IMARC Group, a leading market research company, has recently released a report titled "Advanced Driver Assistance Systems Market Report by Solution Type (Adaptive Cruise Control, Blind Spot Detection System, Park Assistance, Lane Departure Warning System, Tire Pressure Monitoring System, Autonomous Emergency Braking, Adaptive Front Lights, and Others), Component Type (Processor, Sensors, Software, and Others), Vehicle Type (Passenger Cars, Commercial Vehicles), and Region 2025-2033", The study provides a detailed analysis of the industry, including the global advanced driver assistance systems market size, share, growth, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Advanced Driver Assistance Systems Market Overview

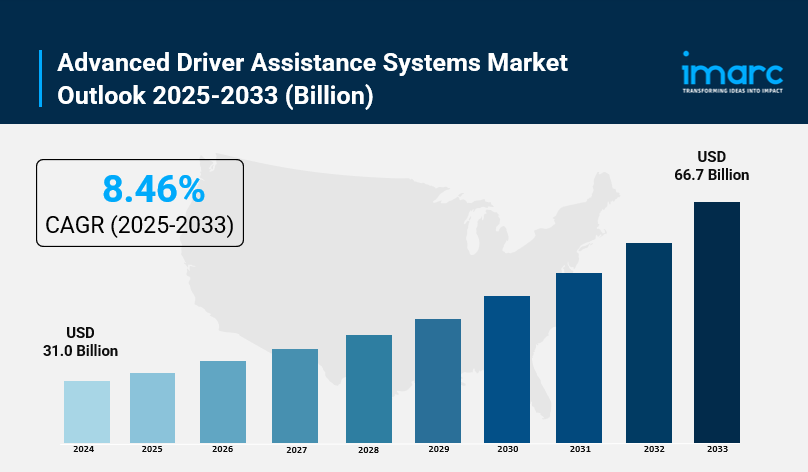

The global advanced driver assistance systems market size was valued at USD 31.0 Billion in 2024 and is projected to reach USD 66.7 Billion by 2033, growing at a CAGR of 8.46% during the forecast period from 2025 to 2033. This growth is driven by factors including stringent safety regulations, rising road accidents, rapid technological progress, and increasing demand for safety and driving comfort features. The market is also positively influenced by the shift towards autonomous vehicles and smart city initiatives.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Advanced Driver Assistance Systems Market Key Takeaways

- Current Market Size: USD 31.0 Billion (2024)

- CAGR: 8.46%

- Forecast Period: 2025-2033

- Advanced driver assistance systems (ADAS) includes technologies such as adaptive cruise control, blind spot detection, park assistance, lane departure warning, tire pressure monitoring, autonomous emergency braking, and adaptive front lights.

- The tire pressure monitoring system segment dominates the solution type market due to stringent safety mandates and its cost-effectiveness.

- Sensors are the largest component type segment, driven by advanced sensor technologies like RADAR, LIDAR, and ultrasonic sensors.

- Passenger cars hold the largest vehicle type segment share because of higher production and regulatory mandates.

- Asia Pacific region leads the market, propelled by a robust automotive industry, regulatory support, and rapid urbanization.

Request Your Free “Advanced Driver Assistance Systems Market” Insights Sample PDF: https://www.imarcgroup.com/advanced-driver-assistance-systems-market/requestsample

Market Growth Factors

The implementation of stringent safety regulations has been pivotal in propelling the growth of the advanced driver assistance systems market. Governmental bodies and regulatory organizations worldwide have mandated or strongly recommended ADAS technologies, including electronic stability control, lane departure warning, pedestrian detection, collision detection, and automatic emergency braking. Such mandates are pushing automobile manufacturers to integrate these safety features extensively to comply with evolving safety standards. Moreover, efforts toward ADAS standardization help overcome interoperability challenges, facilitating broader adoption and market expansion.

The increasing incidences of road accidents globally represent a significant driving force behind the ADAS market growth. Factors such as distracted driving, speeding, adverse weather conditions, alcohol consumption, and human error contribute to higher accident rates. ADAS technologies like collision warning, lane departure warning, and blind-spot detection offer real-time alerts and sometimes corrective actions, effectively reducing accident risks. Growing consumer awareness regarding the safety benefits of ADAS fuels demand, encouraging automotive manufacturers to invest in integrating advanced driver assistance features into vehicles.

Rapid technological advancements, including innovations in artificial intelligence (AI), machine learning (ML), sensor technologies, and data analytics, are enhancing ADAS functionalities and reliability. Sophisticated sensors such as RADAR, LIDAR, ultrasonic, and cameras collect comprehensive real-time data, processed by AI algorithms for accurate environment perception. Additionally, emerging communication technologies like Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) enable real-time traffic and environmental information sharing, boosting ADAS effectiveness and user safety. These technological evolutions are critical growth drivers, broadening the scope and adoption of ADAS in modern vehicles.

Market Segmentation

Breakup by Solution Type:

- Adaptive Cruise Control

- Blind Spot Detection System

- Park Assistance

- Lane Departure Warning System

- Tire Pressure Monitoring System

- Autonomous Emergency Braking

- Adaptive Front Lights

- Others

The tire pressure monitoring system (TPMS) dominates the solution type segment due to global safety regulations mandating its installation in new vehicles to prevent accidents caused by improperly inflated tires. TPMS also enhances fuel efficiency and tire life and is cost-effective, making it attractive for manufacturers.

Breakup by Component Type:

- Processor

- Sensors: Radar, Ultrasonic, LiDAR, and Others

- Software

- Others

Sensors dominate the component segment as they collect and interpret crucial real-time data about the vehicle's environment, enabling ADAS functionalities. Technological advances like sensor fusion further push demand in this category.

Breakup by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Passenger cars represent the largest vehicle segment because they constitute the majority of the automotive market and face stringent safety regulations, driving higher ADAS adoption compared to commercial vehicles.

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific holds the largest share of the advanced driver assistance systems market. This dominance is supported by a strong automotive manufacturing sector, rising consumer demand for vehicle safety features, and stringent regional government safety regulations. Additionally, rapid urbanization, infrastructural advancements like 5G networks, and smart city initiatives in the region further enhance the adoption and effectiveness of ADAS.

Recent Developments & News

- In January 2023, Continental AG partnered with Ambarella Inc. to develop end-to-end hardware and software solutions for ADAS.

- In April 2021, Denso Corporation supplied ADAS products for the Lexus LS and Toyota Mirai advanced drive systems.

- In November 2021, Hyundai Mobis Co. Ltd (Hyundai Motor Group) developed the world’s first urban ADAS called Mobis Parking System (MPS).

Key Players

- Autoliv Inc.

- Continental AG

- Denso Corporation

- Hyundai Mobis Co. Ltd (Hyundai Motor Group)

- Magna International Inc.

- Mobileye (Intel Corporation)

- Robert Bosch GmbH

- Texas Instruments Incorporated

- Valeo

- ZF Friedrichshafen AG

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=3659&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!