IMARC Group has recently released a new research study titled “Mexico Cold Chain Market Size, Share, Trends and Forecast by Type, Temperature Range, Application, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

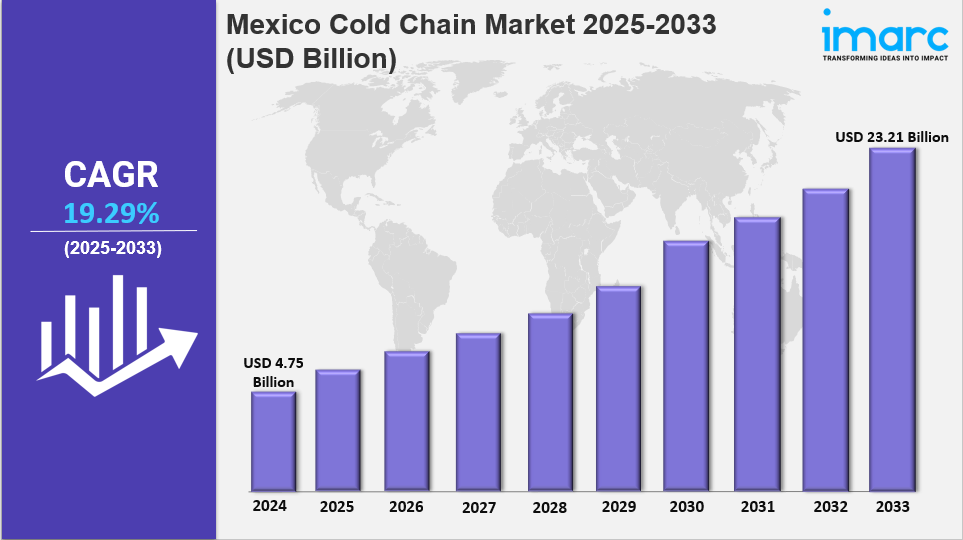

The Mexico cold chain market size was USD 4.75 Billion in 2024. It is projected to reach USD 23.21 Billion by 2033, growing at a CAGR of 19.29% during 2025-2033. Growth is driven by rising demand for perishable foods, pharmaceutical distribution expansion, increasing cross-border trade with the U.S., organized retail growth, and evolving food safety regulations. Technological advances in refrigeration and rising e-commerce penetration are also enhancing infrastructure modernization and investment in temperature-controlled logistics.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

Mexico Cold Chain Market Key Takeaways

● Current Market Size: USD 4.75 Billion in 2024

● CAGR: 19.29% (2025-2033)

● Forecast Period: 2025-2033

● Expansion of cold chain infrastructure has accelerated notably in northern border states such as Baja California, Sonora, Chihuahua, and Nuevo León, driven by proximity to U.S. trade routes.

● Investments involve refrigerated rail and truck fleets and enhanced intermodal connectivity supporting exports of perishable goods like berries, avocados, and seafood.

● The pharmaceutical sector demands ultra-reliable cold chain solutions, prompting investments in validated cold rooms and real-time monitoring aligned with COFEPRIS and WHO-GSDP standards.

● Digitalization with IoT sensors and cloud platforms is improving shipment visibility and operational efficiency, essential for high-value perishable exports.

● Cross-border compliance with U.S. standards and collaborations such as that between CPKC and Americold boost logistics capacity and infrastructure.

Sample Request Link: https://www.imarcgroup.com/mexico-cold-chain-market/requestsample

Mexico Cold Chain Market Growth Factors

Rising demand for perishable food products is a key factor driving Mexico cold chain market growth, as efficient temperature-controlled storage and transportation become increasingly essential. The report states the rising consumption volume of berries, avocados, seafood, and other perishables is driving investments in temperature-controlled warehousing and transportation solutions. This is in part due to rising export volumes to the US and other international markets. In 2023, Mexican agro-food exports reached USD 51.87 Billion. Today, only 6.9% of the Mexican trucking fleet is refrigerated (92,256 trucks), which is an area where there is potential to grow and modernize logistics capacity for the north of the country (where the states that are adjacent to the US are).

Pharmaceutical distribution is also driving growth, following increased domestic production, and multinational pharmaceutical firms moving operations to Mexico. According to the report, logistics firms are building specialized cold chain facilities to meet COFEPRIS and WHO-GSDP regulations by using pharmaceutical-style cold rooms and real-time temperature monitoring systems, in addition to investment in contingency plans. Cities including Mexico City, Guadalajara and Monterrey increasingly have pharmaceutical-grade cold storage facilities, which have been built to store the growing supply of biologics and are needed for personalized medicine, which requires a cold-storage temperature range of 2 to -70 degrees Celsius.

Technological advances and digitization have also helped to ease the market's growth, with IoT-enabled sensors, cloud computing-based control programs, and predictive analytics, which provide real-time visibility of shipments, a reduction in spoilage, and operational efficiencies. These technologies are also used for temperature compliance reporting and route optimization for exports of highly perishable products such as dairy, seafood, and berries. In one example from December 2024, Canadian Pacific Kansas City (CPKC) and Americold collaborated to utilize the North American intermodal rail system and added cold storage connectivity between the two countries to provide greater supply chain resiliency in the cold chain.

Mexico Cold Chain Market Segmentation

Breakup By Type Insights:

● Storage: Facilities/Services (Refrigerated Warehouse, Cold Room), Equipment (Blast Freezer, Walk-in Cooler and Freezer, Deep Freezer, Others)

● Transportation: By Mode (Road, Sea, Rail, Air), By Offering (Refrigerated Vehicles, Refrigerated Containers)

● Packaging: Crates, Insulated Containers and Boxes (Large (32 to 66 liters), Medium (21 to 29 liters), Small (10 to 17 liters), X-small (3 to 8 liters), Petite (0.9 to 2.7 liters)), Cold Chain Bags/Vaccine Bags, Ice Packs, Others

● Monitoring Components: Hardware (Sensors, RFID Devices, Telematics, Networking Devices, Others), Software (On-premises, Cloud-based)

This segmentation provides a detailed analysis of cold chain types, covering storage infrastructure such as refrigerated warehouses and cold rooms, equipment for freezing and cooling, various transport modalities with specialized refrigerated offerings, packaging solutions tailored by container sizes and protective accessories, and monitoring technologies including hardware and software solutions for ensuring temperature compliance and shipment integrity.

Breakup By Temperature Range:

● Chilled (0°C to 15°C)

● Frozen (-18°C to -25°C)

● Deep-frozen (Below -25°C)

The market segments temperature-sensitive goods by precise temperature bands to manage the storage and transport of products requiring chilled, frozen, and deep-frozen conditions, ensuring optimal product integrity across perishables and pharmaceuticals.

Breakup By Application:

● Food and Beverages: Fruits and Vegetables, Fruit Pulp and Concentrates, Dairy Products (Milk, Butter, Cheese, Ice Cream, Others), Fish, Meat, and Seafood, Processed Food, Bakery and Confectionary, Others

● Pharmaceuticals: Vaccines, Blood Banking, Others

● Others

These application segments reflect the wide array of industries relying on cold chain logistics, ranging from fresh produce and various dairy and meat products to specialized pharmaceutical goods like vaccines and blood banking, alongside other niche applications.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=32883&flag=C

Regional Insights

The dominant region is Northern Mexico, especially northern border states such as Baja California, Sonora, Chihuahua, and Nuevo León. This growth is due to proximity to the U.S. and key export hubs facilitating perishable goods logistics. Investments in refrigerated rail and truck fleets and enhanced certification compliance are strengthening infrastructure. The northern region serves as a critical node in Mexico’s cold chain network, supporting major export volumes and cross-border trade efficiency.

Recent Developments & News

In March 2025, ANETIF partnered with the Global Cold Chain Alliance (GCCA) to address Mexico’s cold chain infrastructure challenges including high energy costs and regulatory compliance. This alliance focuses on workforce training, modernization, and promoting certifications to support food safety and improve efficiency. Furthermore, Emergent Cold LatAm inaugurated a new greenfield cold storage facility in Ciénega de Flores, Monterrey, with a 23,000-pallet capacity, marking its first ground-up project in Mexico and representing significant investment into local infrastructure.

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!