IMARC Group has recently released a new research study titled “US Assisted Living Facility Market Size, Share, Trends and Forecast by Assisted Living Services, Target Population, Ownership and Management, Size and Design, Level of Care, and Region, 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

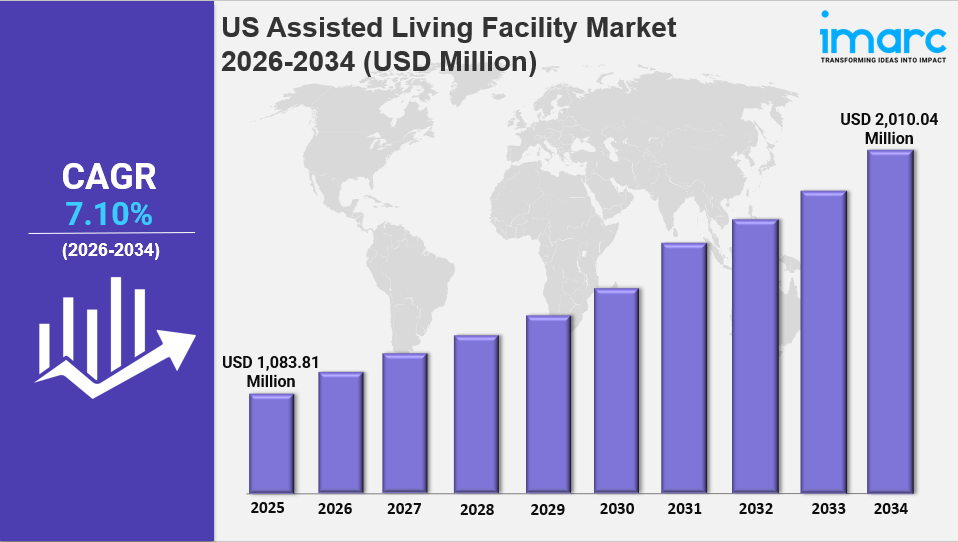

The US assisted living facility market size reached USD 1,083.81 Million in 2025 and is projected to reach USD 2,010.04 Million by 2034, growing at a CAGR of 7.10% during 2026-2034. Growth is driven by demographic shifts with the rapidly growing 85+ population, technology integration and AI adoption transforming care delivery, and value-based care models reshaping finance through Medicare Advantage partnerships. Expansion of home-based care and regulatory support also boost market share.

Study Assumption Years

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

US Assisted Living Facility Market Key Takeaways

● Current Market Size in 2025: USD 1,083.81 Million

● CAGR for 2026-2034: 7.10%

● Forecast Period: 2026-2034

● The 85+ population is projected to more than double from 6.6 Million in 2019 to 14.4 Million by 2040, accelerating demand for specialized senior care.

● Medicare Advantage penetration in senior housing rose from 47.9% in 2023 to 50.2% in 2024, driving value-based payment arrangements.

● Assisted living facilities experienced 87.2% occupancy in Q4 2024, marking the 13th consecutive quarter of increase amid constrained supply.

● The workforce shortage persists with 70% of facilities reporting severe labor constraints affecting growth and quality.

● Technology adoption including AI for predictive health monitoring and telehealth has become standard, enhancing care and operational efficiency.

Sample Request Link: https://www.imarcgroup.com/us-assisted-living-facility-market/requestsample

US Assisted Living Facility Market Growth Factors

Demographic shifts, particularly the aging population, are the primary factor driving US assisted living facility market growth, as demand for senior housing and long-term care services continues to rise.The number of adults aged 85 and older is projected to increase from 6.6 Million in 2019 to 14.4 Million in 2040, more than double in twenty years. Chronic health conditions impair function highly and make the fastest growing segment of the population a key market. The number of people aged 65 and older inside the US is expected to almost double from 52 Million people in 2018 to 95 Million people by 2060. These aging trends imply that around 200,000 units of senior housing may be developed by 2025, increasing to 775,000 units by 2030. However, with developers only developing 5000 new units each quarter in 2023, the current supply and demand balance may cause occupancy rates to reach a record high of 87.2% in the fourth quarter of 2024.

Technology and AI are disrupting health care. The use of electronic health records in the US grew from 36% of facilities in 2018 to 48% in 2022, with larger facilities reaching 80% utilization. AI-based ambient monitoring, predictive analytics reducing preventable incidents by 22%, a 49% projected telehealth use rate in 2024, and machine learning optimizing staffing schedules and outcomes are enabling smaller independent living operators to achieve institutional quality care with the personalization of smaller providers that has historically differentiated the independent living community.

Value-based care, along with Medicare Advantage integration, are shifting financial and delivery models in healthcare. Integrating Medicare Advantage increased from 47.9% during 2023 to 50.2% in 2024. Operators are using potential population health management (PHM) payment structures to proactively manage care. Value-based arrangements encourage collaboration between assisted living and medical systems, using nurse practitioners and managed care coordinators to reduce hospital readmissions and emergency department use. Special Needs Plans for assisted living residents use risk-bearing contracts to combine medical services and social services into one accountable package. These changes have led to a number of helpful outcomes, including resident satisfaction, decreased use of acute care, and financial stability.

To get more information on this market, Request Sample

US Assisted Living Facility Market Segmentation

Breakup By Assisted Living Services:

● Personal Care and Assistance

● Healthcare and Medical Services

● Social and Recreational Activities

● Housekeeping and Laundry Services

● Meals and Dining Services

These segments cover the range of services offered within assisted living facilities, from direct personal care and medical assistance to social and recreational programs and essential housekeeping and meal services.

Breakup By Target Population:

● Seniors with Functional Impairments

● Elderly with Dementia or Cognitive Impairments

● Individuals with Disabilities

● Post-hospitalization Care

● Transitional Care

This segmentation identifies the different resident groups served, including seniors facing functional or cognitive challenges and those needing transitional or post-hospitalization support.

Breakup By Ownership and Management:

● For-profit Assisted Living Facilities

● Non-profit Assisted Living Facilities

● Government-funded Assisted Living Facilities

● Home-based Assisted Living Services

● Assisted Living Communities with Integrated Healthcare

These categories distinguish facilities based on their ownership structure and service integration models.

Breakup By Size and Design:

● Small Assisted Living Homes

● Medium-sized Assisted Living Facilities

● Large Assisted Living Communities

● Independent Living with Care Services

● Assisted Living Facilities with Specialized Amenities

Facilities are classified by scale and design, from smaller homes to large communities and special amenity offerings.

Breakup By Level of Care:

● Independent Living with Limited Assistance

● Assisted Living with Moderate Care

● Memory Care for Cognitive Impairments

● Skilled Nursing Care

● Specialized Care for Chronic Conditions

This classification corresponds to the intensity and specialization of care provided to residents.

Breakup By Region:

● Northeast

● Midwest

● South

● West

Regional classification covers all major U.S. areas, allowing for localized market analysis.

Regional Insights

The report segments the US assisted living facility market regionally into Northeast, Midwest, South, and West. Specific statistics related to regional market shares or CAGR by region are not provided explicitly in the source. Therefore, the dominant region cannot be definitively identified. The segmentation facilitates comprehensive analysis at country and regional levels during the forecast period 2026-2034.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=44050&flag=C

Recent Developments & News

● February 2025: Brookdale Senior Living acquired two portfolios comprising 41 assisted living and memory care communities with 2,789 units for USD 610 Million from Welltower and Diversified Healthcare Trust. This acquisition was financed with USD 310 Million using cash and mortgage debt, enhancing Brookdale’s owned real estate and lowering lease obligations.

● December 2024: Morgan Stanley Investment Management, via Morgan Stanley Real Estate Investing, acquired eight premium senior housing communities with approximately 1,186 units from Brightview Senior Living and Harrison Street. The portfolio spans Baltimore, Philadelphia, Providence, and Boston, focusing on independent living residences in urban, supply-constrained markets.

● October 2024: National Health Investors acquired 10 memory care and assisted living facilities comprising 522 units for around USD 120 Million in North Carolina, expanding their footprint in a rapidly growing southeastern market with rising Alzheimer's prevalence.

Key Players

● Brookdale Senior Living

● Atria Senior Living

● LCS

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!