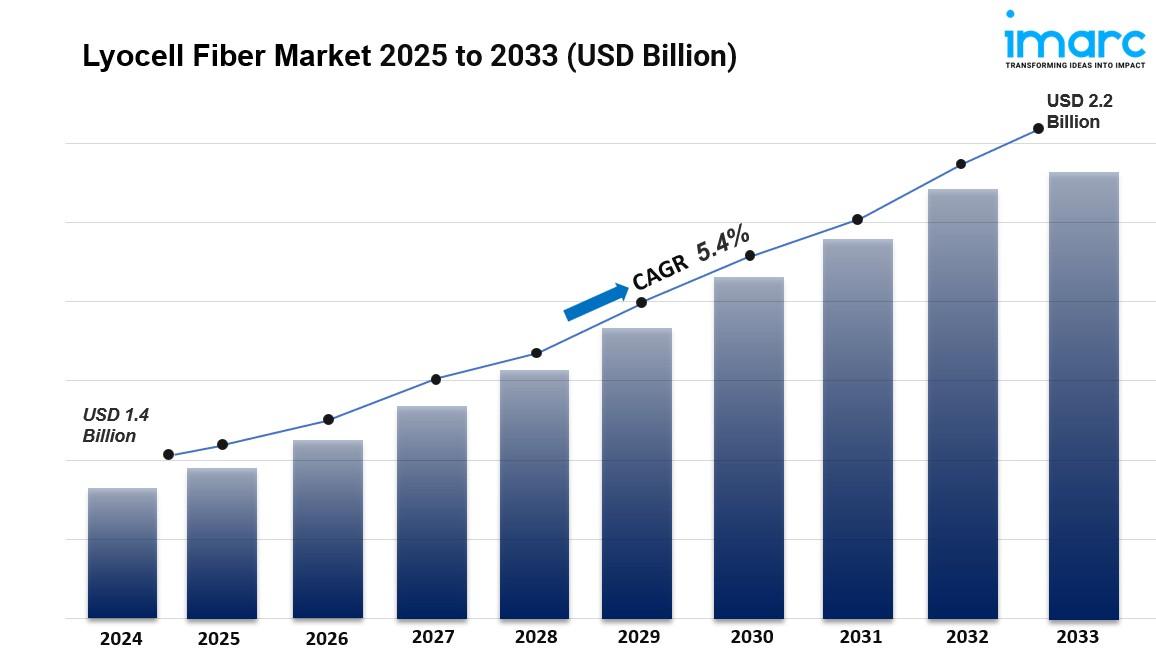

The global lyocell fiber market size was valued at USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.2 Billion by 2033, exhibiting a CAGR of 5.4% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share. The market is experiencing steady growth driven by the rising demand for sustainable and eco-friendly textiles, increasing consumer awareness about the environmental impact of synthetic fibers, and technological advancements in fiber production.

Key Stats for Lyocell Fiber Market:

- Lyocell Fiber Market Value (2024): USD 1.4 Billion

- Lyocell Fiber Market Value (2033): USD 2.2 Billion

- Lyocell Fiber Market Forecast CAGR: 5.4%

- Leading Segment in Lyocell Fiber Market in 2024: Staple Fiber

- Key Regions in Lyocell Fiber Market: Asia Pacific, Europe, North America, Latin America, Middle East and Africa

- Top companies in Lyocell Fiber Market: AceGreen Eco-Material Technology Co., Ltd., Aditya Birla Management Corporation Pvt. Ltd., Baoding Swan Fiber Co. Ltd., Jinan Hengtian high tech Material Co., Ltd, KO-SI d.o.o., Lenzing AG, Sateri, Smart Fiber AG, etc.

Why is the Lyocell Fiber Market Growing?

The lyocell fiber market is riding a powerful wave of change as consumers worldwide wake up to the environmental toll of their fashion choices. This isn't just a passing trend—it's a fundamental shift in how people think about the clothes on their backs and the textiles in their homes. Lyocell, made from dissolving wood pulp sourced primarily from eucalyptus, spruce, or pine trees, has emerged as a champion of sustainable textile production. What makes it stand out? The closed-loop manufacturing process that recycles nearly all the chemicals used—a stark contrast to conventional textile production that guzzles water and spews waste.

The numbers tell a compelling story. Asia Pacific, home to the world's largest textile manufacturing hub, is leading the charge. Countries like China, India, and Bangladesh are seeing surging demand from a rapidly expanding middle class—people with growing disposable incomes who are increasingly willing to pay a premium for quality, sustainable products. The region's robust supply chain infrastructure is making it easier than ever to scale up lyocell production and get these eco-friendly fibers into the hands of manufacturers and, ultimately, consumers.

But sustainability is only part of the equation. Lyocell's material properties are genuinely impressive. We're talking about high tensile strength that makes garments durable and long-lasting, natural breathability that keeps you comfortable in various climates, and moisture-wicking capabilities that rival—and often exceed—traditional fabrics. Then there's the texture: smooth, luxurious, comparable to silk or premium cotton. It's this combination of environmental responsibility and genuine performance that's winning over both manufacturers and end-users.

Social media has amplified awareness exponentially. Influencers and celebrities are championing sustainable fashion, educational campaigns are reaching millions, and younger consumers in particular are demanding transparency about where their clothes come from and how they're made. Brands are responding by expanding their lyocell offerings across apparel, home textiles, and even industrial applications like automotive filters and medical-grade non-woven products. The result? A market that's firing on all cylinders, fueled by genuine consumer demand and technological innovation that's making lyocell more cost-effective and accessible than ever before.

Request to Get the Sample Report: https://www.imarcgroup.com/lyocell-fiber-market/requestsample

AI Impact on the Lyocell Fiber Market:

Artificial intelligence is quietly revolutionizing the lyocell fiber industry, though not in the flashy, headline-grabbing ways you might expect. Instead, AI is working behind the scenes, optimizing every stage of production from raw material sourcing to final product delivery. Machine learning algorithms are helping manufacturers perfect the closed-loop process, identifying tiny inefficiencies that human operators might miss and suggesting adjustments that save water, reduce chemical usage, and improve fiber quality.

In the sourcing phase, AI-powered systems are analyzing satellite imagery and environmental data to identify the most sustainable forests for wood pulp extraction. These systems can predict which forests are being managed responsibly, track reforestation efforts, and ensure that raw materials meet stringent sustainability standards. This level of precision wasn't possible just a few years ago, and it's giving companies the confidence to scale up production while maintaining their environmental credentials.

On the production floor, AI is transforming quality control. Computer vision systems inspect fibers at speeds and accuracies that far exceed human capabilities, catching defects that could compromise the final product. Predictive maintenance algorithms are keeping production equipment running smoothly, minimizing downtime and ensuring consistent output. These AI systems can analyze thousands of data points in real-time—temperature, humidity, chemical concentrations, fiber tension—and make micro-adjustments that optimize both quality and efficiency.

Perhaps most importantly, AI is helping companies understand market dynamics better. Natural language processing algorithms are combing through social media, consumer reviews, and fashion trend reports to identify emerging preferences and shifting demands. This intelligence is guiding R&D efforts, helping manufacturers develop new lyocell variants with specialized properties—enhanced stretch, improved dye retention, temperature regulation—that meet specific market needs. It's also optimizing supply chains, predicting demand fluctuations, and ensuring that inventory levels match real-world needs.

In the design phase, AI is collaborating with textile engineers to develop innovative blends. By simulating millions of possible combinations of lyocell with other natural or synthetic fibers, AI can identify optimal blends that achieve specific performance characteristics—greater elasticity for activewear, enhanced thermal insulation for winter apparel, improved antibacterial properties for medical textiles. This accelerated R&D process is bringing new products to market faster and more cost-effectively than traditional trial-and-error methods.

Segmental Analysis:

Analysis by Product:

- Staple Fiber

- Cross Linked Fiber

Staple fiber dominates the lyocell market, and for good reason. Unlike continuous filament fibers, staple fibers have a discrete length, making them incredibly versatile and easy to work with. Think of staple fibers as the building blocks of textile manufacturing—they can be blended seamlessly with other materials, both natural and synthetic, to create fabrics with precisely tailored properties. Need improved strength? Blend lyocell staple with cotton. Want better elasticity? Mix it with a touch of synthetic fiber. Looking for enhanced moisture-wicking? Adjust the blend ratios.

This flexibility is a game-changer for manufacturers. Lyocell staple fiber retains all the inherent benefits of the material—the eco-friendly production process, the biodegradability, the luxurious feel—while offering endless possibilities for customization. It's ideal for everything from everyday clothing to industrial textiles, and its ability to blend with other materials dramatically widens the market potential. Manufacturers love it because it gives them creative freedom; consumers love it because they get garments that perform well and align with their environmental values.

Analysis by Application:

- Apparel

- Home Textiles

- Medical and Hygiene

- Automotive Filters

- Others

Apparel is the heavyweight champion here, commanding the largest market share, and it's easy to see why. When it comes to clothing, lyocell checks every box that matters. The texture? Silky smooth, luxurious, indistinguishable from high-end fabrics. Breathability? Exceptional—you stay comfortable whether you're in a climate-controlled office or walking through humid summer streets. Moisture management? Outstanding—lyocell wicks away sweat naturally, keeping you dry during workouts or active days.

But what's really driving apparel demand is the sustainability story. Today's consumers—especially millennials and Gen Z—are scrutinizing their fashion choices like never before. Fast fashion is falling out of favor, and people are seeking brands that demonstrate genuine environmental commitment. Lyocell delivers on that promise in a big way. It's biodegradable, produced with minimal environmental impact, and sourced from sustainably managed forests. Fashion brands are scrambling to incorporate lyocell into their collections, from basics like T-shirts and underwear to premium items like dresses and outerwear.

Home textiles are another significant growth area. Bedsheets, towels, curtains—lyocell's natural softness and durability make it perfect for items that need to withstand regular washing while maintaining their quality. Medical and hygiene applications are expanding too, leveraging lyocell's purity and the fact that it's produced from non-toxic solvents. Automotive filters and specialty papers round out the application spectrum, showing just how versatile this remarkable fiber truly is.

Analysis of Lyocell Fiber Market by Regions

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Asia Pacific is the undisputed powerhouse of the lyocell fiber market, and the reasons are multifaceted. First, there's the sheer manufacturing muscle. This region is home to the world's largest textile production facilities, with China, India, and Bangladesh leading the charge. These countries have spent decades building sophisticated supply chains, training skilled workforces, and developing the infrastructure needed for large-scale textile production. When lyocell emerged as a viable sustainable alternative, they were perfectly positioned to pivot quickly.

The numbers are staggering. Asia Pacific accounts for a massive portion of global textile manufacturing, producing everything from basic garments to high-end fashion pieces. The region's burgeoning middle class is a major driver—hundreds of millions of people with rising disposable incomes who are upgrading their wardrobes and becoming more discerning about quality and sustainability. In India alone, initiatives like the 100 Smart Cities Mission are driving IoT adoption and modern infrastructure development, creating sophisticated supply chains that support advanced materials like lyocell.

China's aggressive push toward sustainable manufacturing is reshaping the market. Government regulations are getting stricter on environmental standards, pushing manufacturers to adopt cleaner production methods. Lyocell fits perfectly into this transition. Companies are investing heavily in R&D to improve production efficiency, lower costs, and enhance fiber properties. This innovation is making lyocell more accessible to mass-market brands, not just premium labels.

North America represents a mature but dynamic market. The United States and Canada have strong environmental consciousness among consumers, robust infrastructure for sustainable product distribution, and increasingly stringent regulations around textile production. American and Canadian brands are leading the way in transparency, providing detailed information about their supply chains and environmental impact. This consumer demand is trickling down through the entire value chain, encouraging manufacturers to adopt lyocell and other sustainable fibers.

Europe is another major player, driven by some of the world's most progressive environmental policies. The European Union's Single-Use Plastics Directive and other regulations are pushing manufacturers away from synthetic materials and toward biodegradable alternatives. European fashion houses—many of them centuries-old brands with global influence—are incorporating lyocell into their collections, lending prestige and credibility to the fiber. Countries like Austria (home to Lenzing, a lyocell industry leader) and Italy (with its world-renowned textile craftsmanship) are at the forefront of both production and innovation.

Latin America is experiencing steady growth, particularly in Brazil and Mexico. Rising urbanization—over 80% of Latin America's population now lives in cities—is creating concentrated markets with sophisticated consumer preferences. Digital transformation and improving internet connectivity are exposing consumers to global fashion trends and sustainability movements, driving demand for eco-friendly textiles. The region's industrial sector, which represents more than 30% of GDP, is progressively adopting automation and advanced materials.

The Middle East and Africa, while currently smaller markets, show tremendous potential. The UAE and Saudi Arabia are investing heavily in diversifying their economies beyond oil, with ambitious initiatives like Saudi Arabia's Vision 2030. These programs include substantial investments in sustainable manufacturing and textile production. Africa's mobile penetration is skyrocketing—projections point to 700 million mobile subscribers by 2025—and with it comes greater access to information about sustainable products. As these markets develop, they're leapfrogging older technologies and embracing modern, sustainable solutions like lyocell from the start.

What are the Drivers, Restraints, and Key Trends of the Lyocell Fiber Market?

Market Drivers:

The lyocell fiber market is propelled by several powerful forces converging at once. At the forefront is the global sustainability movement. Environmental concerns aren't just background noise anymore—they're front and center in consumer decision-making. People are actively seeking out products with smaller environmental footprints, and lyocell's closed-loop production process is a compelling selling point. The fact that nearly all chemicals are recycled and reused, that wood pulp comes from sustainably managed forests, that the final product is biodegradable—these aren't just marketing claims, they're verifiable facts that resonate with environmentally conscious consumers.

Material performance is another huge driver. Lyocell isn't asking consumers to compromise quality for sustainability—it's delivering both. The high tensile strength means clothes last longer, reducing the need for frequent replacements. The natural breathability and moisture-wicking properties make garments genuinely comfortable to wear. The silk-like texture adds a touch of luxury that consumers appreciate. This combination of environmental responsibility and genuine performance advantages creates a win-win scenario that's hard to beat.

Consumer awareness has reached critical mass. Thanks to social media, educational campaigns, and celebrity endorsements, information about textile sustainability is spreading rapidly. Younger demographics in particular are doing their homework, researching brands, demanding transparency, and voting with their wallets. Fashion brands are responding aggressively, expanding their lyocell offerings and promoting their sustainability credentials. This creates a positive feedback loop—more awareness drives more demand, which drives more production, which drives further innovation and cost reduction.

Technological advancement is making lyocell increasingly accessible. Manufacturing processes are becoming more efficient, costs are coming down, and new variants with specialized properties are hitting the market regularly. This innovation is expanding lyocell's potential applications beyond traditional textiles into areas like medical-grade materials, automotive components, and industrial applications. The more uses companies find for lyocell, the larger the market grows.

Market Restraints:

Despite robust growth, the market faces legitimate challenges. Cost remains a factor. While lyocell production is becoming more efficient, it's still generally more expensive than conventional synthetic fibers like polyester. For price-sensitive consumers or brands targeting the budget segment, this cost differential can be a barrier. Manufacturers are working to close this gap through economies of scale and process optimization, but it remains a consideration.

Raw material availability presents another constraint. Lyocell production depends on access to sustainably sourced wood pulp, which means relying on responsibly managed forests. While these resources are renewable, they're not infinite, and scaling up production requires careful management to avoid environmental degradation—the very thing lyocell is meant to prevent. Companies are exploring alternative cellulose sources, including agricultural waste, but these alternatives are still in relatively early stages of development.

Consumer education is a double-edged sword. While awareness of sustainability is growing, there's still significant confusion about different fiber types, production methods, and environmental claims. Many consumers can't distinguish between lyocell, viscose, modal, and other cellulose-based fibers. This confusion can dilute marketing messages and make it harder for truly sustainable products to stand out. The industry needs clearer standards, better labeling, and more effective consumer education.

Market fragmentation poses challenges too. While there are some large, established players, the lyocell market includes numerous smaller manufacturers with varying quality standards. This can lead to inconsistent product quality, which potentially undermines consumer confidence. Industry consolidation and standardization efforts are underway, but achieving consistent quality across all market segments remains a work in progress.

Market Key Trends:

Several exciting trends are reshaping the lyocell landscape. Fiber blending innovation is accelerating. Manufacturers are experimenting with novel combinations of lyocell and other materials to create fabrics with precisely tailored properties. Lyocell-cotton blends for everyday wear, lyocell-elastane combinations for activewear, lyocell-wool mixtures for thermal garments—the possibilities are expanding rapidly. AI and advanced simulation tools are accelerating this R&D process, allowing companies to test thousands of potential blends virtually before committing to physical production.

Circular economy principles are gaining traction. Companies aren't just focusing on sustainable production—they're thinking about the entire lifecycle. This includes developing take-back programs where old garments are collected and recycled, creating new fibers from textile waste, and designing products specifically for disassembly and material recovery. Lenzing's TENCEL Lyocell with Refibra technology, which incorporates cotton scraps and offers full traceability, exemplifies this circular approach.

Alternative raw materials are being explored aggressively. While eucalyptus remains the primary source, companies are investigating bamboo, agricultural waste, and other cellulose sources. This diversification reduces dependence on any single raw material and potentially opens up new sustainability benefits. Bamboo, for instance, grows extremely rapidly without requiring pesticides, making it an attractive alternative.

Transparency and traceability are becoming non-negotiable. Consumers want to know exactly where their clothes come from, how they're made, and what impact they have. Blockchain and other tracking technologies are being implemented to provide end-to-end visibility in the supply chain. Brands that can demonstrate verifiable sustainability are winning customer loyalty and commanding premium prices.

Technical innovation is pushing boundaries. New variants of lyocell are being developed for specialized applications—hydrophobic fibers for hygiene products, variable cut-length fibers that mimic natural irregularities, enhanced-strength variants for industrial uses. These innovations are expanding lyocell's addressable market and opening up application areas that weren't previously feasible.

Leading Players of Lyocell Fiber Market:

According to IMARC Group's latest analysis, prominent companies shaping the global lyocell fiber landscape include:

- AceGreen Eco-Material Technology Co., Ltd.

- Aditya Birla Management Corporation Pvt. Ltd.

- Baoding Swan Fiber Co. Ltd.

- Jinan Hengtian high tech Material Co., Ltd

- KO-SI d.o.o.

- Lenzing AG

- Sateri

- Smart Fiber AG

These industry leaders are at the forefront of sustainable fiber innovation, investing heavily in R&D to enhance both environmental performance and material properties. They're expanding production capacity, forming strategic partnerships across the value chain, and developing new fiber variants for emerging applications. Through advanced manufacturing technologies, commitment to circular economy principles, and continuous process optimization, these companies are setting the pace for the entire industry. Their focus on transparency, certification, and environmental stewardship is raising standards across the board and driving the market toward a more sustainable future.

Key Developments in Lyocell Fiber Market:

- November 2024: Lenzing Nonwovens made a significant move by expanding its LENZING™ Lyocell Dry fiber portfolio with two groundbreaking additions—a fine dry fiber delivering exceptional strength and softness, and a coarse dry fiber providing enhanced liquid and air flow. These innovations are game-changers for the nonwovens industry. The fine fiber can pack up to 30% more cellulosic material in the same space, creating denser, stronger, softer products ideal for hygiene applications like diapers and sanitary pads. The coarse fiber, with its extended diameter and larger pore sizes, allows more air and liquid to flow through, making it perfect for acquisition and distribution layers in hygiene products and showing promise in industrial filtration applications. What's particularly noteworthy is that all these fibers are hydrophobic and not classified as plastic under the EU's Single-Use Plastics Directive, giving manufacturers a compliant alternative for a wider range of applications.

- January 2024: Lenzing Group unveiled an innovative processing technique for TENCEL™ branded lyocell fibers specifically designed to create stretch fabrics without fossil-fuel-based materials. This is a big deal. Traditional stretch fabrics typically rely on elastane or spandex—both petroleum-derived synthetics. Lenzing's new technique unlocks the inherent potential of lyocell to produce stretch fabrics that move in harmony with the body, enhancing comfort while maintaining easy-care properties. Rex Mok, Vice President of Fiber Technical Marketing at Lenzing, emphasized that this development makes lyocell ideal for lightweight apparel while offering a genuinely sustainable alternative to conventional stretch materials. For brands trying to eliminate petroleum-based materials from their supply chains, this innovation opens up new possibilities.

- 2024: Lenzing launched TENCEL™ Lyocell – HV100 fibers, bringing what they call "the undefined rawness of nature" into the TENCEL™ portfolio. These fibers feature variable cut lengths ranging from 10 mm to 28 mm, deliberately designed to mirror the irregularities of natural fibers. This might sound counterintuitive—why intentionally create irregularity?—but it's actually brilliant. Natural fibers like cotton and linen have inherent variations that give fabrics character, texture, and a distinctive hand-feel. By replicating these natural imperfections in lyocell, Lenzing is creating fibers that blend seamlessly with natural materials while maintaining lyocell's sustainability advantages. This opens up new aesthetic possibilities and makes lyocell even more versatile for textile designers.

- Recent Development: Lenzing introduced TENCEL Lyocell with Refibra technology, now incorporating pulp from bamboo alongside recycled cotton scraps. This circular fiber innovation offers full traceability—you can track the materials from source to final product—and represents a significant step toward true circular economy principles in textile production. By upcycling cotton scraps that would otherwise be waste and combining them with fast-growing bamboo, Lenzing is demonstrating how the industry can reduce its reliance on virgin materials while maintaining quality. The company is scaling production and forming partnerships to expand this technology's reach, potentially transforming how the industry thinks about raw material sourcing.

- Recent Innovation: VEOCEL™ upgraded its lyocell shortcut fiber offering specifically for the flushable market, focusing on enhanced performance in wet environments. The new finish provides protection against mechanical stress at water temperatures ranging from 0°C to 40°C during the wetlaid production process. This might seem like a narrow technical improvement, but it's actually crucial for manufacturers of flushable wipes and similar products. The ability to maintain fiber integrity across a wide temperature range during production means more consistent quality, fewer production issues, and better end-product performance. With 27 years of experience producing specialty fibers, VEOCEL™ is leveraging deep technical knowledge to solve real-world manufacturing challenges.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=923&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

Join our community to interact with posts!