Introduction:

Financial literacy isn’t just a nice-to-have—it’s a life skill that helps people navigate budgets, debt, investing, and everything in between. Yet many young Australians finish school without this essential knowledge.

-

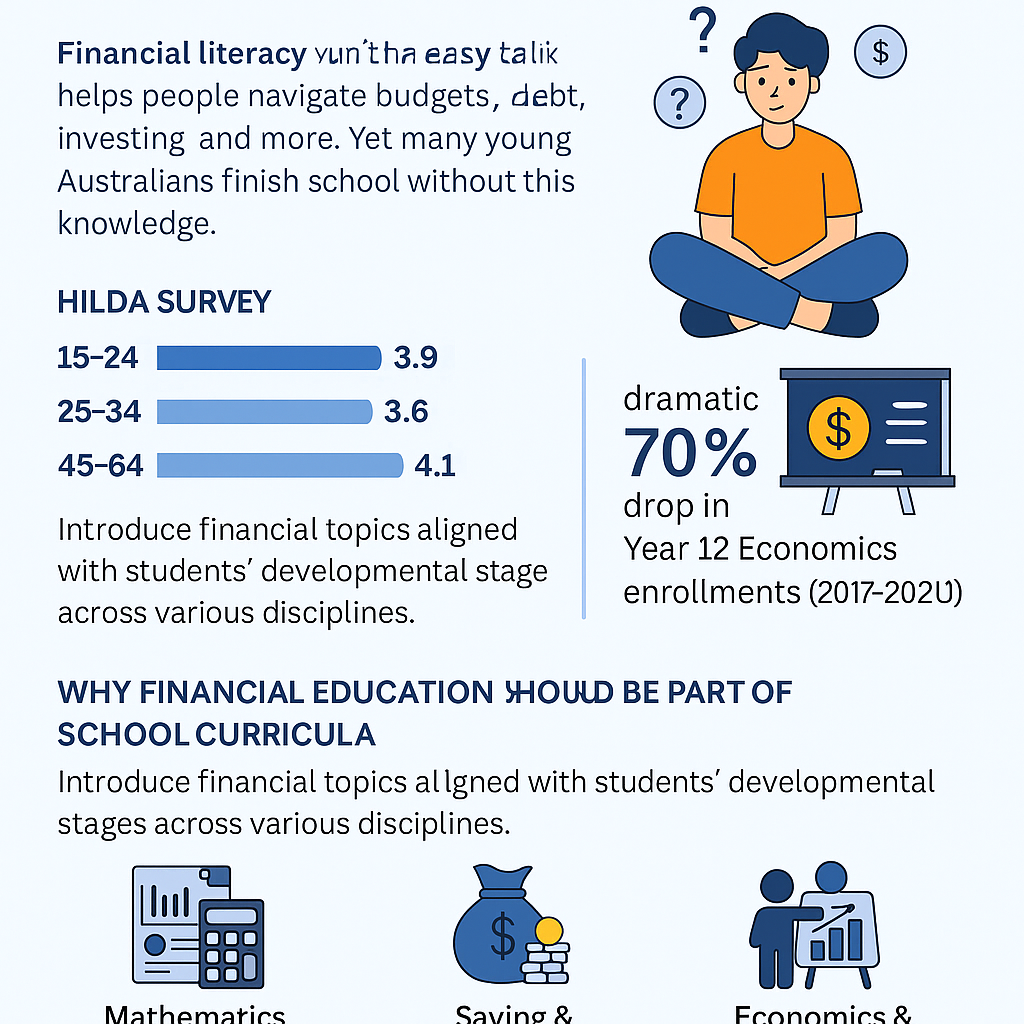

Ages 15–24 saw average scores drop from 3.4 to 2.9.

-

Ages 25–34 went from 3.9 to 3.6.

-

For ages 45–64, scores fell slightly from 4.2 to 4.1.

Roger Wilkins from HILDA highlighted that this downturn parallels a dramatic 70% drop in Year 12 Economics enrollments between 2017–2020. This trend makes the case for Financial education Australia stronger than ever.

Why Financial Education Should Be Part of School Curricula

Our financial world is becoming more complex by the day. Teaching financial literacy in schools lays a foundation of sound money habits. It empowers students to budget, manage savings, understand credit, and make informed financial decisions long before leaving home.

Integrating Financial Education into the Classroom

Introduce financial topics gradually—aligned with students’ developmental stages and supported across various disciplines.

-

Mathematics: Teach budgeting, interest, and financial calculations.

-

Humanities & Social Sciences: Explore how personal finance impacts society.

-

Economics & Business: Provide deeper insight into financial systems and responsibilities.

Collaborative planning between teachers ensures financial literacy isn’t siloed but woven into real-world classroom discussion.

What Students Should Learn About Money

Here are the core concepts every school should cover:

-

Budgeting & Money Management: Understanding income, expenditure, and planning.

-

Saving & Investing: Learning about options like saving accounts, compound interest, and goal-based planning.

-

Credit & Debt: Teaching responsible borrowing, credit scores, and preventing financial hardship.

-

Banking Basics: How to open accounts, transact, and interact with financial institutions.

Effective Strategies for Teaching Financial Literacy

To engage students and build real understanding:

-

Active Learning: Use simulations, games, and role-play to teach budgeting or investing.

-

Digital Tools: Interactive apps, investing simulators, and budgeting platforms make lessons more authentic and accessible.

-

Collaboration with Financial Institutions: Guest speakers and partnerships bring real-world context into your classroom.

Why Parents Matter: Reinforcing Financial Skills at Home

Supporting financial education at school is vital—but parental involvement amplifies impact.

-

Share practical experiences: Discuss budgeting, saving, or shopping smart.

-

Model healthy financial habits: Show kids how to compare prices or save for goals.

-

Reinforce lessons at home: Let children help with household funds or planning smaller buy-ins.

Conclusion: Financial Literacy Empowers a Generation

Bringing financial literacy into schools is more than curriculum—it’s preparation for adult life. Through active learning, tech-driven tools, and community collaboration, we build financially capable Australians ready for the challenges ahead.

Join our community to interact with posts!