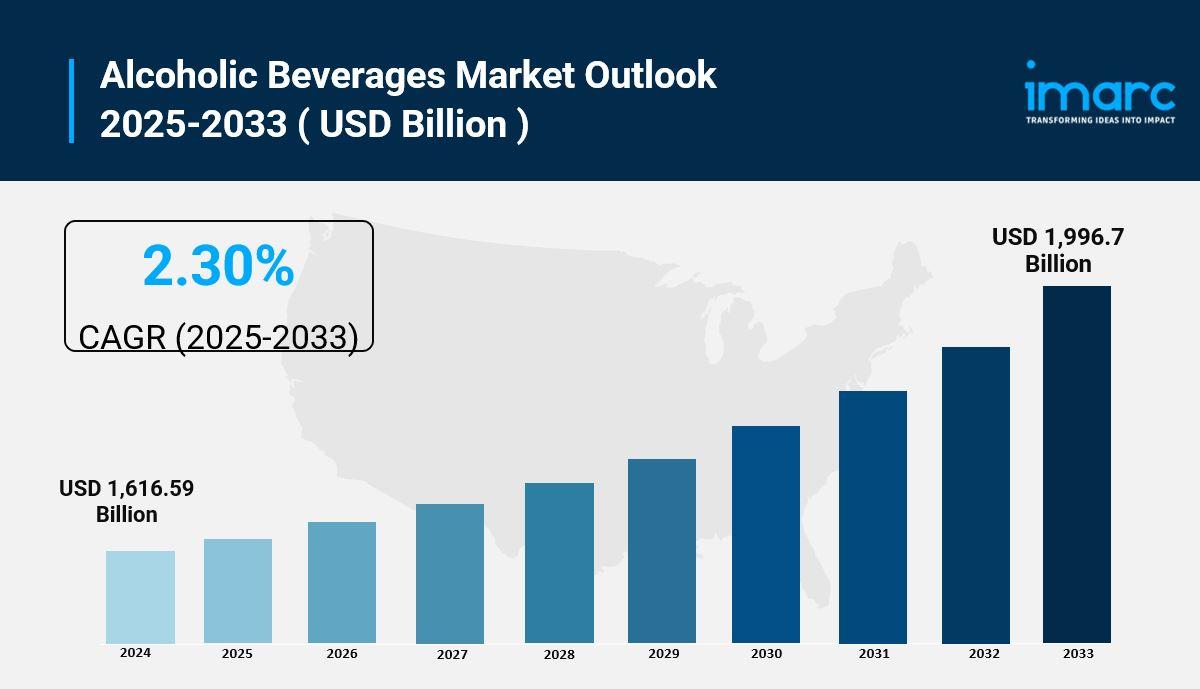

The global alcoholic beverages market share was valued at USD 1,616.59 Billion in 2024 and is projected to reach USD 1,996.7 Billion by 2033, exhibiting a CAGR of 2.30% during the forecast period of 2025-2033. Europe dominates the market with over 45.0% share in 2024, driven by cultural norms, established production facilities, and stable demand for premium wines, beers, and spirits. Growing consumer preference for premium and craft products across emerging economies also fuels market growth.

The global Alcoholic Beverages Market Size continues to expand steadily, driven by evolving consumer preferences, rising premiumization trends, and increasing demand for innovative flavors and craft-based products. Growth is further supported by the rapid expansion of e-commerce platforms, which are reshaping distribution channels and improving accessibility for a wide range of alcoholic drinks. Millennials and young adults are playing a key role in market growth, favoring experiential drinking, low-alcohol alternatives, and sustainable packaging. Additionally, strong tourism activity and rising disposable incomes in developing regions are boosting consumption. As manufacturers focus on product diversification, brand storytelling, and healthier formulations, the alcoholic beverages market is expected to witness consistent growth in the coming years.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Alcoholic Beverages Market Key Takeaways

- Current Market Size: USD 1,616.59 Billion in 2024

- CAGR: 2.30%

- Forecast Period: 2025-2033

- Europe holds over 45.0% market share in 2024, dominating the industry.

- The U.S. accounted for about 85.00% share of the alcoholic beverages market in North America in 2024.

- The market is driven by rising disposable incomes, growing demand for premium and craft products, and expansion of nightlife and hospitality sectors.

- Increasing product innovation in flavors and packaging caters to experiential and younger consumers.

Download a sample PDF of this report: https://www.imarcgroup.com/alcoholic-beverages-market/requestsample

Market Growth Factors

The global market for alcoholic beverages is booming, largely thanks to a growing appetite for premium and craft drinks. As people in emerging economies see their incomes rise, they’re on the lookout for unique flavors, authenticity, and a touch of craftsmanship in their drinks. There’s been a noticeable shift towards regionally produced wines, small-batch spirits, and craft beers, particularly among Gen Z and millennials who value curated experiences over mass-produced options. Plus, with the rise of digital technology and international travel, consumers are exposed to a wider variety of drinks, which is driving demand across borders and influencing trends in product innovation, marketing, and consumption.

Another key factor fueling the growth of the alcoholic beverages market is the increase in disposable income, which encourages more spending on drinks. For instance, in 2021, consumers in the EU shelled out over EUR 1.035 billion on alcoholic beverages, making up 7.1% of the overall EU GDP and nearly 14.3% of household spending. On top of that, shoppers are increasingly leaning towards the convenience of online shopping and delivery services, which offer a broad selection, including rare spirits and specialty items. This trend is enhancing market prospects by making products more accessible to consumers.

The push for premium products is rapidly reshaping the market, with consumers willing to spend more for high-quality, unique, and exclusive alcoholic beverages. According to the U.S. Distilled Spirits Council, in 2021, there were 21.7 million 9-liter packs of premium whiskey and 21.1 million packs of premium vodka consumed, with super-premium options seeing significant year-on-year growth. Exotic flavors are also drawing in adventurous consumers, sparking innovation and boosting revenues. Premium brands around the world are rolling out botanically infused and blended spirits, elevating taste profiles and exclusivity, which in turn supports revenue growth in the alcoholic beverages sector.

Market Segmentation

Analysis by Category:

- Beer

- Wine

- Still

- Light Wine

- Sparkling Wine

- Spirits

- Baijiu

- Vodka

- Whiskey

- Rum

- Liqueurs

- Gin

- Tequila

- Others

Beer is the largest segment in 2024, holding around 43.6% share, driven by shifting consumer tastes, demand for variety, craft beers, and globalization facilitating foreign brand availability.

Analysis by Alcoholic Content:

- High

- Medium

- Low

High content includes bottled cocktails and pre-mixed spirits growing with cocktail culture. Medium content covers wine and fortified wine, linked to social and mealtime consumption. Low alcohol content drinks such as beer and low-ABV options gain traction due to moderation and health trends.

Analysis by Flavor:

- Unflavored

- Flavored

Unflavored beverages account for 68.8% of the market, favored for their authenticity, heritage, and cultural acceptance.

Analysis by Packaging Type:

- Glass Bottles

- Tins

- Plastic Bottles

- Others

Glass bottles dominate for premium appeal and preservation, especially in wine and spirits. Tins provide convenience and portability, plastic bottles suit economical packaging, and others include pouches, kegs, and tetra packs.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

Supermarkets and hypermarkets lead with around 42.5% market share in 2024, due to convenience, broad assortment, competitive prices, and promotional activities.

Regional Insights

Europe is the dominant region with over 45.0% market share in 2024. Its growth is supported by cultural drinking customs, stable economy, disposable incomes, premium product demand, strong distribution chains, and tourism. Government regulations assure product quality and consumer confidence, while sustainability concerns and technological advances in production further enhance market growth.

Recent Developments & News

- March 2025: Kraft Heinz launched Crystal Light Vodka Refreshers with 3.8% ABV, zero sugar, and 77 calories, entering the alcohol category with Wild Strawberry and Lemonade flavors.

- February 2025: Diageo introduced Smirnoff Miami Peach vodka (35% ABV) and an RTD lemonade-flavored can (5% ABV).

- February 2025: ABD acquired Fullarton Distilleries' premium craft spirits portfolio for INR 40 Crore, including Woodburns Whisky, Pumori Small Batch Gin, and Segredo Aldeia Rum.

- September 2024: Bacardi and Coca-Cola partnered to release an RTD rum and cola cocktail debuting in Europe and Mexico in 2025.

- September 2024: Maharaja Drinks expanded into the UK market with Indian-made wines, beers, teas, and coffees, targeting sustainability and younger demographics.

Key Players

- AB InBev

- Asahi Group Holdings Ltd

- Bacardi Limited

- Beijing Yanjing Brewery Co., Ltd.

- Carlsberg Breweries A/S

- Constellation Brands, Inc.

- Diageo PLC

- Heineken N.V.

- Kirin Holdings Company, Limited

- Molson Coors Beverage Company

- Olvi PLC

- Pernod Ricard

- Tsingtao Brewery Co., Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=1483&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!