IMARC Group has recently released a new research study titled “United States Precast Concrete Market Size, Share, Trends and Forecast by Type, Product, End Use, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

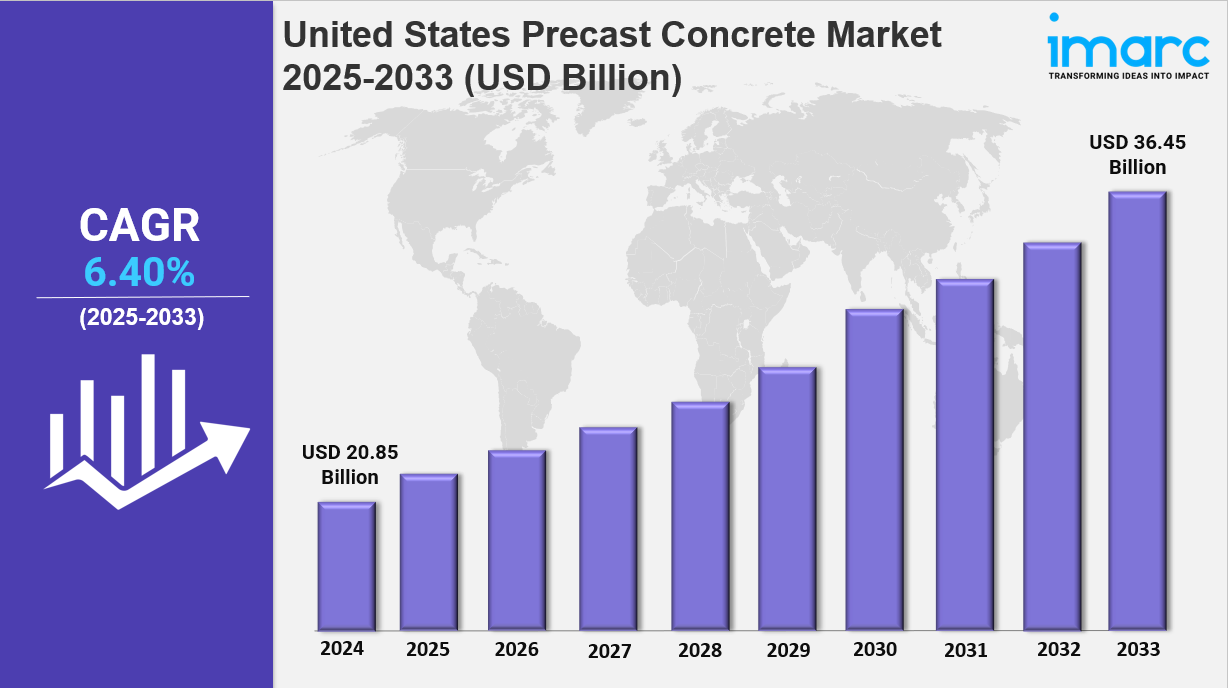

The United States precast concrete market size was valued at USD 20.85 Billion in 2024 and is projected to reach USD 36.45 Billion by 2033, exhibiting a CAGR of 6.40% during the forecast period 2025-2033. Growth is driven by increased construction activities, infrastructure modernization, cost efficiency, durability, urbanization, technological advancements, and sustainability practices. The market benefits from government initiatives such as the Infrastructure Investment & Jobs Act and rising demand across residential and commercial sectors.

Study Assumption Years

-

Base Year: 2024

-

Historical Year/Period: 2019-2024

-

Forecast Year/Period: 2025-2033

United States Precast Concrete Market Key Takeaways

-

Current Market Size: USD 20.85 Billion in 2024

-

CAGR: 6.40% from 2025 to 2033

-

Forecast Period: 2025-2033

-

Infrastructure development and urbanization are primary growth drivers.

-

The U.S. construction spending reached $1.9 trillion in 2023, a 5.7% increase from 2022.

-

Labor shortages in construction increase demand for precast concrete’s efficient off-site manufacturing.

-

Sustainability focus includes recycled materials, energy efficiency, and alignment with green building standards.

-

Technological advancements in automation and design software enhance product precision and versatility.

Sample Request Link: https://www.imarcgroup.com/united-states-precast-concrete-market/requestsample

To get more information on this market, Request Sample

United States Precast Concrete Market Growth Factors

The precast concrete industry in the United States is driven by a growth in infrastructure projects and urbanization. In late 2021, the Infrastructure Investment & Jobs Act funded infrastructure projects with US$1 trillion over eight years and relied more on precast concrete components. Investments that are a lot in the infrastructure sector, especially in the roadways, bridges, and utilities sectors, are causing the market to grow. Growing urbanization is also fueling demand for lightweight, time-saving precast concrete components for residential and commercial buildings.

The U.S construction industry has a meaningful labor shortage, with over 919000 businesses employing eight million people in 2023. Because it is short, precast concrete can help meet the demand when moving the bulk of construction off-site to manufacturing facilities. This moving can lessen labor on-site and shorten build time. This minimizes delays, reduces labor costs, and allows for quality control in times when labor is hard to come by.

Sustainability pushes the precast industry toward energy efficiency with use of durable materials and recycled content. The precast concrete industry in the United States generated over $25.8 billion in sales and paid over $5.1 billion in salaries in 2022. Precast concrete can contribute toward achieving the specifications of green certifications by reducing waste, improving thermal performance, and reducing the environmental impacts of the life cycle of buildings, resulting from the growing demand for low-carbon-footprint and sustainable building products.

United States Precast Concrete Market Segmentation

Analysis by Type:

-

Floors and Roofs: Demand stems from rapid installation and high load-bearing capacity crucial for large commercial and industrial structures, reducing on-site labor.

-

Columns and Beams: These precast structural elements provide enhanced strength and uniformity, supporting modern architectural complexity and structural flexibility.

-

Stairs and Landing: Greater demand driven by requirements for precision, safety, building codes, and accessibility in multi-story buildings.

-

Walls: Valued for thermal insulation and soundproofing, meeting energy efficiency and acoustic optimization needs, especially in urban environments.

Analysis by Product:

-

Structural Building Components: Dominate the market with 38.7% share, prized for accelerating construction timelines and enhancing structural integrity of large projects.

-

Architectural Building Components: High demand for aesthetic versatility and durability, supporting intricate designs and long-lasting building facades.

-

Transportation Products: Include precast bridge components and railroad ties, vital for the expanding and maintaining U.S. transportation infrastructure.

-

Water and Waste Handling Products: Usage includes pipes and culverts, favored for strength and longevity supporting sustainable infrastructure.

-

Others: Include utility structures and retaining walls offering flexibility and resilience for diverse construction needs.

Analysis by End Use:

-

Residential: Leads the market with 63.2% share; driven by needs for safe, sustainable, and affordable housing with thermal insulation and resistance to floods and fires.

-

Non-Residential: Growth supported by large commercial, industrial, and institutional projects requiring thermal insulation and soundproofing for energy efficiency and occupant comfort.

Regional Insights

The report identifies the South as a region experiencing rapid population growth and urbanization, driving increased residential and commercial construction projects. The cost-effectiveness and speed of precast concrete installation make it preferred in this region. The Northwestern U.S. focuses on sustainable construction and seismic resilience, aligning with precast concrete's durability and energy efficiency suitable for seismic requirements. The Western region, including California, faces strict seismic building codes favoring precast concrete for earthquake-resistant structures.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=19938&flag=C

Recent Developments & News

In January 2025, TCC Materials merged Minnesota subsidiaries Amcon Concrete Products LLC and Borgert Products LLC into its primary business, streamlining operations into four divisions to boost efficiency. In December 2024, Vulcan Materials acquired Superior Ready Mix Concrete L.P., expanding its presence in California with 13 ready-mix plants and other assets. In July 2024, NPCA, PCI, and ACPA received a $9.975 million EPA grant for updating the precast concrete Product Category Rule and developing Environmental Product Declarations. In March 2024, Coreslab Structures launched eco-friendly precast concrete panels using recycled materials for improved insulation. In May 2023, the UB obtained $1.6 million to join the TRANS-IPIC initiative boosting transportation infrastructure innovation.

Key Players

-

Balfour Beatty plc

-

CEMEX S.A.B. de C.V.

-

HOLCIM

-

Olson Precast Company

-

Wells Concrete

-

Tindall Corporation

-

Coreslab Structures

-

Gage Brothers Concrete

-

Cemstone

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

Join our community to interact with posts!