IMARC Group, a leading market research company, has recently released a report titled "Event Management Software Market Size, Share, Trends and Forecast by Component Type, Deployment Type, Organization Size, End Use Sector, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global event management software market trends, size, share, growth and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Event Management Software Market Overview:

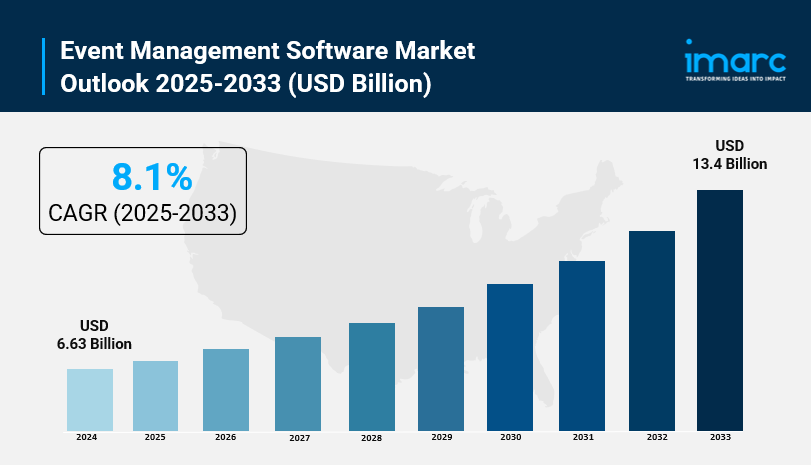

The global event management software market was valued at USD 6.63 Billion in 2024 and is projected to reach USD 13.4 Billion by 2033, growing at a CAGR of 8.1% during the forecast period from 2025 to 2033. Growth is driven by increased adoption of digital platforms for managing large-scale events, advances in AI and cloud integrations, and rising demand for real-time analytics and hybrid event solutions.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Event Management Software Market Key Takeaways

- Current Market Size: USD 6.63 Billion in 2024

- CAGR: 8.1%

- Forecast Period: 2025-2033

- North America dominates the market with over 42.8% share in 2024.

- Software constitutes approximately 62.5% of the market by component type in 2024.

- On-premise deployment holds about 61.2% market share, favored for control and data security.

- Large enterprises lead organization size segment with 55.3% share in 2024.

- Third-party planners represent the largest end use sector with 40.0% market share.

Request Your Free “Event Management Software Market” Insights Sample PDF: https://www.imarcgroup.com/event-management-software-market/requestsample

Market Growth Factors

The global event management software market is propelled by the rise in digital platforms used for event planning and execution. Organizations increasingly seek integrated, streamlined tools that facilitate efficient management of large-scale events. The demand for real-time analytics and operational flexibility, especially post-pandemic with the rise of virtual and hybrid events, fuels software adoption. For example, Bishop-McCann's 2024 launch of the Joy Index AI tool exemplifies innovation that captures moment-by-moment attendee engagement to enhance event effectiveness.

Escalating demand for automation is a core growth driver, helping reduce human error and save time through scheduling, registration, and payment processing automation. The U.S. Bureau of Labor projects a 7% growth in meeting and event planner roles from 2018 to 2028, surpassing average occupational growth and underscoring automation's importance. Businesses value automation for precision and cost-efficiency, accelerating market expansion.

The steady increase in the number of global events, including corporate and social gatherings, amplifies the need for effective management software. In the US alone, over 44,348 trade show and conference planning businesses operated in 2023, a 3.8% rise from 2022. This growth drives demand for comprehensive solutions covering marketing, ticketing, and attendee management to ensure event success. Continuous technological advancements, including AI-driven personalization and real-time analytics, further enhance software capabilities and attract users seeking dynamic event experiences.

Market Segmentation

Breakup By Component Type:

- Software

- Venue Management Software

- Ticketing Software

- Event Registration Software

- Event Marketing Software

- Event Planning Software

- Others

- Content Management Software

- Visitor Management Software

- Analytics and Reporting Software

- Resource Scheduling Software

- Others

- Service

- Professional Services

- Deployment and Integration

- Consulting

- Support and Maintenance

- Managed Services

- Professional Services

Breakup By Deployment Type:

- On-Premise: Preferred for control, customization, and data security. Favored by large enterprises and high-regulatory industries.

- Cloud: Growing segment offering scalability and accessibility but currently smaller than on-premise.

Breakup By Organization Size:

- Small and Medium Enterprises: Not separately quantified but recognized as a segment.

- Large Enterprises: Lead with extensive event needs, prioritizing real-time analytics, integration, and security.

Breakup By End Use Sector:

- Corporate

- Government

- Third-party Planner: Largest segment, utilizing advanced tools for diverse client event management.

- Education

- Mining

- Others

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the event management software market with a share exceeding 42.8% in 2024, propelled by a mature IT infrastructure and adoption of advanced technologies. The region benefits from a strong corporate sector and high event frequency. Investment in AI, cloud, and real-time analytics, along with the rise of hybrid events, fuels further market growth, positioning North America as the innovation epicenter.

Recent Developments & News

- September 2024: Chillz U.S., parent company of Linkstub, acquired WYA to enhance event management capabilities, focusing on campus safety and communication tools.

- July 2024: Motorola Solutions acquired Sydney-based Noggin, specializing in cloud-based operational resilience and critical event management.

- July 2024: Grip acquired Connectiv Holdings' event management system, expanding its 'Manage' product suite for enhanced organizer efficiency.

- June 2024: Evexus launched a platform integrating AI, sequential registration, and pay-first billing, enhancing hybrid event management.

- November 2023: Eventsforce, powered by Simpleview, introduced a scalable mobile app improving attendee engagement and planning across event types.

Key Players

- Active Network, LLC

- Cvent Inc. (Blackstone Inc.)

- Eventbrite Inc.

- RainFocus Inc.

- Accruent, LLC (Fortive Corporation)

- Zoho Corporation Pvt. Ltd.

- Whova

- Bizzabo Ltd.

- Grenadine Technologies Inc.

- EventMobi

- Momentus Technologies

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=1648&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

Join our community to interact with posts!