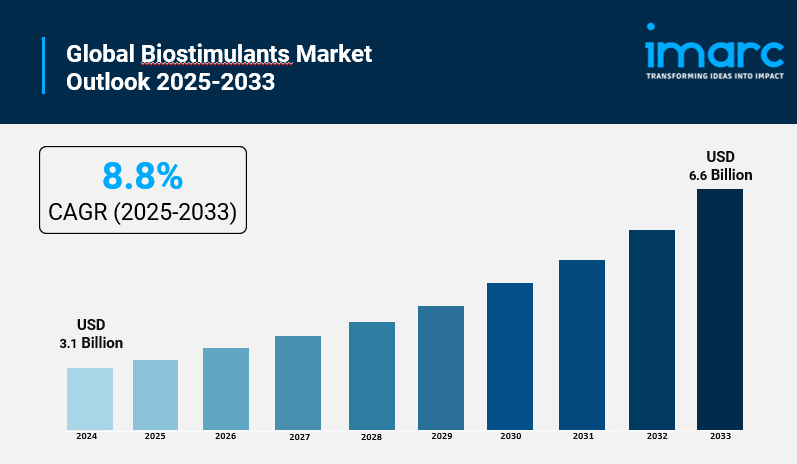

The global biostimulants market was valued at USD 3.1 Billion in 2024 and is projected to reach USD 6.6 Billion by 2033, exhibiting a CAGR of 8.8% during 2025-2033. Growing consumer demand for organic and clean-label food products, governmental efforts to promote sustainable agricultural practices, and advancements in biostimulant technology are driving market expansion. Europe holds a significant share, leading the market with over 38.0% in 2024. The market growth is fueled by the need for increased crop productivity alongside environmental sustainability. The study provides a detailed analysis of the industry, including the biostimulants market report, trends, growth, size, and industry growth forecast.

STUDY ASSUMPTION YEARS

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

BIOSTIMULANTS MARKET KEY TAKEAWAYS

- Current Market Size: USD 3.1 Billion in 2024

- CAGR: 8.8% during 2025-2033

- Forecast Period: 2025-2033

- The biostimulants market is expanding steadily due to increased public demand for sustainable agriculture and cleaner food.

- Europe leads with over 38.0% market share in 2024, supported by ecological farming policies like the EU Common Agricultural Policy.

- Acid-based biostimulants capture the largest product segment share at around 45.3% in 2024.

- Fruits and vegetables lead crop types with about 51.1% market share due to their economic value and quality sensitivity.

- Liquid form dominates with nearly 63.8% market share, favored for ease of application and efficacy.

- Farmers account for the majority of biostimulant end-users with approximately 84.2% share.

Request for a Free Sample of this Report: https://www.imarcgroup.com/biostimulants-market/requestsample]

MARKET GROWTH FACTORS

The increased demand for sustainable farming and crop enhancement across the world, environmental hazards related to chemical fertilizers, and the growth of the organic farming sector drive the global market for biostimulants. More contributing factors exist. Food demand is one. Crop adjustments to climate variability are another. Government policies and technologies promoting agricultural inputs are also factors. Growing markets in Asia-Pacific and Latin America are expected to add incremental R&D along with decreasing costs and improving efficacy.

Furthermore, rapid technological advancements with growing global investment in plant research are expected to increase the market growth. Globally, investors put USD 60 Billion toward agricultural R&D in 2023. Identifying bioactive compounds (amino acids and peptides) enables developers to tailor highly effective biostimulant products. Academia and industry partner to ensure the transfer of results for use in the field. Farmers receive concrete benefits with product quality.

Governments and international organizations need to set clear regulatory expectations and safety requirements to enable market uptake via the EU Fertilizing Products Regulation (EU 2019/1009) to increase trust in products. When standards exist, the market more easily accepts biostimulants. These biostimulants are like fertilizers and plant protection products. Standardization lets suppliers guarantee quality. Standardization lets consumers choose with knowledge. These standards trade internationally and research to innovate toward sustainable agriculture and climate targets.

MARKET SEGMENTATION

Product Type:

- Acid-based: Humic Acid, Fulvic Acid, Amino Acid

- Extract-based: Seaweed Extract, Other Plant Extracts

- Others: Microbial Soil Amendments, Chitin and Chitosan, Others

*Acid-based biostimulants promote plant growth and nutrient uptake and enhance soil structure; they hold around 45.3% market share in 2024.

Crop Type:

- Cereals and Grains

- Fruits and Vegetables

- Turf and Ornamentals

- Oilseeds and Pulses

- Others

*Fruits and vegetables have the largest share at about 51.1% due to their economic importance and need for high yield and quality.

Form:

- Dry

- Liquid

*Liquid biostimulants are preferred for their ease of application, effectiveness, and compatibility with spraying and irrigation systems, accounting for 63.8% share.

Origin:

- Natural

- Synthetic

*Natural biostimulants, derived from organic sources such as seaweed and microbial extracts, dominate with a 63.6% share due to demand for eco-friendly farming.

Distribution Channel:

- Direct

- Indirect

*Direct sales to farmers and agronomists represent 65.2% of the market, providing personalized support and cost benefits.*

Application:

- Foliar Treatment

- Soil Treatment

- Seed Treatment

*Foliar treatment leads with 79.3% share as it allows rapid nutrient absorption and quick plant response.*

End-User:

- Farmers

- Research Organizations

- Others

*Farmers are the largest end-user segment holding 84.2%, incorporating biostimulants into sustainable crop management.*

REGIONAL INSIGHTS

Europe holds over 38.0% of the biostimulants market share in 2024. Regulation support that is strong, such as EU Common Agricultural Policy (CAP), drives the market. It funded more than EUR 50 Billion (USD 52.02 Billion) during 2023 for ecological farming. Italy, France, and Spain are the largest markets inside the EU a world leader that produces biostimulants because strict pest management regulations manage pests and recent technological advances advance technology.

RECENT DEVELOPMENTS & NEWS

- August 2024: Valent BioSciences certified its Transit® 500 biostimulant with a third Biostimulant Certification from The Fertilizer Institute.

- April 2024: BioConsortia raised USD 15 Million through Otter Capital for nitrogen-fixing and nematicidal seed treatment products.

- In April 2024, Acadian Plant Health partnered with Koppert USA in order to distribute biostimulants and provide technical support to people in the U.S.

- BASF SE plans construction of a fermentation plant that is new. The plant will produce biological and biotechnology crop protection products at the Ludwigshafen site in October 2023.

- February 2023: Bayer AG partnered with Kimitec in calculation to develop and market biological crop protection products and biostimulants.

KEY PLAYERS

- Ag BioTech, Inc.

- Agrinos AS

- BASF SE

- Bayer AG

- Biolchim Spa

- FMC Corporation

- Futureco Bioscience

- Koppert B.V.

- Micromix Plant Health ltd

- Miller Chemical & Fertilizer, LLC

- Syngenta

- UPL Limited

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=1960&flag=E

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

Join our community to interact with posts!