IMARC Group, a leading market research company, has recently released a report titled "Adaptive Cruise Control Market by Technology (Light Detection and Ranging (LiDAR) Sensors, Ultrasonic Sensors, Image Sensors, Laser Sensors, RADAR Sensors), Vehicle Type (Commercial Vehicles, Passenger Cars), End Use (OEMs, Aftermarket), and Region 2025-2033." The study provides a detailed analysis of the industry, including the global adaptive cruise control market share, size, growth, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Adaptive Cruise Control Market Highlights:

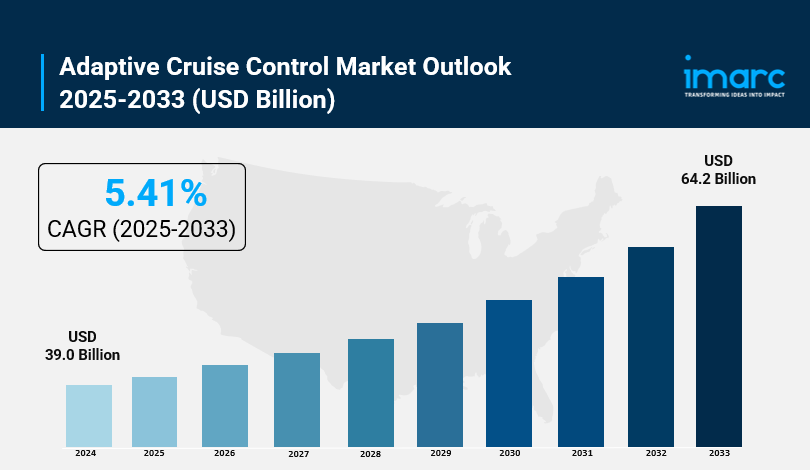

- Adaptive Cruise Control Market Size: Valued at USD 39.0 Billion in 2024.

- Adaptive Cruise Control Market Forecast: The market is expected to reach USD 64.2 Billion by 2033, experiencing significant expansion.

- Market Growth: The adaptive cruise control market is witnessing robust momentum driven by escalating demand for advanced driver assistance systems and expanding automotive safety regulations worldwide.

- Technology Integration: Revolutionary sensor technologies including RADAR, LiDAR, and camera-based systems are transforming vehicle automation, with RADAR sensors dominating market adoption due to superior distance detection capabilities.

- Regional Leadership: North America commands the largest market position, powered by stringent safety regulations and strong consumer demand for autonomous driving features.

- Safety Enhancement: Rising global concerns about road accidents are pushing automakers to invest heavily in sophisticated ACC systems that automatically adjust vehicle speed and maintain safe following distances.

- Key Players: Industry leaders include Continental AG, Robert Bosch GmbH, Valeo, ZF Friedrichshafen AG, Magna International Inc., and Ford Motor Company, which are pioneering next-generation adaptive cruise solutions.

- Market Challenges: High component costs, sensor calibration complexities, and varying regulatory standards across different regions present ongoing challenges for widespread adoption.

Claim Your Free “Adaptive Cruise Control Market” Insights Sample PDF: https://www.imarcgroup.com/adaptive-cruise-control-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Road Safety Awareness:

The automotive industry is putting safety at the forefront for all stakeholders that are focused on safety. In April 2024, the National Highway Traffic Safety Administration (NHTSA) issued a final rule to require almost all light-duty vehicles be equipped with automatic emergency braking (AEB) by 2029. The rule would importantly impact how complementary driver assistance systems develop. For example, adaptive cruise control uses the same sensors as AEB systems. According to World Health Organization data, there are approximately 1.19 million road deaths per year and 3% of a country's GDP is spent on road accidents. There is a great deal of pressure on manufacturers and engineers to produce advanced ACC systems to combat the road safety issue of rear-end collisions and the growing dilemma of increasing driver fatigue. Consumers expect their vehicles to assist them in high pressure, heavily trafficked and difficult situations as required.

- Revolutionary Sensor Technology Breakthroughs:

The next generation of adaptive cruise control will begin to incorporate new sensor technologies. Audi of America unveiled improved Traffic Jam Assist and Adaptive Cruise Control with Stop & Go systems available on the Q5, A6 and e-tron where new forward-facing cameras and radar units allow the system to regulate vehicle speed and distance. These systems would allow for more precise measurement of distance and relative speed of other vehicles around it. In February 2025, General Motors announced that it had purchased the remainder of its self-driving subsidiary Cruise, with the intention of integrating the Cruise autonomous vehicle software into its GM Super Cruise concept on a larger scale across North America. In addition, AI and machine learning are used to predict traffic conditions and to calculate speed changes in real time, which increases the performance and reliability of ACC systems in all driving conditions.

- Massive Regulatory Push for Vehicle Safety:

Recent regulatory mandates have also pushed automotive safety in a more stringent direction. For example, in the European Union, the implementation deadline for emergency braking systems in new EU car models was May 2022 and became mandatory in all new car models in May 2024. This is an important business opportunity for ACC system suppliers, with the standards working as a barrier to entry. In June 2024 the US Department of Transportation awarded approximately USD 60 million to the states of Arizona, Texas and Utah to develop connected vehicle systems, including vehicle-to-everything (V2X) systems that complement and extend ADAS capabilities. The applications are being driven by regulatory concerns in developed markets, where safety agencies are promoting technology to reduce crashes, and in commercial fleets, where downtime associated with accidents makes a compelling case for better safety performance and more advanced vehicle specification.

- Surging Adoption in Emerging Markets Signals Global Expansion

The ACC market growth in emerging countries is phenomenal, for example, ADAS vehicle penetration rate in India increased to 8.3% in H1 2025. The number of vehicle variants featuring ADAS launched in H1 2025 was 434 vs 241 in H1 2024, reflecting an increase of 80.1% YoY, mainly driven by changing consumer perspectives and increasing disposable income in emerging markets. Mahindra has now emerged as the fastest scaler in India with a 28% penetration with the launch of the Thar ROXX to the XUV 3XO mass-market SUVs. ACC technology has now been democratized from the luxury segment to mid-segment and economical cars as a standard or optional feature. The size of the Indian ADAS market increased from an estimated INR 150 Crore in 2019 to INR 300 Crore in 2023 with the adaptive cruise control sub-segment comprising 35% of the overall market. What is now known as ACC moved from being a premium offering to a minimum requirement, changing the dynamics of the global automotive segment.

Adaptive Cruise Control Market Report Segmentation:

Breakup by Technology:

- Light Detection and Ranging (LiDAR) Sensors

- Ultrasonic Sensors

- Image Sensors

- Laser Sensors

- RADAR Sensors

RADAR sensors dominate the technology segment, representing the largest market share due to their exceptional accuracy in distance measurement and velocity detection across diverse weather conditions.

Breakup by Vehicle Types:

- Commercial Vehicles

- Passenger Cars

Passenger cars account for the largest market share, reflecting the concentration of ACC adoption in personal vehicles where consumer demand for safety and convenience features is strongest.

Breakup by End Use:

- OEMs

- Aftermarket

OEMs represent the largest segment, as automotive manufacturers increasingly integrate ACC systems during vehicle production to meet regulatory requirements and consumer expectations for advanced safety features.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Continental AG

- Ford Motor Company

- Hella KGaA Hueck & Co. (Faurecia SE)

- HL Mando Corporation

- Magna International Inc.

- Robert Bosch GmbH

- Valeo

- ZF Friedrichshafen AG

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=7184&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302

Read our latest blogs:

Join our community to interact with posts!