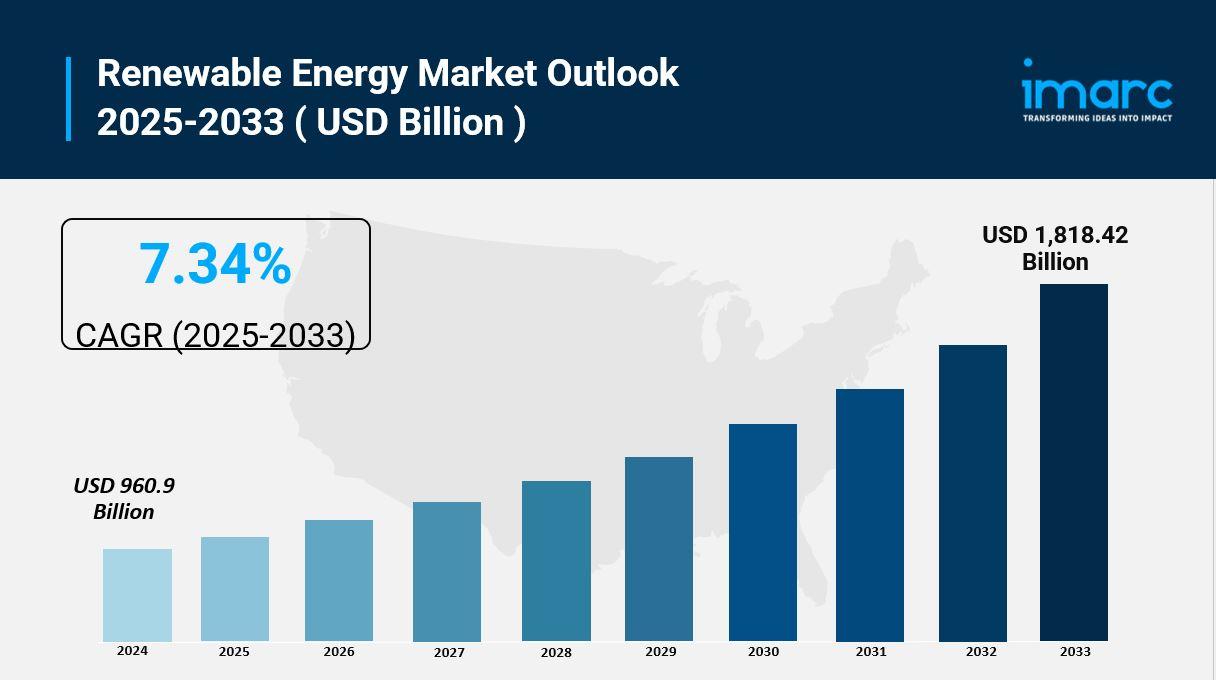

The global renewable energy market size around USD 960.9 Billion and is expected to reach about USD 1,818.42 Billion by 2033 with growth at a CAGR of 7.34% during 2025-2033. Across the globe, increasing climatic changes and depletion in fossil fuels are pushing the growth of the global renewable energy market. The renewable energy market is undergoing a rapid growth phase due to a greater demand for energy resources and increasing knowledge of environmental sustainability within. Renewable energy is created from sunlight, wind, water, geothermal energy and biomass, all of which have a relatively low environmental impact and are abundant and sustainable energy resources. Government policies influence this demand as they promote renewable energy. The declining cost of renewable energy technologies also influences it. In many businesses, the growing demand for sustainability influences this demand. Manufacturers and energy developers offer a variety of renewable energy products including solar panels, turbine-based wind power and energy storage. Smart grid technology increasingly penetrates and green hydrogen projects are adopted. These actions will further help improve the renewable energy market size during the forecast period.

The global Renewable Energy Market Share is accelerating as countries prioritize clean power generation to reduce carbon emissions and enhance energy security. Rapid adoption of solar, wind, hydropower, and bioenergy technologies is driven by supportive government policies, declining installation costs, and rising environmental awareness. Advancements in energy storage, smart grids, and green hydrogen are further boosting Renewable Energy Market Growth. Additionally, corporate sustainability initiatives and large-scale investments in renewable infrastructure are strengthening market expansion worldwide, positioning renewables as a key pillar of future global energy systems.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Renewable Energy Market Key Takeaways

- Current Market Size: USD 960.9 Billion (2024)

- CAGR: 7.34% (2025-2033)

- Forecast Period: 2025-2033

- The market is estimated to reach USD 1,818.42 Billion by 2033.

- Asia Pacific dominates as the largest consumer, driven by rapid industrialization, government policies, and strong renewable energy capacity additions.

- Hydropower is the leading product segment by type, while solar power is the fastest-growing segment.

- Industrial applications represent the largest end-user segment, with utilities sector showing significant growth potential.

- Market growth is supported by declining technology costs, favorable government policies, and increasing corporate sustainability commitments.

Request a Sample Report: https://www.imarcgroup.com/renewable-energy-market/requestsample

Market Growth Factors

Consumers and industry adopt renewable energy to replace fossil fuels. These fuels emit greenhouse gases. These gases are harmful to the environment. Climate change awareness, energy security needs and global treaties for combatting climate change are factors. These factors are driving this adoption. Over 140 countries pledge to reach net-zero emissions between the 2030s and 2070s, so support increases for renewable energy to generate energy and for energy to be used. This created enormous demand for renewable energy as a sustainable power source. Renewable energy is becoming adopted by governments, corporations and green consumers because it is abundant, sustainable, low-cost over the long term and a low carbon energy source.

Multiple renewable energy technologies have been introduced for example solar photovoltaic, offshore wind, floating solar photovoltaic, green hydrogen, and energy storage technologies. These technologies need energy and adopt renewable energy in various geographies and demographics. Of late, they have also received strong government support worldwide through tax incentives, feed-in tariffs, renewable portfolio standards, or direct subsidies. For example, according to the European Union's REPowerEU plan, more than 600 GW of solar and 510 GW of wind exist by 2030, and the United States Inflation Reduction Act provides more than $370 billion of tax credits for clean energy.

Renewable energy impacts the environment to a lesser degree than fossil fuel energy because it needs no fuel mining or burning, does not emit where it is used and makes much less carbon dioxide equivalent during its life. This is meeting a consumer and corporate demand for renewable energy, and a growth in renewable technologies such as perovskite solar cells, high-efficiency offshore wind turbines, floating solar farms and long-duration energy storage at both grid and distributed generation scales. Innovations in grid integration, smart grid technologies and storage have made renewable energy more reliable, and thus more attractive to power system operators.

Greater deployment of renewables for energy security and cost reduction is also driving demand. In 2025, solar PV and wind are projected to make up 95% of global renewable capacity additions and renewables are becoming increasingly competitive with fossil fuel sources in terms of cost. The expansion in corporate sustainability mandates (ESG) and renewable power purchase agreements (PPAs) has been driven by major technology firms, automotive companies and industrial sectors alike committing to renewable energy generation portfolios. The common adoption of renewable energy in the power sector, climate awareness via social media and corporate sustainability commitments have all supported the inclusion of clean energy in national energy plans. Success stories about renewable energy are frequently shared by the renewable energy industry and climate advocacy organizations to further adoption and investment.

Market Segmentation

- Type:

- Hydropower: Dominates the market due to reliability, efficiency, and consistent baseload power generation; includes run-of-river, reservoir, and pumped-storage hydroelectric systems providing grid stability.

- Wind Power: Rapidly growing segment featuring both onshore and offshore wind installations; offshore wind technology leveraging stronger and more consistent wind patterns drives significant capacity additions.

- Solar Power: Fastest-growing segment with versatile applications including utility-scale solar farms, commercial rooftop installations, and residential solar systems; declining module costs and technological advancements accelerate adoption.

- Bioenergy: Utilizes biomass, biogas, and liquid biofuels for power generation and heating; particularly valuable in rural areas and industries with readily available biomass resources.

- Geothermal: Provides stable baseload power in geologically favorable regions; expanding through enhanced geothermal systems (EGS) technology.

- Others: Includes emerging technologies such as tidal energy, wave energy, and ocean thermal energy conversion.

- End User:

- Industrial: Largest segment, driven by energy-intensive sectors such as manufacturing, chemicals, data centers, mining, and heavy industries adopting renewables to reduce costs and improve ESG performance.

- Residential: Growing rapidly through rooftop solar installations, community solar programs, and small-scale wind systems; driven by declining costs and government incentives.

- Commercial: Includes office buildings, retail centers, and commercial facilities installing solar panels and procuring renewable energy through PPAs.

- Utilities: Major segment encompassing large-scale renewable power plants operated by utility companies for grid-connected electricity generation.

- Distribution Channel & Deployment:

- On-Grid: Renewable energy systems connected to national or regional electricity grids, representing the majority of installations for utility-scale and large commercial projects.

- Off-Grid: Stand-alone renewable energy systems providing power in remote areas without grid access; includes microgrids and distributed generation solutions.

- Direct Sales: Energy companies and developers selling renewable power directly to industrial consumers and utilities through long-term contracts.

- Power Purchase Agreements (PPAs): Corporate and institutional buyers procuring renewable electricity through long-term agreements with renewable energy producers.

Regional Insights

Asia Pacific currently dominates the market with over 41.8% market share, driven by rapid industrialization, urbanization, and strong government support for renewable energy development across China, India, Japan, South Korea, and other regional countries. Its dominance is attributed to massive investments in solar and wind capacity, declining technology costs, energy security priorities, and ambitious national renewable energy targets. China alone accounts for approximately 55% of global annual renewable capacity deployment, while India has committed to achieving 500 GW of renewable energy capacity by 2030.

Recent Developments & News

- March 2025: Iberdrola announced the commissioning of a 500 MW solar photovoltaic plant in Extremadura, Spain, one of the largest in Europe, generating clean electricity for over 250,000 households annually.

- March 2025: Siemens Gamesa secured a contract to supply 100 wind turbines to a 1.2 GW offshore wind project in Taiwan, one of the largest offshore developments in Asia-Pacific.

- February 2025: Tesla Energy launched its V5 solar roof system in Europe, combining PV generation with integrated Powerwall storage and smart grid-ready inverters.

- January 2025: Adani Green Energy commissioned a 2 GW hybrid solar-wind park in Gujarat, India, the largest hybrid renewable facility globally.

- January 2025: GE Vernova's Onshore Wind business entered a strategic framework agreement with Squadron Energy for 1.4 GW of onshore wind projects in New South Wales, Australia.

- December 2024: ABB announced acquisition of Gamesa Electric Business to strengthen its renewable power conversion portfolio, with closure expected in second half of 2025.

- November 2024: Endesa, a subsidiary of Enel SpA, acquired Corporación Acciona Hidráulica for €1 billion, adding 34 hydroelectric plants with 626 MW combined capacity.

- November 2024: Ørsted began construction of a 1.5 GW floating offshore wind farm off the coast of Norway, leveraging advanced deep-water anchoring systems.

- September 2024: Shell and BP jointly invested $1.8 billion in green hydrogen production plants powered by onshore wind and solar in Oman, targeting export markets in Europe and Asia.

- August 2024: ABB achieved a milestone by surpassing 10 GW in delivering solutions for renewable power plants in India, operating over 300 projects across the country.

Key Players

- ABB Ltd.

- Acciona S.A.

- Duke Energy Corporation

- Électricité de France S.A. (EDF)

- Enel S.p.A.

- General Electric Company (GE Vernova)

- Innergex Renewable Energy Inc.

- Invenergy

- National Grid Renewables

- NextEra Energy Inc.

- Schneider Electric SE

- Siemens Gamesa Renewable Energy

- Suzlon Energy Ltd.

- Tata Power Company Limited

- Xcel Energy Inc.

- Iberdrola S.A.

- Vestas Wind Systems A/S

- Canadian Solar

- Ørsted

- Engie

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=12646&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!