IMARC Group has recently released a new research study titled “North America Dog Food Market Size, Share, Trends and Forecast by Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Country, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

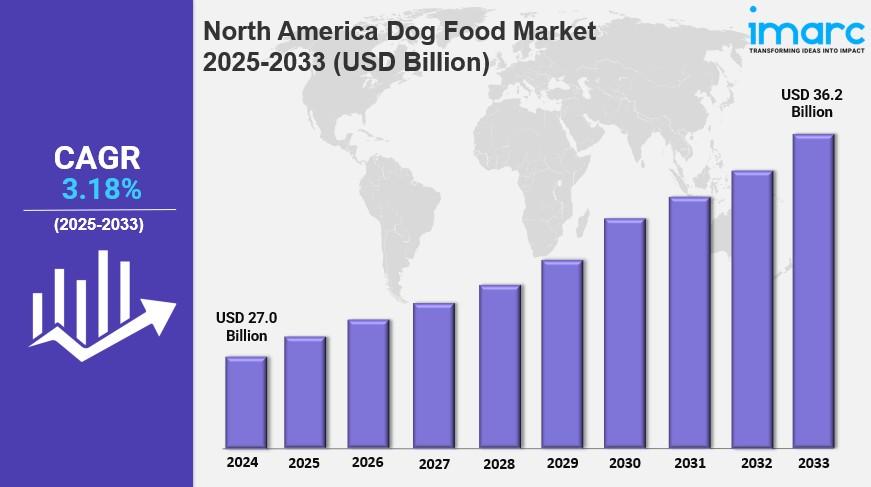

The North America dog food market size was valued at USD 27.0 Billion in 2024 and is projected to reach USD 36.2 Billion by 2033, registering a CAGR of 3.18% over the forecast period 2025-2033. Growth is driven by rising pet ownership, demand for premium and organic products, pet humanization, and expansion of e-commerce with a preference for sustainable and high-protein formulations.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

North America Dog Food Market Key Takeaways

● Current Market Size: USD 27.0 Billion in 2024

● CAGR: 3.18% during 2025-2033

● Forecast Period: 2025-2033

● Pet ownership is increasing in North America due to growing disposable incomes and lifestyle changes.

● Premium, organic, and natural ingredients with no artificial additives are in rising demand.

● E-commerce and subscription services are transforming consumer purchasing behavior.

● Sustainability and ethical sourcing are gaining prominence in product development.

● The U.S. dominates the market due to high pet population and disposable incomes.

Sample Request Link: https://www.imarcgroup.com/North-america-dog-food-market/requestsample

Market Growth Factors

The North America dog food market share is predominantly driven by the rising trend of pet ownership, underpinned by increasing disposable incomes and lifestyle changes. According to the 2024 APPA National Pet Owners Survey, 82 million households in the United States possess pets, illustrating the importance of pet care. This surge in pet ownership encourages demand for healthier, nutrient-rich dog food choices. The market gains momentum from the humanization of pets, where owners increasingly view pets as family members, leading to demand for premium, organic, and natural ingredients without artificial fillers or additives. Manufacturers are responding with products designed to enhance pets’ lifespan and overall health.

A notable growth driver is the rising consumer demand for functional dog foods fortified with health-benefiting ingredients such as probiotics, antioxidants, and omega fatty acids. These formulations tackle specific animal health concerns including joint health, digestion, and skin conditions. Dietary trends such as grain-free, high-protein, and raw diets are becoming popular, reflecting pet owners' interest in specialized nutrition. Subscription services and e-commerce channels expand premium and niche product reach, making high-quality dog food more accessible. Additionally, the surge in pet adoptions further fuels the demand for superior-quality pet foods.

Sustainability and ethical sourcing are gaining prominence, influencing product development and consumer purchase behavior. Pet owners increasingly favor dog food made from responsibly sourced, eco-friendly ingredients and packaging. Some manufacturers explore alternative protein sources like plant-based proteins and insect-derived additives to reduce environmental impact. Surveys reveal that animal welfare significantly influences purchase decisions, prompting companies to highlight sustainability through certifications and transparent ingredient traceability. These efforts reflect a growing commitment to reducing plastic waste and adopting carbon-neutral operations, reinforcing the importance of sustainability in the North American dog food industry.

To get more information on this market Request Sample

Market Segmentation

Analysis By Product Type:

● Dry Dog Food: Dominates the market due to convenience, cost-effectiveness, longer shelf life, and ease of storage and feeding.

● Dog Treats

● Wet Dog Food

Analysis By Pricing Type:

● Mass Products: Not separately described in detail in the source.

● Premium Products: Lead the market driven by pet humanization, disposable income rise, and demand for nutrient-rich, preservative-free, plant-based, and organic ingredients with health benefits.

Analysis By Ingredient Type:

● Animal Derived: Not separately described in detail in the source.

● Plant Derived: Holds majority market share due to shift toward sustainable, ethical consumption. Includes lentils, chickpeas, flaxseeds, and soy protein; rich in nutrients and hypoallergenic.

Analysis By Distribution Channel:

● Supermarkets and Hypermarkets: Largest share due to extensive reach, convenience, bulk discounts, and availability of organic and plant-based products.

● Specialty Stores: Not separately described in detail in the source.

● Online Stores: Growing due to e-commerce adoption, convenience, and personalized subscription models.

● Others

Analysis By Country:

● United States: Dominant market with high pet population, disposable incomes, strong demand for premium and specialized products, and large retail and e-commerce platforms.

● Canada

Regional Insights

The United States is the dominant region in the North America dog food market, supported by a significant pet population of around 89.7 million dogs and 82 million pet-owning households. High disposable incomes and pet humanization drive demand for premium and sustainable products. The country's extensive retail and e-commerce infrastructure ensures easy access to a wide variety of dog food, contributing to its market leadership.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=1728&flag=C

Recent Developments & News

● January 2024: PawCo Foods launched InstaBites, the first shelf-stable, fresh, plant-based dog food, and LuxBites with added gut health benefits of postbiotics.

● April 2024: Purina PetCare announced plans to introduce over 100 new U.S. products, expanding premium brands and microbiome-focused pet foods, aiming to leverage scientific expertise.

● December 2024: Kismet, founded by Chrissy Teigen and John Legend, launched dry treats on Chewy.com made with real animal proteins and superfoods.

● August 2024: Noochies! began FDA approval process for cultivated chicken dog food in the U.S.; parent Further Foods submitted a feeding trial protocol pending approval.

Key Players

● PawCo Foods

● Purina PetCare

● Kismet

● Noochies!

● Further Foods

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!