IMARC Group has recently released a new research study titled “United States Electric Bus Market Report by Propulsion Type (Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-in Hybrid Electric Vehicle (PHEV)), Battery Type (Lithium-ion Battery, Nickel-Metal Hydride Battery (NiMH), and Others), Length (Less than 9 Meters, 9-14 Meters, Above 14 Meters), Range (Less than 200 Miles, More than 200 Miles), Battery Capacity (Up to 400 kWh, Above 400 kWh), and Region 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

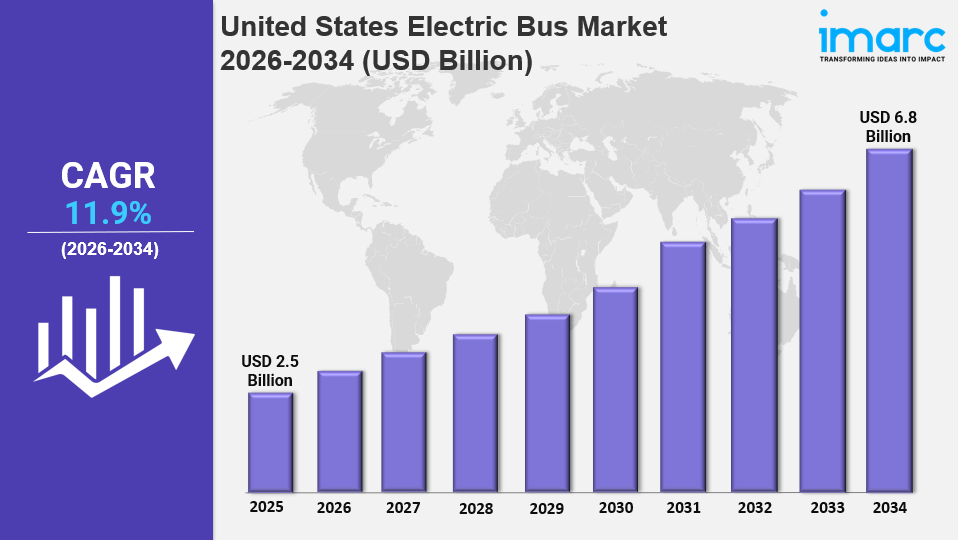

The United States electric bus market size reached USD 2.5 Billion in 2025. It is projected to grow to USD 6.8 Billion by 2034, registering a CAGR of 11.9% during the forecast period 2026-2034. This growth is driven by rising environmental concerns, strict emission regulations, expanding charging infrastructure, and advancements in electric bus technology.

Study Assumption Years

-

Base Year: 2025

-

Historical Year/Period: 2020-2025

-

Forecast Year/Period: 2026-2034

United States Electric Bus Market Key Takeaways

-

Current Market Size: USD 2.5 Billion (2025)

-

CAGR: 11.9% (2026-2034)

-

Forecast Period: 2026-2034

-

Government initiatives and environmental concerns are major growth drivers.

-

Growth is supported by expansion of charging infrastructure and deployment of zero-emission buses.

-

Declining lithium-ion battery costs and subsidies by government bodies propel market growth.

-

Challenges include high initial costs, inadequate charging infrastructure, and battery degradation.

-

Ongoing R&D in battery technology is improving energy density and charging efficiency.

Sample Request Link: https://www.imarcgroup.com/united-states-electric-bus-market/requestsample

United States Electric Bus Market Growth Factors

The United States electric bus market growth is being fueled by rising government initiatives combined with increasing environmental concerns. The deployment of zero-emission buses, alongside expansion of charging infrastructures, is supporting the industry's steady growth. Electric buses also offer notably lower operating costs than diesel buses due to reduced maintenance and fuel expenses, encouraging transit agencies to embrace this eco-friendly alternative.

Decreased costs of lithium-ion batteries and regulatory pressures, including subsidies from government bodies, are expected to accelerate market growth. Diesel-powered buses substantially contribute to greenhouse gas emissions, prompting an urgent need to improve urban air quality. States such as California, with strict air quality and climate policies, are leading the transition towards electric bus acceptance.

Despite the high initial cost and limitations like inadequate charging infrastructure, battery degradation, and long charging times, the market benefits from ongoing research in battery technology. Improvements in energy density, charging speed, and efficiency are anticipated to reduce costs and enhance electric bus performance, thus boosting the United States electric bus market revenue.

United States Electric Bus Market Segmentation

Breakup by Propulsion Type:

-

Battery Electric Vehicle (BEV): Powered entirely by batteries recharged via the electric grid, producing zero tailpipe emissions and reducing urban air pollution.

-

Fuel Cell Electric Vehicle (FCEV): Uses hydrogen fuel cells to generate electricity, emitting only water vapor and contributing to cleaner air.

-

Plug-in Hybrid Electric Vehicle (PHEV): Combines an internal combustion engine with an electric battery that can be externally recharged, offering flexibility for short electric and longer combustion engine ranges.

Breakup by Battery Type:

-

Lithium-ion Battery: High energy density, allowing longer travel distances on a single charge. Lightweight and compact, preferred for weight and space sensitive electric buses.

-

Nickel-Metal Hydride Battery (NiMH): Lower energy density than Li-ion but known for stability and safety, with no toxic heavy metals, making them environmentally friendly.

-

Others

Breakup by Length:

-

Less than 9 Meters: Smaller buses suited for inner-city routes, narrow streets, and lower passenger volume areas, used for shuttles and last-mile connectivity.

-

9-14 Meters: Standard city buses used in public transit, optimal for urban and suburban routes handling moderate passenger volumes.

-

Above 14 Meters: Designed for high-capacity routes, including busy urban corridors, intercity routes, and Bus Rapid Transit (BRT) systems, with longer ranges.

Breakup by Range:

-

Less than 200 Miles: Typically used for urban routes with frequent stops, ideal for inner-city transit, school buses, and shuttle services.

-

More than 200 Miles: Suitable for intercity routes, longer urban routes, and BRT systems, facilitating higher daily mileage with fewer recharges.

Breakup by Battery Capacity:

-

Up to 400 kWh: Used for shorter urban and suburban routes with frequent stops, more affordable and requiring less charging infrastructure.

-

Above 400 kWh: Designed for longer routes and higher capacity, suitable for intercity travel and BRT systems, providing greater operational flexibility.

Breakup by Region:

-

Northeast

-

Midwest

-

South

-

West

The demand in these regions is influenced by government initiatives, public support, partnerships, and environmental concerns with state-level clean energy policies shaping adoption.

Regional Insights

The United States electric bus market is regionally segmented into Northeast, Midwest, South, and West. Demand in these regions is driven by government initiatives, public-private partnerships, and environmental awareness. The Northeast and South notably benefit from aggressive clean energy policies, subsidies, tax credits, and grants to encourage electric bus adoption, contributing significantly to market growth.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=6239&flag=C

Recent Developments & News

In May 2024, MTA launched new electric buses equipped with charging stations across Queens, Brooklyn, and Staten Island. Also, in May 2024, Zūm delivered 74 electric school buses with bidirectional chargers to Oakland Unified School District, establishing the first fully electrified school bus system with vehicle-to-grid technology. In April 2024, the United States Environmental Protection Agency announced the 2024 Clean Heavy-Duty Vehicles Grant Program to aid the transition of heavy-duty vehicles to zero-emission models.

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!