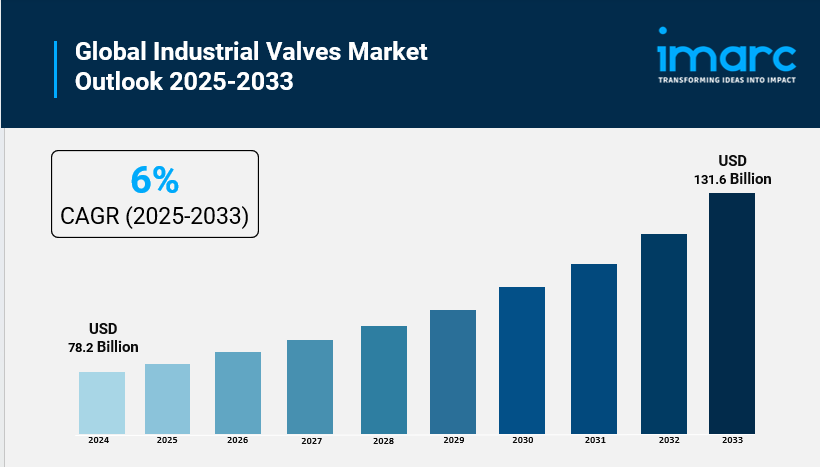

The global industrial valves market share was valued at USD 78.2 Billion in 2024 and is projected to reach USD 131.6 Billion by 2033, growing at a CAGR of 6% during 2025-2033. Asia Pacific dominates with over 42% share in 2024, driven by sectors like oil and gas, water treatment, and power generation. Increasing automation, energy efficiency demands, smart valve innovations with IoT, and infrastructure projects further boost market growth. The study provides a detailed analysis of the industry, including the industrial valves market share, trends, growth, size, and industry growth forecast.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Industrial Valves Market Key Takeaways

- Current Market Size: USD 78.2 Billion in 2024

- CAGR: 6%

- Forecast Period: 2025-2033

- Asia Pacific holds the largest market share of over 42% as of 2024, fueled by rapid industrialization and infrastructure growth.

- Ball valves lead the product type segment with around 19.5% market share in 2024.

- On-Off/Isolation valves account for approximately 61% of the market by functionality in 2024.

- Steel is the leading material segment with a 28.4% market share in 2024.

- The 1"-6" size segment leads with about 27.9% market share in 2024.

- Oil and gas is the leading end-use industry segment holding roughly 22% market share in 2024.

Request for a Free Sample Report: https://www.imarcgroup.com/industrial-valves-market/requestsample

Market Growth Factors

The growth of the industrial valves market is mainly a result of expanding demand for energy infrastructure in developing countries. A major factor that leads to the increased need for advanced valve technologies is the rise in oil and gas exploration activities as well as the upgrading of old power generation facilities. The transition to cleaner energy sources, such as natural gas and renewables, requires the use of sophisticated valves for precise flow control and safety of operations, thus ensuring the continued expansion of the market.

Rapid urbanization and strict environmental regulations in the areas of water and wastewater management systems contribute to the growth of the industrial valve market as these valves are essential components for fluid control in the mentioned infrastructures. The demand for industrial valves and the overall industrial sectors and infrastructure development in regions like Asia Pacific, particularly China and India, is going hand-in-hand.

Market demand is fueled by technological improvements in valve construction, e.g. adoption of IIoT, smart valves, and better materials that are resistant to corrosion and wear. The examples of these trends are Emerson's Crosby™ J-Series pressure relief valves and Parker Hannifin's TFP throttle valve series. The mentioned technologies enhance operational safety, energy efficiency, and contribute to less environmental pollution, thus setting a positive market outlook.

Market Segmentation

Product Type:

- Gate Valve

- Globe Valve

- Butterfly Valve

- Ball Valve

- Check Valve

- Plug Valve

- Others

*Ball valves account for the largest share (19.5%) in 2024, favored for precise control, low maintenance, and high-pressure handling in various industries.*

Functionality:

- On-Off/Isolation Valves

- Control Valves

*On-Off/Isolation valves lead with 61% share in 2024 due to their reliability in flow shut-off and widespread industrial use.*

Material:

- Steel

- Cast Iron

- Alloy Based

- Others

*Steel valves dominate with 28.4% share in 2024, valued for strength, corrosion resistance, and durability under harsh conditions.*

Size:

- Upto 1"

- 1"-6"

- 7"-25"

- 26"-50"

- 51" and Above

*Valves sized 1"-6" hold 27.9% market share in 2024, favored for versatility across industries requiring moderate flow and precise control.*

End Use Industry:

- Oil and Gas

- Power

- Pharmaceutical

- Water and Wastewater Treatment

- Chemical

- Food and Beverage

- Others

*Oil and gas segment leads with approximately 22% market share in 2024, driven by the need for reliable flow control in exploration, refining, and distribution.*

Regional Insights

In 2024, Asia Pacific was the leader of the global industrial valves market, with a bit over 42% share. The main reasons for this leadership are fast industrialization, big infrastructural projects, and high demand for energy-saving technologies. The main contributors to the region are China and India due to their expanding manufacturing, power generation, and water treatment sectors, that are strengthened by government initiatives and cross-border investments.

Recent Developments & News

- February 2024: Beijer Tech acquired AVS Power Oy, enhancing its position in Finland's industrial valves market.

- February 2024: NDL Industries introduced the largest stainless-steel ball valve DN65 for transcritical CO2 systems at AHR Expo 2024, rated for 120 bar pressure.

- October 2023: AVK Holding A/S acquired Bayard and Belgicast Groups, expanding their product portfolio.

- October 2023: Crane Company acquired Baum Lined Piping GmbH to strengthen its Process Flow Technologies segment.

- February 2023: Flowserve acquired Velan Inc., enhancing presence in nuclear and cryogenic markets.

Key Players

- Alfa Laval

- Bray International

- Crane Company

- Curtiss-Wright Corporation

- Emerson Electric Co.

- Flowserve Corporation

- IDEX India

- IMI Process Automation

- KITZ Corporation

- KLINGER Group

- SLB

- Spirax Sarco Limited

- Valmet

- Walworth

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!