Brazil Banking as a Service (BaaS) Market Overview 2026-2034

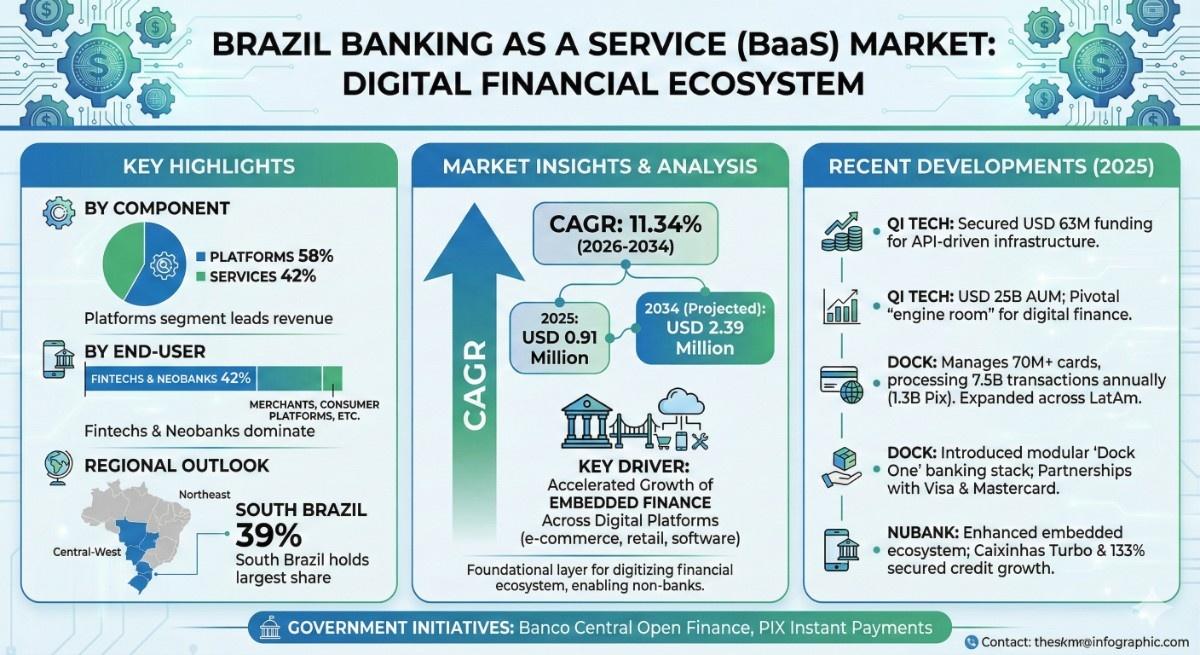

According to the latest report by The Report Cube, study Brazil Banking as a Service (BaaS) Market is anticipated to register a CAGR of 11.34% during 2026-2034. The market size was valued at USD 0.91 million in 2025 and is projected to reach USD 2.39 million by 2034. Banking as a Service has emerged as a foundational layer within Brazil’s rapidly digitizing financial ecosystem, enabling non-bank enterprises to embed regulated financial services through APIs without holding a banking license.

Economic apprehensions, industrial demands, and altering customer tastes are all driving substantial fluctuations in the Brazil Banking as a Service (BaaS) Market. Across the landscape of the country, liquid sugar, a sweetener made from sugarcane or sugar beets has risen in popularity owing to its affordability, ease of usage, and variety. The mounting need for Brazil Banking as a Service (BaaS)s & beverages, the shift toward healthier options, the impact of the progressing food & beverage sector, and the influence of technological developments in production processes are some of the key aspects prompting the market.

Download an Exclusive Sample of the Brazil Banking as a Service (BaaS) Market Report in PDF Format Today! https://www.thereportcubes.com/request-sample/banking-as-a-service-baas-market-brazil

Time Period Considered:

· Study Period: 2020-2034

· Base Year: 2025

· Forecast Years: 2026-2034

Brazil Banking as a Service (BaaS) Market Segment-wise Analysis

The Brazil Banking as a Service (BaaS) Market is categorized into different segments to provide a detailed analysis of growth patterns, trends, outlook, share, and estimates.

Brazil Banking as a Service (BaaS) Market Overview (2021-2034)

- Market Share, By Component

- Services

- Platforms

- Market Share, By Service Component

- Credit, Lending & BNPL APIs

- Fraud, Risk & Compliance Engines

- Digital Onboarding, KYC & AML

- Core Banking & Ledger APIs

- Payments, Cards & Wallet APIs

- Value-Added Financial APIs

- Market Share, By Deployment Model

- Hybrid (Bank Core + BaaS APIs)

- Public Cloud Multi-Tenant BaaS

- Bank-Hosted BaaS (Licensed Entity Stack)

- Dedicated / Single-Tenant Cloud BaaS

- Market Share, By Organization Size

- Small

- Large

- Market Share, By End-User

- Merchants & Retail Chains

- Banks & Licensed Institutions

- Vertical SaaS Platforms

- Consumer Platforms & Marketplaces

- Fintechs & Neobanks

- Market Share, By Region

- Northeast

- South

- Central-West

Competitive Landscape and Brazil Banking as a Service (BaaS) Market Share Scope:

The competitive landscape of the cord stem cell banking Market offers detailed insights into key competitors. It includes company overviews, financial performance, revenue generation, Market potential, R&D investments, new Market initiatives, global presence, production sites and capacities, company strengths and weaknesses, product launches, product range, and application dominance. The provided data points specifically focus on companies operating within the Brazil Banking as a Service (BaaS) Market.

- PagSeguro

- Banco Topázio

- Zoop

- Nubank

- QI Tech

- Dock

- Fitbank

- Bradesco

- Pomelo

- Zro Bank

- Banco Inter

- Celcoin

- Baru BaaS

- Others

With strong competition among global and regional players, the market is highly fragmented. Discover the major trends shaping the future of the Top 10 Brazil Banking as a Service (BaaS) Market companies:

https://www.thereportcubes.com/report-store/banking-as-a-service-baas-market-brazil#product--toc

Brazil Banking as a Service (BaaS) Market Dynamics

Key Driver: Accelerated Growth of Embedded Finance Across Digital Platforms

One of the strongest growth drivers for the Brazil Banking as a Service Market is the rapid expansion of embedded finance across e-commerce, retail, and software platforms. Brazilian merchants increasingly prefer integrated financial solutions that reduce dependency on traditional banks while improving customer retention. Embedded payments alone accounted for nearly 24% of all digital transactions in Brazil during 2024. BaaS enables companies to launch branded cards, wallets, and credit offerings in under six months, compared to multi-year timelines under traditional banking models. This speed-to-market advantage is critical in Brazil’s highly competitive digital economy. Additionally, widespread adoption of PIX has normalized instant digital payments, pushing platforms to offer end-to-end financial experiences. As customer expectations shift toward seamless financial journeys, BaaS providers are becoming indispensable infrastructure partners.

Major Challenge: Regulatory Complexity and Compliance Burden

Regulatory compliance remains a key challenge for the Brazil Banking as a Service Market. While Brazil’s regulatory environment is progressive, it is also highly structured, requiring strict adherence to Central Bank guidelines. BaaS providers must continuously invest in compliance infrastructure, reporting systems, and audit readiness. For smaller platforms, regulatory costs can account for up to 30% of operational expenditure. Frequent updates to data protection, open finance, and payment regulations increase operational complexity. Additionally, liability sharing between licensed banks and BaaS platforms requires carefully structured agreements, often slowing partnership formation. These compliance demands create entry barriers and limit the pace of innovation for emerging providers.

Key Questions Addressed in the Brazil Banking as a Service (BaaS) Market Report

1. How has the Brazil Banking as a Service (BaaS) Market evolved so far, and what are the growth projections for the coming years?

2. How is the Brazil Banking as a Service (BaaS) Market segmented, and what are the key trends within each segment?

3. What is the Geographical breakdown of the Brazil Banking as a Service (BaaS) Market, and how does it vary across different geographies?

4. What are the key stages in the value chain of the Brazil Banking as a Service (BaaS) Market?

5. What are the major driving factors, challenges, and opportunities shaping the Brazil Banking as a Service (BaaS) Market?

6. What is the competitive landscape of the Brazil Banking as a Service (BaaS) Market, and who are the leading players?

7. How intense is the competition in the Brazil Banking as a Service (BaaS) Market, and what strategies are companies adopting to stay ahead?

Have questions or looking for something more specific? Customization is available—we’re here to tailor our solutions to your needs.

About Us:

At Report Cube, we are more than just a Market research company; we are your strategic partner in unlocking the insights that drive your business forward. With a passion for data, a commitment to precision, and a dedication to delivering actionable results, we have been a trusted resource for businesses seeking a competitive edge.

Our mission is to empower businesses with the knowledge they need to make informed decisions, innovate, and thrive in an ever-evolving marketplace. We believe that data-driven insights are the cornerstone of success, and our team is dedicated to providing you with the highest quality research and analysis to help you stay ahead of the curve.

Our Commitment is to your success. We understand the challenges and opportunities that businesses face in today's dynamic environment, and we're here to help you navigate them with confidence. Our work is not just about collecting data; it's about providing you with the knowledge and insights that empower you to make smarter decisions and achieve your business goals.

Related Reports

https://www.prlog.org/13108847-india-mango-candy-market-set-to-reach-usd-3-98-billion-by-2034.html

Need More Assistance?

Connect with our experienced analysts for valuable insights into the current Market landscape.

-Customize the report by adding specific segments and countries to match your requirements.

-Gain a competitive edge by leveraging the report’s insights to optimize your operations and boost revenue.

Request for special pricing available according to the market – Special Pricing

For further support, reach out to our expert analysts today

OFFICE

The Report Cube

Burjuman Business Tower, Burjuman, Dubai

Email : sales@thereportcube.com

Our Blog - https://www.thereportcubes.com/blogs

Join our community to interact with posts!