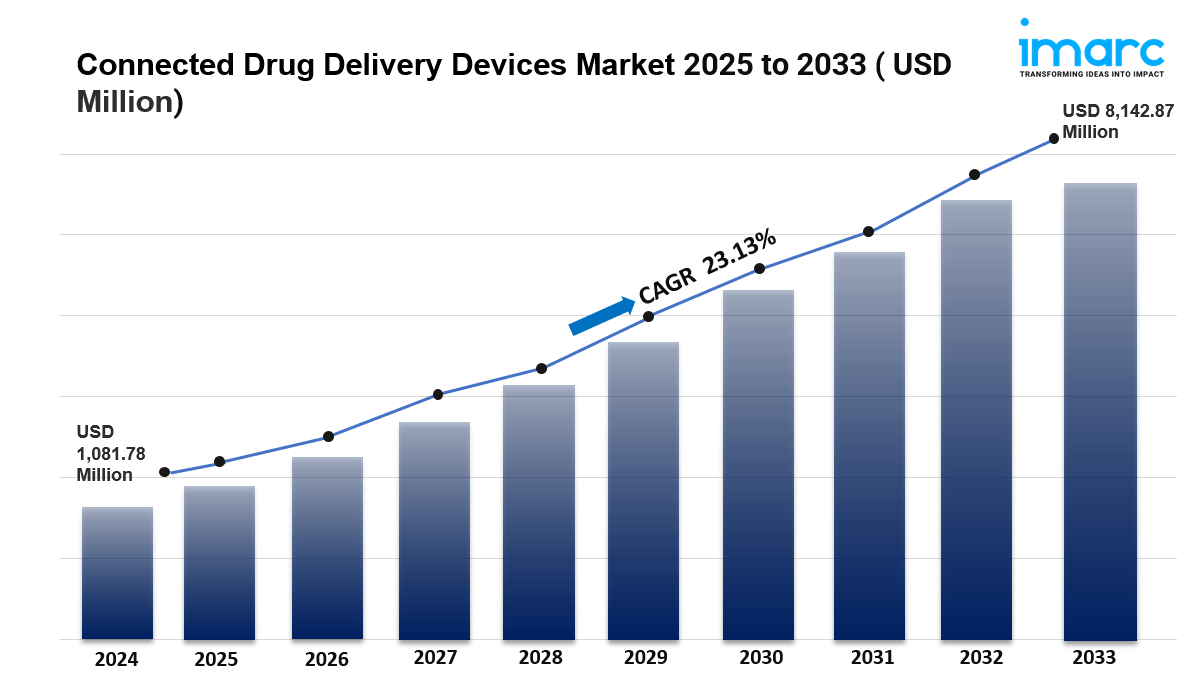

The global connected drug delivery devices market was valued at USD 1,081.78 Million in 2024 and is expected to reach USD 8,142.87 Million by 2033, growing at a CAGR of 23.13% from 2025 to 2033. Growth is driven by technological advancements, increasing chronic disease prevalence, and rising adoption of connected devices. North America leads with a market share of over 41.2% in 2024.

The Connected Drug Delivery Devices Market Share is witnessing significant growth as healthcare systems worldwide increasingly adopt digital health technologies to improve treatment outcomes and patient adherence. Connected drug delivery devices—such as smart inhalers, wearable injectors, and digital insulin pens—integrate advanced connectivity features (e.g., Bluetooth, IoT) that enable real-time data transmission, remote monitoring, and personalized therapy management. These capabilities support healthcare providers in tracking usage patterns, optimizing medication adherence, and reducing hospital readmissions. Rising prevalence of chronic diseases, growing demand for patient-centric care, and heightened focus on remote healthcare solutions are primary drivers of market expansion. Furthermore, the integration of artificial intelligence (AI) and cloud-based platforms enhances device functionality and fosters seamless data interoperability within healthcare ecosystems.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Connected Drug Delivery Devices Market Key Takeaways

- Current Market Size: USD 1,081.78 Million in 2024

- CAGR: 23.13% (2025-2033)

- Forecast Period: 2025-2033

- North America dominates the market with a 41.2% share in 2024, led by advancements in healthcare technology and supportive regulatory frameworks.

- The COVID-19 pandemic accelerated use of remote healthcare solutions, boosting demand for self-monitoring medication devices.

- Chronic diseases like diabetes and cardiovascular conditions increase demand for accurate medication delivery and adherence.

- Integration of sensors and mobile apps enhances real-time monitoring, supporting patients and healthcare providers.

Request a Sample PDF Report: https://www.imarcgroup.com/connected-drug-delivery-devices-market/requestsample

Market Growth Factors

The global connected drug delivery devices market growth is propelled by the rising prevalence of chronic diseases such as asthma, diabetes, and cardiovascular conditions, which require efficient and accurate medication administration. These devices enable precise dosing and improve treatment outcomes, playing a vital role in long-term health management. Additionally, connected devices help mitigate medication non-adherence through reminders, dosage tracking, and notifications, ensuring patients follow prescribed regimens effectively.

The COVID-19 pandemic heightened the adoption of connected drug delivery devices by emphasizing remote healthcare and self-management. Reduced patient visits in healthcare facilities increased demand for devices allowing home use to monitor medication adherence and treatment efficacy. Furthermore, telehealth reimbursement policies expanded, supporting the integration of connected drug delivery technologies into everyday healthcare, enhancing accessibility and convenience.

Technological advancements in sensor technology, wireless connectivity such as Bluetooth, and integration with mobile health applications have improved device functionalities. Bluetooth, the largest technology segment with 61.8% market share in 2024, offers low power consumption and seamless data transmission. Such innovation enables real-time feedback, remote patient monitoring, and personalized treatment adjustments, increasing patient engagement and driving market demand globally.

Market Segmentation

By Product:

- Connected Sensors:

- Connected Inhaler Sensors

- Connectable Injection Sensors

- Integrated Connected Devices:

- Connected Inhalation Devices

- Connected Injection Devices

Integrated connected devices hold the largest market share at 56.8% in 2024, combining medication delivery with advanced monitoring features. These devices offer real-time tracking of usage frequency, technique, injection sites, doses, and timing, thereby improving treatment adherence and outcomes.

By End User:

- Hospitals and Healthcare Providers

- Homecare

Hospitals and healthcare providers represent the largest end-user segment with a 59.3% market share in 2024. They leverage connected devices to enhance patient care, monitor medication adherence, and enable remote patient monitoring, thus facilitating personalized treatment and reducing hospital visits.

By Technology:

- Bluetooth

- NFC

- Other Technologies

Bluetooth dominates with a 61.8% share in 2024 due to its low power consumption, reliable wireless communication, and broad compatibility with smartphones and medical devices. These traits enable seamless data transmission for remote monitoring and patient adherence management.

Regional Insights

North America dominates the connected drug delivery devices market with a 41.2% share in 2024. The region benefits from increased healthcare spending—USD 4.5 trillion in 2022 in the U.S.—and active R&D investments in connected device technologies. Favorable reimbursement policies and strong regulatory support also fuel market expansion, positioning North America as the leading region for connected drug delivery adoption.

Recent Developments & News

- October 2024: Modivcare Inc. partnered with Tenovi to introduce Adherium’s Hailie Smart inhalers, enhancing care for chronic respiratory patients.

- September 2024: SHL Medical launched the Elexy device, an electromechanical drug delivery system with cellular and Bluetooth connectivity.

- June 2024: Aptar Digital Health teamed with SHL Medical to improve connected drug delivery systems by combining software expertise with autoinjector technologies.

- May 2024: Adherium Limited secured a USD 1.1M clinical trial contract with AstraZeneca for the Hailie® Smartinhaler® platform over three years.

Key Players

- Adherium Ltd.

- BioCorp Production

- Cohero Health Inc. (AptarGroup Inc.)

- Elcam Medical ACS. Ltd

- Findair Sp. z o. o.

- Merck KGaA

- Phillips Medisize (Molex LLC)

- Propeller Health (Resmed Inc.)

- Teva Pharmaceutical Industries Ltd.

- West Pharmaceutical Services Inc.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst:https://www.imarcgroup.com/request?type=report&id=3738&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!