IMARC Group has recently released a new research study titled “South Korea Energy Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Energy Market Overview

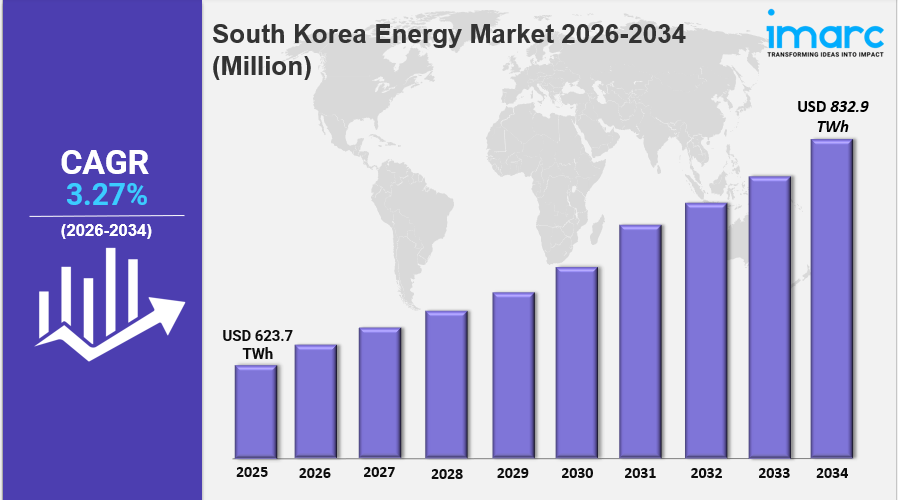

The South Korea energy market share reached 623.7 TWh in 2025 and is projected to reach 832.9 TWh by 2034, growing at a CAGR of 3.27% during the forecast period 2026-2034. Growth is driven by expanding renewable energy, nuclear power commitments, and cleaner technology adoption. Policy reforms, energy security goals, and decarbonization efforts are diversifying South Korea’s energy mix and shaping investment.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

South Korea Energy Market Key Takeaways

- Current Market Size: 623.7 TWh in 2025

- CAGR: 3.27%

- Forecast Period: 2026-2034

- The energy market is growing due to strong push towards renewables, nuclear expansion, and adoption of cleaner technologies.

- South Korea is accelerating its transition to renewable energy, supported by government incentives for solar and wind power, and emerging hydrogen initiatives.

- Significant foreign investment, such as Vena Energy's $300 million investment in the 384MW Yokji Offshore Wind Project, is enhancing energy security and carbon neutrality.

- The government plans nuclear energy to sustain 30% of the energy mix by 2030, with new reactor construction and financial support amounting to KRW150 billion in 2025.

- Energy infrastructure upgrades like smart grids and energy storage systems support integration of renewables.

- The market is shaped by national policy on carbon neutrality, foreign and domestic investments, and emphasis on energy security.

Sample Request Link: https://www.imarcgroup.com/south-korea-energy-market/requestsample

Market Growth Factors

South Korea's energy market is driven primarily by a decisive shift toward renewable energy. The government supports solar and wind through incentives, integrating hydrogen as a key clean energy source. Infrastructure advancements such as smart grids and energy storage systems are being rolled out to manage the variable nature of renewables. Foreign investments, exemplified by Vena Energy's $300 million funding for the Yokji Offshore Wind Project, demonstrate confidence in renewables' growth and their role in supporting carbon neutrality while fostering local economic development.

The nuclear energy sector is a critical growth pillar, with government-backed sustainment of nuclear power at 30% of the energy mix by 2030. Financial support increased by KRW150 billion in 2025, with plans for Shin Hanul nuclear units 3 and 4. Nuclear energy provides low-emission, stable baseload power, complementing intermittent renewables. The government is extending reactor lifespans, restarting paused constructions, and prioritizing exports of nuclear technology globally to boost market presence and energy security.

Policy reforms targeting decarbonization and energy security goals significantly influence investments and diversification of the energy mix. The ambitious target to increase renewables capacity to 7 GW annually and reduce coal power generation by 2038 underlines this strategy. These policy-driven initiatives coupled with public and political support create momentum, shaping future investments, technology upgrades, and international collaboration to sustain market growth through cleaner, diversified energy sources.

Market Segmentation

Type Insights:

- Coal: Traditional fossil fuel segment; detailed market breakup provided.

- Oil: Analyzed as a key fossil fuel component within the energy mix.

- Gas: Includes natural gas as a major energy source segment.

- Renewables: Covers solar, wind, hydrogen, and other clean energy technologies supported by government incentives.

- Nuclear: Nuclear power segment sustained at 30% share, with active expansion and modernization.

Application Insights:

- Transport: Energy consumption and market trends related to fuel and electrification in transport.

- Electric Power: Demand and generation insights for the electric power sector.

- Agricultural: Application of energy in agriculture sector analyzed.

- Industrial: Industrial energy consumption patterns and forecasts included.

- Others: Additional applications covered within the report analysis.

Ask For an Analyst- https://www.imarcgroup.com/request?type=report&id=31554&flag=C

Regional Insights

The report covers major South Korean regions: Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others. Specific market shares and CAGR data per region are not provided in the source. The dominant region is not explicitly stated. These regions collectively contribute to the overall market growth influenced by policy and infrastructure.

Recent Developments & News

In March 2025, Recurrent Energy, 3M Korea, and local leaders signed a Carbon Neutrality Agreement at the 2025 Capital Region Investment Roadshow to develop a 200MW solar power plant in Naju City, advancing decarbonization and sustainable energy independence. In February 2025, the South Korean government announced plans to construct two large nuclear reactors and a small modular reactor by 2038, aiming to expand carbon-free power generation to 70% of the energy mix. The plan includes yearly renewable capacity increases to 7 GW and significant coal power reduction by 2038.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!