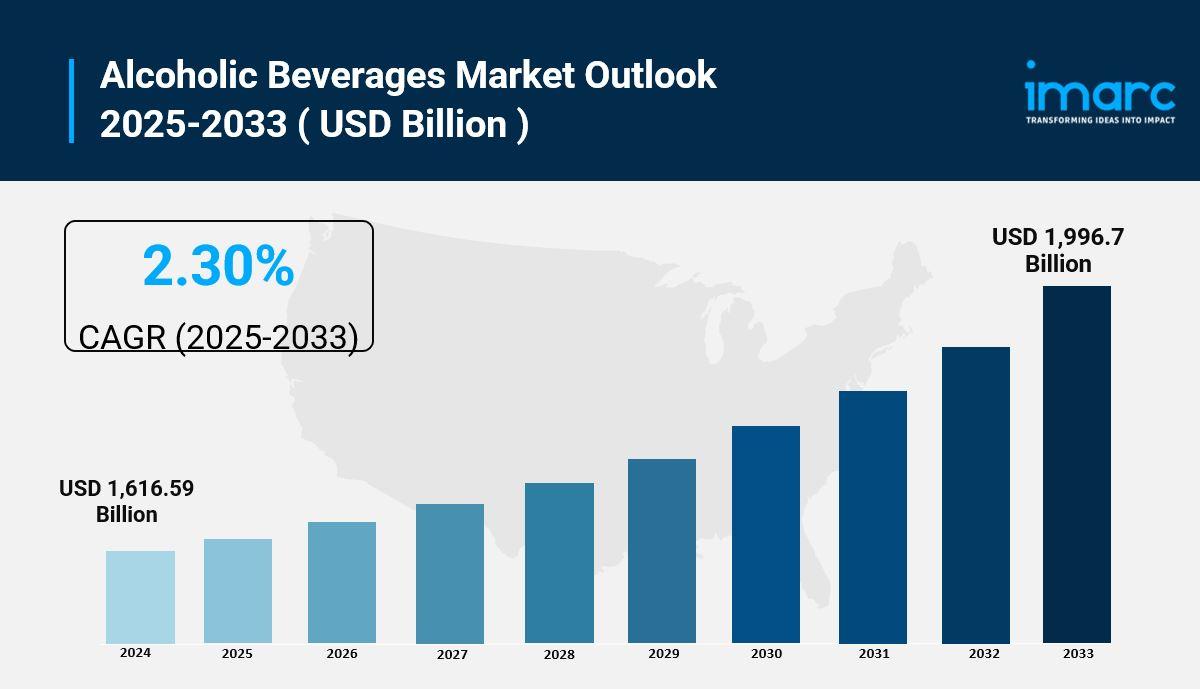

The global alcoholic beverages market Trends was valued at USD 1,616.59 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,996.7 Billion by 2033, exhibiting a CAGR of 2.30% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 45.0% in 2024. The market is experiencing steady growth driven by rising consumer interest in premium and craft products, increasing disposable incomes across emerging economies, and growing demand for diverse flavor profiles and authentic drinking experiences that cater to evolving lifestyle preferences.

Key Stats for Alcoholic Beverages Market:

- Alcoholic Beverages Market Value (2024): USD 1,616.59 Billion

- Alcoholic Beverages Market Value (2033): USD 1,996.7 Billion

- Alcoholic Beverages Market Forecast CAGR: 2.30%

- Leading Segment in Alcoholic Beverages Market in 2024: Beer (43.6%)

- Key Regions in Alcoholic Beverages Market: Europe, North America, Asia Pacific, Latin America, Middle East and Africa

- Top Companies in Alcoholic Beverages Market: AB InBev, Asahi Group Holdings Ltd, Bacardi Limited, Beijing Yanjing Brewery Co., Ltd., Carlsberg Breweries A/S, Constellation Brands, Inc., Diageo PLC, Heineken N.V., Kirin Holdings Company, Limited, Molson Coors Beverage Company, Olvi PLC, Pernod Ricard, Tsingtao Brewery Co., Ltd., etc.

Request Sample PDF Report: https://www.imarcgroup.com/alcoholic-beverages-market/requestsample

Why is the Alcoholic Beverages Market Growing?

The alcoholic beverages market is expanding due to several interconnected factors that reflect changing consumer lifestyles and preferences. As people's purchasing power increases, particularly in emerging markets, there's a noticeable shift toward quality over quantity. Consumers aren't just looking for any drink anymore—they want something special, something with a story behind it.

Premium and craft beverages have become more than products; they represent experiences and personal taste statements. Small-batch spirits, artisanal wines, and craft beers are capturing the imagination of consumers who value authenticity and craftsmanship. According to industry data, in 2021, EU consumers spent over EUR 1.035 Billion on alcoholic and non-alcoholic beverages, representing 7.1% of overall EU GDP. This substantial investment reflects how deeply embedded these products are in social and cultural experiences.

The rise of cocktail culture and mixology has also transformed how people engage with alcohol. Entertainment venues, themed bars, and upscale restaurants have become destinations where consumers explore high-quality products and unique flavor combinations. Social media amplifies these experiences, making trending drinks and innovative products spread faster than ever before. When someone discovers an interesting botanical gin or a uniquely aged whiskey, they're not just buying a bottle—they're participating in a lifestyle movement.

Ready-to-drink cocktails have emerged as game-changers in the convenience category. According to NIQ, RTD consumption has expanded by 104% over the last two years, significantly outpacing other segments. These products appeal to busy consumers who want quality cocktail experiences without the effort of mixing drinks themselves. The California market alone has seen spirits-based RTD cocktails grow 37% compared to the previous year, demonstrating the powerful momentum behind this category.

E-commerce and direct-to-consumer platforms have revolutionized how people buy alcohol, offering unprecedented convenience and variety. In 2024, 41% of consumers reported using alcohol delivery services more than the previous year, with 39% citing the ability to shop from home as their primary motivation. This digital transformation has made specialty products more accessible than ever, allowing consumers to discover international brands and niche offerings they might never encounter in traditional retail settings.

The market's diversity is also a strength. Different beverage types serve different occasions and preferences—beer for casual gatherings, wine for dining experiences, spirits for sophisticated cocktails, and ready-to-drink options for spontaneous social moments. This variety ensures the market can adapt to changing consumer needs while maintaining broad appeal across demographics and cultures.

AI Impact on the Alcoholic Beverages Market:

Artificial intelligence is reshaping the alcoholic beverages industry in ways that go far beyond simple automation. The technology is fundamentally changing how companies understand consumers, develop products, and operate their businesses.

Product innovation has been one of AI's most visible impacts. Companies are using machine learning to analyze vast databases of flavor profiles, ingredient combinations, and consumer preferences to create new beverages that resonate with target audiences. Diageo pioneered this approach with its "What's Your Whiskey" platform, which uses AI to map individual taste preferences and recommend specific whiskies from their portfolio. The platform asks users about their affinity for various flavors—from rosemary and chilies to ginger and apricot—then matches them with appropriate products. This level of personalization was simply impossible before AI.

Belgian scientists at KU Leuven University took this concept further by training AI to act as a "beer taster." By analyzing 250 different beers and measuring 226 chemical properties—including alcohol content, sugar levels, and flavor notes like caramel and citrus—their AI models can predict flavor profiles and consumer preferences. The research has practical applications too: the data was used to adjust existing commercial beer recipes, emphasizing components like lactic acid and glycerol that improve consumer appreciation.

Some companies have gone all-in on AI-created products. Circumstance Distillery in the UK developed an AI program called Ginette, which was trained on thousands of botanicals and gin recipes. Ginette created "Monker's Garkel," a completely novel gin that combines traditional distillation with AI-generated flavor combinations. Similarly, AB InBev launched Beck's Autonomous, a beer with both recipe and marketing campaign created by AI, using local German produce and natural ingredients.

Beyond product development, AI is transforming operational efficiency across the supply chain. AB InBev has integrated AI across multiple functions, including quality control improvements in beer filtration that enhance both quality and efficiency. Heineken uses AI for revenue management, commercial mix optimization, and sales execution. Treasury Wine Estates employs AI-powered sensors to monitor vineyard irrigation with remarkable precision—critical when California experiences 100-plus-degree temperatures. The system detects pressure changes and flags inefficiencies, like when coyotes chew through drip lines, allowing quick responses that save both crop yield and quality.

Marketing and consumer insights have become dramatically more sophisticated through AI. Diageo partners with AI Palette, a startup that analyzes social media and food trends to predict emerging flavors. This year, their analysis pointed to umami and "bloom harvest" (featuring jasmine, lavender, and hibiscus) as trending flavor profiles. This predictive capability allows companies to plan product innovations and cocktail promotions that align with where consumer preferences are heading, not just where they've been.

Quality control has also benefited from AI implementation. Smaller brands like Dairy Distillery's Vodkow cream liquor use camera-based AI systems to catch production errors that might slip past human inspectors. These visual inspection systems ensure bottles leaving the factory meet quality standards, protecting brand reputation while reducing waste.

The technology is even helping vineyards combat environmental challenges. Sicilian winery Donnafugata uses AI-powered cameras that photograph twice daily to recognize and predict European moth invasions, allowing proactive pest management. As climate change creates new agricultural challenges, these AI applications become increasingly valuable for maintaining consistent production quality.

Segmental Analysis:

Analysis by Category:

- Beer

- Wine (Still Light Wine, Sparkling Wine)

- Spirits (Baijiu, Vodka, Whiskey, Rum, Liqueurs, Gin, Tequila, Others)

Beer dominates the market in 2024 with 43.6% share, driven by its universal appeal and diverse consumption occasions. The category's success stems from several factors: craft beer innovation has attracted quality-conscious consumers, while established brands maintain broad accessibility. The rise of specialty beers and locally brewed options has revitalized consumer interest, offering everything from traditional lagers to experimental IPAs with unique flavor profiles. In December 2023, Medusa Beverages Pvt Ltd introduced Medusa Air, a beer featuring imported two-row malted barley and selected hops, delivering 4.5% alcohol content that appeals to consumers seeking quality at moderate strength.

Analysis by Alcoholic Content:

- High

- Medium

- Low

High alcoholic content beverages, including bottled cocktails, white spirits, and pre-mixed spirits, are experiencing robust growth as premiumization takes hold. Consumers seek these products for strong flavors, brand heritage, and upscale drinking experiences in both retail and hospitality settings.

Medium alcoholic drinks like wine and fortified wine maintain popularity due to their association with dining experiences and social gatherings. The segment benefits from increasing interest in organic and biodynamic options, with ongoing innovation in packaging and flavor profiles keeping the category fresh.

Low alcohol content drinks—beer, cider, and low-ABV mixed beverages—are seeing accelerating demand as health-conscious consumers prioritize moderation. These categories appeal to drinkers wanting lighter, sessional choices for everyday consumption, particularly for casual social occasions. Non-alcoholic beer purchases among U.S. households increased 22% from December 2023 to November 2024, reflecting this wellness-driven trend.

Analysis by Flavor:

- Unflavored

- Flavored

Unflavored alcoholic beverages hold the largest market share at 68.8%, representing traditional spirits, wines, and beers valued for authenticity and heritage. These products maintain strong positions because consumers appreciate classic taste profiles and established brand legacies. Purists and connoisseurs gravitate toward unflavored options that showcase the fundamental character of the beverage without contemporary modifications.

Flavored beverages are gaining momentum as consumers become more experimental. In the U.S. and Canada, flavored alcoholic beverages with flavor blends have experienced 33% compound annual growth over the past five years. Trending flavors include "swicy" combinations (spicy plus sweet) like mango habanero and pineapple jalapeño, along with botanical infusions and fruit-forward profiles.

Analysis by Packaging Type:

- Glass Bottles

- Tins

- Plastic Bottles

- Others

Glass bottles maintain their premium position in the market, particularly for wines and spirits where presentation and product integrity directly influence consumer perception and pricing. The format conveys quality and tradition, making it the preferred choice for high-end products.

Tins have surged in popularity, especially for beer and ready-to-drink cocktails. Their convenience, portability, and faster chilling times make them ideal for outdoor activities and casual consumption. Aluminum cans are also recyclable and lightweight, aligning with sustainability preferences while reducing shipping costs and breakage risks during distribution.

Plastic bottles serve economy and travel-oriented segments, mainly for lower-cost spirits and bulk sizes. While less favored in premium categories, their breakage resistance and cost-effectiveness make them suitable for specific retail settings and developing markets.

Alternative packaging including pouches, kegs, and tetra packs addresses niche segments and evolving consumer demands. These formats are gaining traction for their sustainability advantages, convenience factors, and suitability for specific applications like boxed wine or event-based dispensing systems.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

Supermarkets and hypermarkets lead the market with approximately 42.5% share in 2024, offering unmatched convenience through one-stop shopping experiences. These large-format retailers stock extensive product ranges covering both mainstream brands and specialty items, attracting diverse consumer segments. Their buying power enables competitive pricing and frequent promotional offers that drive volume sales. In May 2024, Ontario announced plans to extend alcohol sales in convenience stores and grocery stores, reflecting this channel's growing importance.

Online channels are experiencing explosive growth, particularly post-pandemic. Digital platforms provide unprecedented product variety, detailed information, and home delivery convenience that appeals to time-conscious consumers. The channel has been particularly successful in reaching younger demographics comfortable with e-commerce and interested in discovering specialty products.

On-trade channels—bars, restaurants, and entertainment venues—remain crucial for premium product exposure and brand building. These settings allow consumers to experience products in social contexts before committing to retail purchases, making them invaluable for new product launches and premiumization strategies.

Analysis of Alcoholic Beverages Market by Regions

- Europe

- North America

- Asia Pacific

- Latin America

- Middle East and Africa

Europe dominates with 45.0% market share, supported by deep-rooted cultural traditions of alcohol consumption, established production facilities, and high per capita consumption rates. The region's strength lies in its diverse portfolio—from French wines and German beers to Scottish whiskies and Italian spirits. Strong tourism and hospitality industries drive consistent demand, while consumers actively seek premium products and local specialties. In February 2024, Coca-Cola and Pernod Ricard collaborated to launch Absolut Vodka and Sprite as a ready-to-drink cocktail across European markets, demonstrating how established brands continue innovating to capture consumer attention.

North America represents a significant market characterized by evolving consumer preferences and rapid innovation. The United States, comprising approximately 85% of regional market share, has a vibrant on-premises consumption culture through restaurants, bars, and entertainment venues. Social drinking is deeply embedded in American culture, with alcohol commonly consumed during celebrations, dining experiences, and leisure activities. The growth of cocktail culture and mixology has intensified consumer engagement with diverse spirits. In August 2024, Beyoncé partnered with Moët Hennessy to launch SirDavis Whisky, a 44% ABV American rye made from 51% rye and 49% malted barley, matured in oak and sherry casks—demonstrating how celebrity collaborations amplify brand visibility and consumer interest.

Asia Pacific shows the highest growth potential, driven by rising disposable incomes, rapid urbanization, and gradually changing social norms around alcohol consumption. India's beer market holds particular promise, with per capita consumption of 2.15 liters showing substantial room for growth. International cocktail culture and high-end bar concepts are gaining traction in major cities, increasing demand for both imported and domestically produced premium spirits.

Latin America benefits from vibrant cultural heritage and strong traditions around domestic spirits like cachaça, pisco, and tequila. Social festivities deeply integrated into regional culture support consistent consumption patterns. Growing middle-class populations with increasing purchasing power are driving premiumization trends, while tourism sectors in key destinations bolster demand across on-trade channels.

Middle East and Africa present unique dynamics with gradual market evolution. Urbanization and expanding expatriate communities are creating demand pockets, particularly in Gulf nations where tourism and hospitality sectors are experiencing significant development. While regulatory restrictions vary across the region, select markets are seeing relaxed alcohol sales regulations that improve accessibility and enable more diverse product offerings.

What are the Drivers, Restraints, and Key Trends of the Alcoholic Beverages Market?

Market Drivers:

Several powerful forces are propelling market expansion. Rising disposable incomes, especially in emerging markets, enable consumers to allocate more spending toward premium alcoholic beverages that offer superior quality and distinctive experiences. The Distilled Spirits Council of the United States reported that in 2021, 21.7 million 9-liter cases of premium whiskey and 21.1 million cases of premium vodka were consumed, with super-premium vodka and whiskey growing 14.1% and 13.9% year-over-year respectively.

Cultural shifts toward experiential consumption are transforming purchasing behavior. Consumers increasingly seek products that provide not just refreshment but memorable experiences—whether through unique flavors, artisanal production methods, or compelling brand narratives. A study showed 52% of consumers want premium beverages prepared with high-quality ingredients, 33% seek distinctive experience venues like signature serves, and 31% are attracted to products generating buzz and conversation.

Social media and digital platforms have accelerated trend propagation, making viral sensations out of specific drinks or cocktail styles. This digital influence creates new opportunities for brands to engage consumers and build communities around their products. The expansion of e-commerce has democratized access to specialty products, allowing consumers to explore international brands and niche offerings previously unavailable in their local markets.

Innovation in product formats—particularly ready-to-drink cocktails—addresses consumer demand for convenience without compromising quality. These products bridge the gap between home consumption and bar-quality experiences, appealing to busy lifestyles while maintaining premium positioning.

Market Restraints:

Despite strong growth drivers, the market faces several headwinds. Economic uncertainty and inflationary pressures impact consumer spending patterns, particularly for discretionary purchases. Total alcohol sales faced challenges in 2024, with beer experiencing value decline of 0.7% and volume decline of 2.9%, wine suffering steeper drops with value down 3.5% and volume down 5.3%, and spirits showing moderate declines with value down 1.1% and volume down 2.3%.

Generational shifts in alcohol consumption present long-term challenges. Younger consumers, particularly Gen Z, are drinking less alcohol than previous generations, with 27% reporting they never drink alcoholic beverages, citing physical and mental health concerns. This moderation trend, while creating opportunities in low-alcohol and non-alcoholic segments, reduces overall market volume.

Regulatory environments vary significantly across markets, creating compliance complexities that affect production, distribution, and marketing strategies. Strict advertising restrictions in some regions limit brand-building opportunities, while varying taxation policies impact pricing competitiveness.

Health and wellness trends continue pressuring the industry. Growing awareness of alcohol's health impacts encourages moderation, while competing beverage categories—including functional drinks, premium non-alcoholic options, and cannabis-infused beverages—vie for consumer attention and spending.

Market Key Trends:

Premiumization continues reshaping the market landscape. Consumers increasingly prioritize quality over quantity, willing to pay higher prices for products offering superior taste, craftsmanship, and brand heritage. This trend is particularly pronounced among younger consumers: 54% of 18- to 34-year-olds are likely to choose premium drinks versus just 35% of older demographics. Wine premiumization is particularly strong in the $15-$24.99 segment, which is currently the only wine price category experiencing growth.

Sustainability has evolved from niche concern to mainstream expectation. Nearly 92% of consumers say sustainability is important when choosing brands, with 56% of respondents willing to spend more for sustainably sourced products. Companies are responding with eco-friendly packaging, carbon-neutral production processes, and transparent supply chains. This emphasis extends beyond environmental considerations to encompass ethical sourcing and social responsibility.

Flavor innovation is accelerating across all beverage categories. Exotic botanicals, unexpected spice combinations, and globally inspired flavors are capturing consumer imagination. In March 2022, UK premium gin brand Whitley Neill released Oriental Spiced Gin incorporating coriander, ginger, pepper, cumin, saffron, star anise, and grains of paradise. Similarly, in April 2024, luxury collective D'YAVOL launched VORTEX, a blended Scotch whisky featuring rich malt flavors, sherried sweetness, and subtle peat notes.

Cross-category products are blurring traditional boundaries. Wine cocktails, hard sodas, and whiskey seltzers challenge conventional definitions, offering consumers novel experiences that combine familiar elements in unexpected ways. In December 2023, Coca-Cola launched flavored wine cocktails under its Minute Maid brand, available in piña colada, strawberry daiquiri, and lime margarita flavors—demonstrating how established companies from adjacent beverage categories are entering the alcoholic drinks space.

The moderation movement is creating substantial opportunities within the market. Non-alcoholic beverage sales approached $1 billion in 2024, demonstrating genuine consumer demand for sophisticated alcohol-free options. However, this trend doesn't represent complete abstinence—94% of non-alcoholic beverage buyers also purchase alcoholic drinks, suggesting consumers are adopting flexible approaches to drinking based on occasion, health goals, and social contexts.

Leading Players of Alcoholic Beverages Market:

According to IMARC Group's latest analysis, prominent companies shaping the global alcoholic beverages landscape include:

- AB InBev

- Asahi Group Holdings Ltd

- Bacardi Limited

- Beijing Yanjing Brewery Co., Ltd.

- Carlsberg Breweries A/S

- Constellation Brands, Inc.

- Diageo PLC

- Heineken N.V.

- Kirin Holdings Company, Limited

- Molson Coors Beverage Company

- Olvi PLC

- Pernod Ricard

- Tsingtao Brewery Co., Ltd.

These industry leaders are expanding their market presence through strategic partnerships, product innovation, sustainability initiatives, and digital transformation. They're investing heavily in understanding consumer preferences through AI and data analytics, developing premium and craft offerings, and building robust distribution networks that span both traditional retail and emerging e-commerce channels. Their focus extends beyond alcoholic beverages to include growing portfolios of non-alcoholic and low-alcohol alternatives, positioning them to serve evolving consumer preferences across the complete spectrum of drinking occasions.

Key Developments in Alcoholic Beverages Market:

September 2024: Maharaja Drinks expanded into the UK market, bringing Indian-made wines, beers, teas, and coffees to British consumers. Emphasizing sustainability throughout its operations, the brand specifically targets UK-born Indians along with adventurous Gen Z and millennial consumers. The portfolio includes premium alcoholic and non-alcoholic drinks as well as craft beverages, reflecting growing consumer interest in diverse, high-quality options from emerging production regions.

August 2024: Beyoncé collaborated with Moët Hennessy to introduce SirDavis Whisky, a sophisticated 44% ABV American rye whiskey. The blend consists of 51% rye and 49% malted barley, carefully matured in oak and sherry casks to develop complex flavor profiles. The product received award-winning pre-launch acclaim, demonstrating how celebrity partnerships can elevate brand prestige while attracting new consumer segments to premium spirits categories.

May 2024: Ontario announced a significant policy change extending alcohol sales to convenience stores and grocery stores across the province. This regulatory shift represents a major distribution channel expansion, improving product accessibility for consumers while creating new revenue opportunities for retailers and beverage companies. The move aligns with consumer preferences for convenience and one-stop shopping experiences.

April 2024: Global luxury collective D'YAVOL released D'YAVOL VORTEX, an innovative blended Scotch whisky targeting premium spirits consumers. The product features a sophisticated palate balancing rich malt flavors, sherried sweetness, and subtle peat notes. Created by expertly marrying single malt and single grain Scotch whiskies, VORTEX demonstrates continuing innovation within traditional spirit categories as brands seek to differentiate through distinctive flavor profiles.

March 2022: United Kingdom premium gin brand Whitley Neill launched Oriental Spiced Gin, pushing boundaries in botanical combinations. This innovative product incorporates an ambitious range of botanicals and spices including coriander, ginger, pepper, cumin, saffron, star anise, and grains of paradise. The launch exemplifies how established premium brands are experimenting with exotic ingredients to create distinctive products that appeal to adventurous consumers seeking novel taste experiences.

February 2024: The Coca-Cola Company and Pernod Ricard joined forces to launch a ready-to-drink innovation: Absolut Vodka and Sprite cocktails in European markets. This collaboration between beverage industry giants demonstrates the growing importance of RTD formats, combining established brand equities to create convenient, high-quality products that meet consumer demand for portability and consistency in pre-mixed cocktails.

December 2023: The Coca-Cola Company expanded further into alcoholic beverages by launching flavored wine cocktails under its iconic CSD and Minute Maid juice brands. The Minute Maid Spiked line debuted in three crowd-pleasing flavors: piña colada, strawberry daiquiri, and lime margarita. This move illustrates how major non-alcoholic beverage companies are leveraging their strong brand recognition and distribution capabilities to capture market share in the growing RTD cocktail segment.

December 2023: Doritos partnered with beverage firm Empirical to create an unprecedented product: a liquor that tastes like nacho cheese. The experimental spirit is distilled from Belgian saison yeast and malted barley, incorporating peppery, spicy flavor notes. Through vacuum distillation, the beverage captures the essence of actual nacho-flavored Doritos, contributing flavors of corn tostada, umami, and acidity. While unconventional, this collaboration demonstrates how brands are pushing creative boundaries to generate buzz and attract attention in a crowded marketplace.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=1483&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

Join our community to interact with posts!