributing to the US pharmaceutical market growth, as the rising elderly population drives higher demand for medications and advanced healthcare solutions. The population aged 65 and over is projected to rise from 58 million in 2022 to 82 million by 2050, a 42% increase. This leads to increased demand for chronic illness management, age-specific therapies, and continuous medication treatments. Additionally, lifestyle diseases like heart conditions, diabetes, and cognitive disorders are becoming more prevalent, reinforcing the need for innovative pharmaceuticals.

Digital transformation is deeply impacting all stages of pharmaceutical development. Technologies such as artificial intelligence (AI), machine learning (ML), big data analytics, and automation are improving drug discovery, clinical trial design, and predictive modeling with enhanced accuracy and efficiency. Digital health tools, including wearable monitors and telemedicine, support patient compliance and personalized treatment, while cloud infrastructure facilitates collaboration and speeds up R&D timelines.

Strategic collaborations are increasingly common among pharmaceutical firms, combining expertise in research, production, regulatory compliance, and commercialization. These partnerships help reduce financial risks, provide access to advanced technologies and specialized manufacturing, and optimize scalability. They also enable faster launches of important therapies and improve market penetration by blending global manufacturing knowledge with local distribution networks.

To get more information on this market: Request Sample

Market Segmentation

Breakup by Prescription Type:

● Prescription Drugs

● Branded

● Generics

● OTC Drugs

Breakup by Therapeutic Category:

● Antiallergics

● Blood and Blood Forming Organs

● Cardiovascular System

● Dermatological

● Genito Urinary System

● Respiratory System

● Sensory Organs

● Others

Breakup by Region:

● Northeast

● Midwest

● South

● West

Regional Insights

The report provides detailed market analysis for four US regions: Northeast, Midwest, South, and West. Specific statistics such as region-wise market share or CAGR are not provided in the source. The dominant region is not explicitly stated.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=43452&flag=C

Recent Developments & News

● October 2025: Lupin launched a generic version of Janssen’s Xarelto (Rivaroxaban for Oral Suspension, 1 mg/mL) in the US to treat and prevent venous thromboembolism (VTE) in pediatric patients.

● August 2025: Natco Pharma introduced Bosentan tablets for pulmonary arterial hypertension treatment in children aged 3 and above, securing 180-day exclusivity as a first-to-file generic of Tracleer. Lupin Ltd is Natco’s marketing partner, with estimated US sales of USD 10 million in the past year.

Key Players

● Zydus Lifesciences

● Synthon BV

● Lupin

● Natco Pharma

● Lupin Ltd

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!