IMARC Group has recently released a new research study titled “United States Energy Drinks Market Report by Type (Alcoholic, Non-Alcoholic), End User (Kids, Adults, Teenagers), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, and Others), and Region 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

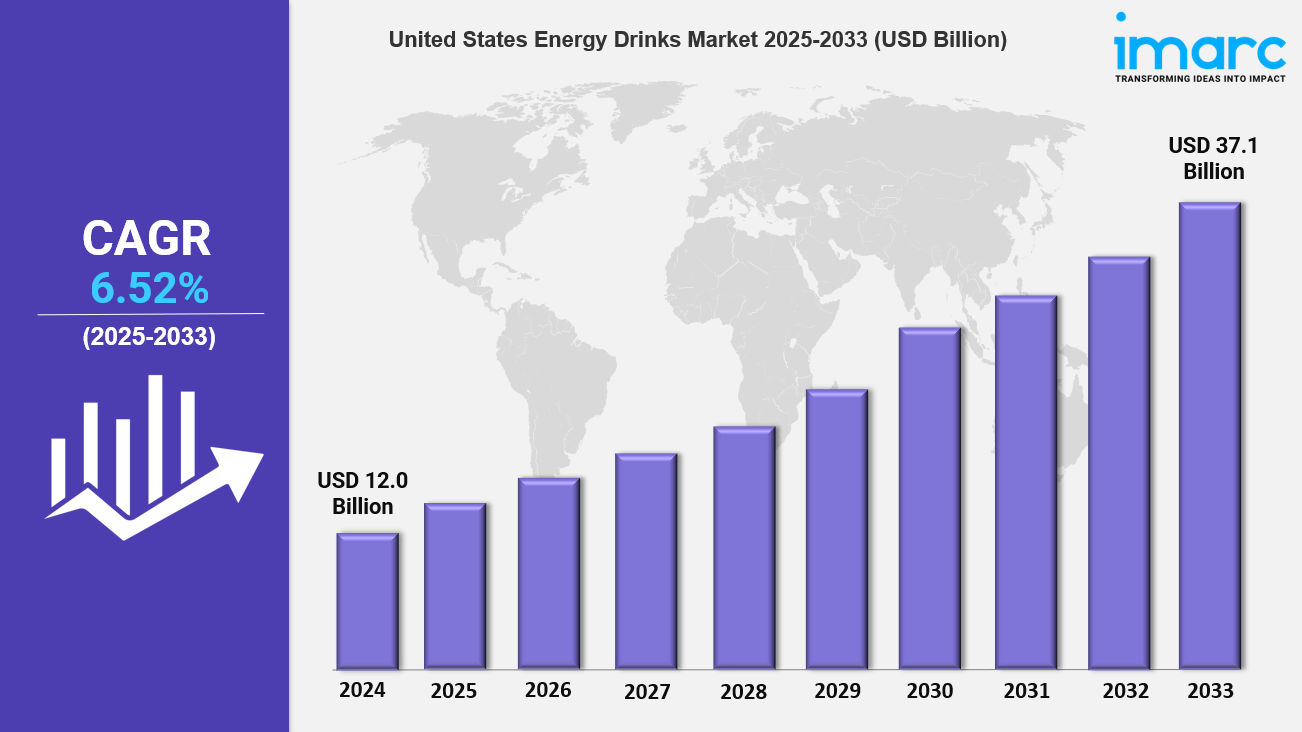

The United States energy drinks market size was valued at USD 12.0 Billion in 2024 and is projected to reach USD 37.1 Billion by 2033, expanding at a CAGR of 6.52% during the 2025-2033 forecast period. Growth is driven by rising consumer awareness, expanding distribution channels, urbanization, digital marketing influence, and a shift toward natural and organic ingredients.

Study Assumption Years

-

Base Year: 2024

-

Historical Year/Period: 2019-2024

-

Forecast Year/Period: 2025-2033

United States Energy Drinks Market Key Takeaways

-

Current Market Size: USD 12.0 Billion (2024)

-

CAGR: 6.52% (2025-2033)

-

Forecast Period: 2025-2033

-

The market is propelled by increased consumer preference for functional beverages and a growing youth demographic demanding quick energy boosts.

-

Expansion of diverse distribution networks including supermarkets, convenience stores, and online platforms is boosting market accessibility.

-

Innovation trends include unique flavors, product diversification, and the use of natural and organic ingredients.

-

Digital marketing and social media campaigns play a crucial role in consumer engagement and sales growth.

-

Urban areas dominate demand due to busy lifestyles and regional preferences influence product offerings.

Sample Request Link: https://www.imarcgroup.com/united-states-energy-drinks-market/requestsample

To get more information on this market, Request Sample

United States Energy Drinks Market Growth Factors

The United States energy drinks market growth is experiencing steady growth driven by several identifiable factors explicitly mentioned in the report. Firstly, increased consumer awareness and preference for functional beverages encourage consumption, especially among millennials and Generation Z who seek products promising enhanced physical and mental performance. This trend aligns with health consciousness that's fueling demand beyond simple hydration, supporting rapid market expansion at a CAGR of 6.52% during 2025-2033.

Secondly, the market benefits from the expansion of distribution channels. Manufacturers extend their reach through supermarkets, hypermarkets, specialty stores, convenience stores, online stores, and other channels. Strategic marketing initiatives include integrating energy drinks with sports events, music festivals, and endorsements from celebrities and athletes, enhancing visibility and driving wider consumer engagement, directly contributing to increased revenue.

Thirdly, product innovation and diversification emphasize the market's shift towards natural and organic ingredients. Customers' growing awareness of the harmful effects of artificial additives drives reformulation of energy drinks using organic caffeine, natural sweeteners, and plant extracts. This trend both supports the market demand and caters to consumers focused on health and wellness outcomes such as improved focus, athletic performance, and reduced tiredness.

Market Segmentation

By Type:

-

Alcoholic: Energy drinks containing alcoholic content. These cater to consumers seeking a combination of energy-boosting effects along with alcoholic effects.

-

Non-Alcoholic: These beverages do not contain alcohol and are preferred by a broader demographic including adults, teenagers, and kids for a quick energy boost.

By End User:

-

Kids: Energy drinks targeted specifically at children, tailored to meet safety and consumption guidelines for this age group.

-

Adults: The largest consumer segment, encompassing working professionals and fitness enthusiasts seeking mental and physical energy.

-

Teenagers: Youth consumers, particularly millennials and Generation Z, who actively consume energy drinks for instant energy during busy lifestyles.

By Distribution Channel:

-

Supermarkets and Hypermarkets: Large retail chains offering wide availability and convenience.

-

Specialty Stores: Stores focusing on health, organic, or niche beverages.

-

Convenience Stores: Small retail outlets providing quick purchase options.

-

Online Stores: E-commerce platforms increasing accessibility and variety.

-

Others: Additional distribution avenues including vending machines and direct sales.

By Region:

-

Northeast: Regional market segment reflecting local preferences.

-

Midwest: Geographic focus capturing consumption trends in central U.S.

-

South: Region showing distinctive demand characteristics.

-

West: Western U.S. market with specific consumer behavior patterns.

Regional Insights

The urban regions of the United States dominate the demand for energy drinks due to rapid urbanization and busy lifestyles that require convenient energy solutions. Metropolitan areas are significant consumption hubs where professionals, students, and athletes seek quick energy sources. Regional flavor and ingredient preferences also impact product offerings, with some areas showing higher demand for natural and organic ingredients, underscoring the market's diverse and urban-centric nature.

Recent Developments & News

On 2nd July 2024, Exponent Energy Inc., a London-based maker of plant-based, sugar-free energy drinks, announced a production shift to Black Fly Beverage Co. to increase capacity and meet growing demand in the U.S. and Canada. This move enhances their production capability to serve an expanding market.

On 3rd April 2024, Nutrabolt's C4 Energy became the first official energy drink partner of WWE in the United States, featuring prominent branding across WWE properties including WrestleMania XL. This partnership introduced WWE-inspired flavors such as Ruthless Raspberry and Berry Powerbomb, with a new Nectarine Guava Knockout flavor available exclusively at Circle K.

Key Players

-

Red Bull

-

Monster Beverage Corporation

-

Exponent Energy Inc.

-

Nutrabolt

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

Join our community to interact with posts!