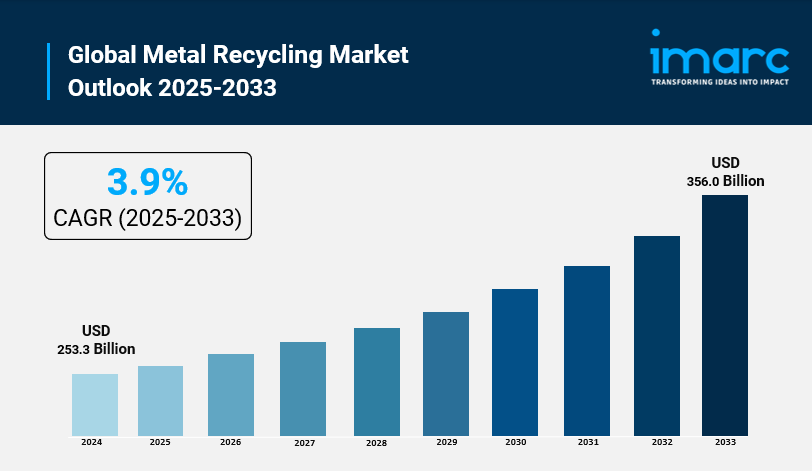

The global metal recycling market was valued at USD 253.3 Billion in 2024 and is projected to reach USD 356.0 Billion by 2033, growing at a CAGR of 3.9% between 2025 and 2033. The market is primarily driven by heightened environmental awareness, industrial expansion, energy conservation efforts, automotive sector applications, and the construction industry's increasing demand. Asia Pacific currently leads the market with a share exceeding 51.9%. The study provides a detailed analysis of the industry, including the Metal Recycling Market Trends, share, growth, size, and industry growth forecast.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Metal Recycling Market Key Takeaways

- Current Market Size: USD 253.3 Billion in 2024

- CAGR: 3.9% during 2025-2033

- Forecast Period: 2025-2033

- Asia Pacific dominates with over 51.9% market share in 2024.

- Aluminum leads the market by metal type with approximately 56.6% share in 2024.

- Ferrous metal holds around 62.0% market share by type in 2024.

- Building and construction is the leading end use segment with about 40.0% share in 2024.

- The market growth is propelled by rising environmental awareness, industrial growth, strict regulations, and advancements in recycling technologies.

Request for a Free Sample Report: https://www.imarcgroup.com/metal-recycling-market/requestsample

Market Growth Factors

The global metal recycling market is majorly influenced by the increased concern for the environment and a general move towards sustainable resource management among the industries and the consumers. Metal recycling helps in reducing carbon emissions, minimizes the harm to the environment through lessening of mining activities, and at the same time saves a lot of energy. For instance, recycling of aluminum consumes 95% less energy than when it is made from the primary raw material. Apart from that, government regulations and corporate responsibility programs spread throughout the world are helping the green practices to be adopted easily thus making metal recycling an inevitable practice.

One of the greatest contributors to the steel and cast-iron production in the United States has been the recycling effort. In detail, recycling one ton of steel saves 1.1 tons of iron ore, 0.05 ton of limestone, and 0.6 ton of coking coal. Steel recycling can lead to energy saving of up to 72%, while copper recycling can result in energy saving of approximately 85%. With the increase in the costs of energy and the rise in the demand for energy, the industries are progressively turning metal recycling into their method of cutting costs and improving their sustainability.

The escalating vehicle production in the automotive industry is a significant market driver. The worldwide production of vehicles reached a total of over 85 million units in 2022, which was a 6% increment compared to the previous year; while the US was responsible for the 10% increase out of these. The recycled metals find their way heavily in the parts of vehicles such as the fenders and hoods where they are are use to support the objectives of sustainability and circular economy. Moreover, the modernization of the scrap metal processing facilities and investments such as the USD 10 million Greenwave Technology Solutions' investment in 2023, as well as the strategic acquisitions, for example, ArcelorMittal's acquisition of Złomex and Riwald Recycling, are going further to solidify the market's capacity and positive prospects for growth.

Market Segmentation

Analysis by Metal Type:

- Steel

- Aluminum

- Copper

- Others

*Aluminum leads with around 56.6% market share in 2024 owing to its high recyclability and usage in sectors such as automotive, construction, and packaging.*

Analysis by Type:

- Ferrous Metal

- Non-Ferrous Metal

*Ferrous metal holds around 62.0% market share in 2024 due to its strength, durability, and extensive application across automotive, construction, and industrial manufacturing sectors.*

Analysis by End Use Industry:

- Building and Construction

- Packaging

- Automotive

- Industrial Machinery

- Electronics and Electrical Equipment

- Shipbuilding

- Others

*Building and construction dominate with approximately 40.0% share in 2024, driven by recycled metals used in infrastructure and residential projects that provide cost-effective and sustainable solutions.*

Regional Insights

Asia Pacific is the leading global metal recycling market player with a market share of more than 51.9% in 2024. The primary reason behind the regional leadership is the well-developed recycling industry that is a direct result of the processes of industrialization and urbanization. Big countries like China, India, and Japan are the main beneficiaries of strict environmental regulations and a concerted move towards resource conservation. Large scrap metal volumes, huge infrastructure projects, and high production capacities make the region the largest producer and consumer of the metal recycling market globally.

Recent Developments & News

- October 2024: Aurubis and COFICAB renewed a multi-year contract to supply sustainably sourced copper wire rods for the automotive sector, focusing on recycling and carbon neutrality by 2050.

- October 2024: Harsco Environmental signed a 10-year contract with Nucor Steel Kingman for slag recovery and scrap yard management services starting 2025.

- May 2024: European Metal Recycling (EMR) invested in Renewable Metals to establish a demonstration-scale EV battery recycling plant in the UK, extracting critical minerals by 2025.

- January 2024: German metal recycling trade groups published a report emphasizing scrap metals' role in cutting emissions.

- January 2024: GreenSpark Software received US$ 9.4 million funding to expand its modern operating system for metal recycling.

- December 2023: Caterpillar invested USD 44 Million in recycling company Nth Cycle.

Key Players

- ArcelorMittal

- Aurubis AG

- Commercial Metals Company

- Dowa Holdings Co. Ltd.

- European Metal Recycling Ltd (Ausurus Group Ltd)

- Nucor Corporation

- OmniSource LLC (Steel Dynamics Inc.)

- Schnitzer Steel Industries Inc.

- Sims Limited

- Tata Steel Limited

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!