India Ice Cream Market Size & Forecast (2025–2033)

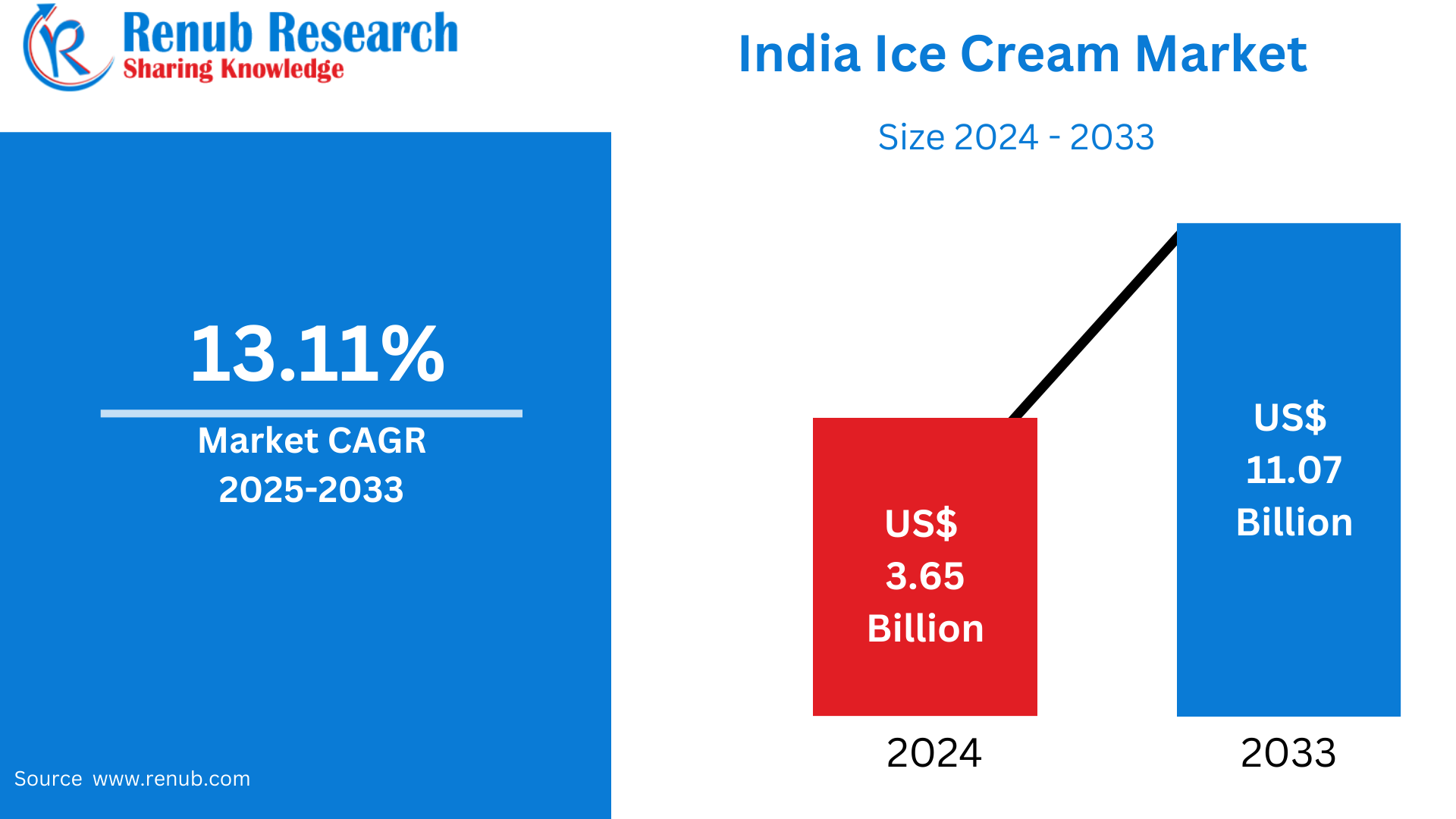

According To Renub Research India ice cream market is poised for remarkable growth over the forecast period, reflecting changing consumer lifestyles, rising incomes, and evolving food preferences. The market, valued at approximately US$ 3.65 billion in 2024, is projected to surge to around US$ 11.07 billion by 2033, expanding at a strong compound annual growth rate of 13.11% from 2025 to 2033. This rapid expansion is driven by increasing demand for frozen desserts, deeper penetration of organized retail, aggressive expansion of quick-service restaurants, and continuous innovation in flavors and formats. Ice cream in India is no longer limited to a seasonal indulgence but is steadily becoming a year-round treat across demographics.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=india-ice-cream-market-p.php

India Ice Cream Market Outlook

Ice cream is a popular frozen dessert made using milk, cream, sugar, and flavoring agents, often enriched with fruits, nuts, chocolate, or syrups. The production process involves freezing and churning the mixture while incorporating air, resulting in a smooth and creamy texture. In India, ice cream is offered in diverse formats such as cones, cups, sticks, sundaes, tubs, and family packs, allowing brands to cater to both impulse buyers and take-home consumers.

Traditionally consumed as a dessert after meals or during celebrations, ice cream has evolved into an everyday snack, especially in urban areas. Its versatility allows it to be paired with cakes, waffles, brownies, and beverages such as milkshakes and floats. Indian consumers also show a strong preference for regionally inspired and seasonal flavors like mango, saffron, rose, and kulfi, alongside globally popular flavors such as chocolate and vanilla. The warm climate across most parts of the country ensures consistent demand, while improved cold-chain logistics and retail reach have made ice cream more accessible than ever.

Increasing Disposable Income and Urbanization

Rising disposable incomes and accelerating urbanization are among the most influential drivers of the India ice cream market. India’s expanding middle class is increasingly willing to spend on branded, premium, and experiential food products. Urban consumers, in particular, are more open to experimenting with gourmet flavors, artisanal offerings, and international-style desserts, driving value growth in the market.

Urbanization also enhances access to modern retail infrastructure, including supermarkets, hypermarkets, malls, and quick-commerce platforms. As more consumers migrate to cities, exposure to organized retail and food service outlets increases, boosting impulse and planned ice cream purchases. Economic growth and rising per capita income further strengthen purchasing power, allowing consumers to trade up from unbranded frozen desserts to trusted and premium ice cream brands.

Expansion of Retail and E-Commerce Channels

The rapid expansion of organized retail and digital commerce has transformed ice cream distribution in India. Modern trade formats such as supermarkets, convenience stores, and specialty food outlets provide better visibility, freezer placement, and product assortment. These channels play a crucial role in driving impulse purchases and improving brand recall.

Simultaneously, e-commerce and quick-commerce platforms have emerged as powerful sales enablers for ice cream brands. Apps offering ultra-fast delivery have made it possible to order ice cream conveniently at home, even during peak summer months. Improved insulated packaging and last-mile cold-chain solutions have reduced spoilage risks, enabling brands to expand their digital footprint across metropolitan and tier-2 cities.

Innovation in Flavors and Product Formats

Continuous innovation is central to sustaining growth in the India ice cream market. Manufacturers are introducing new flavors, textures, and product formats to cater to diverse consumer segments. Beyond traditional vanilla and chocolate, there is growing demand for fruit-based, nut-infused, fusion, and indulgent dessert-inspired flavors.

Health-conscious consumers are also influencing product development, leading to the launch of low-fat, low-sugar, high-protein, and plant-based ice creams. Limited-edition and seasonal flavors, particularly during festivals and summers, generate excitement and repeat purchases. Innovations in packaging, portion size, and premium presentation further enhance product appeal and differentiation in a crowded market.

High Dependence on Cold Chain Infrastructure

Despite strong growth prospects, the India ice cream market faces structural challenges related to cold-chain infrastructure. Ice cream requires uninterrupted temperature control during manufacturing, storage, transportation, and retail display. Inadequate cold storage facilities and inconsistent electricity supply in rural and semi-urban areas can compromise product quality and lead to higher wastage.

For manufacturers and distributors, maintaining temperature integrity across long distances remains a critical operational challenge. Investments in refrigerated transport, modern freezers, and energy-efficient storage systems are essential but capital-intensive, particularly for smaller and regional players.

Increasing Competition and Price Sensitivity

The competitive intensity of the India ice cream market is increasing due to the presence of national brands, regional players, and local manufacturers. Price sensitivity remains high, especially in smaller towns and rural markets, where consumers prioritize affordability over premium features. Local brands often compete aggressively on price, posing margin pressures for established players.

Additionally, substitutes such as frozen desserts, kulfi, and flavored ice lollies compete directly with ice cream, particularly in value-conscious segments. Maintaining brand loyalty while balancing pricing strategies is a key challenge for companies operating across diverse income groups.

India Ice Cream Sticks and Bars Market

Ice cream sticks and bars are among the most popular formats in India, driven by affordability, portability, and convenience. These products dominate impulse purchases, especially among children and young consumers. Offerings include chocolate-coated bars, fruit-based popsicles, and traditional kulfi sticks.

Demand for sticks and bars peaks during summer months, but continuous innovation in coatings, fillings, and flavors helps sustain year-round interest. Attractive pricing and single-serve packaging make this segment a volume driver for major brands.

India Dairy-Based Ice Cream Market

Dairy-based ice cream continues to dominate the Indian market, supported by strong consumer trust in milk-based products. Known for their rich taste and creamy texture, dairy ice creams appeal to consumers seeking quality and authenticity. Manufacturers emphasize the use of real milk, cream, nuts, and fruits to enhance product value.

This segment enjoys widespread acceptance across urban and rural markets, with brands leveraging India’s strong dairy supply base. Premium dairy-based variants with exotic ingredients and indulgent formulations further strengthen growth prospects.

India Impulse Ice Cream Market

Impulse ice cream includes single-serve products such as cones, cups, and sticks that are consumed immediately after purchase. This segment thrives on visibility and convenience, with sales heavily influenced by freezer placement in retail outlets and street-side stores.

Impulse consumption rises sharply during summer and festive seasons, accounting for a significant share of urban ice cream sales. Strong branding, promotional offers, and eye-catching packaging are key success factors in this category.

India Chocolate Ice Cream Market

Chocolate remains one of the most popular ice cream flavors in India, enjoyed across age groups. The chocolate segment includes variants such as milk chocolate, dark chocolate, choco chips, and chocolate almond. Premium chocolate ice creams are increasingly available in tubs, bars, and novelty formats.

Growing consumer preference for indulgent desserts and international flavor profiles continues to fuel demand for chocolate-based ice creams. Effective marketing and seasonal promotions further support this segment’s growth.

India Ice Cream Convenience Stores Market

Convenience stores play a pivotal role in driving ice cream sales, particularly for impulse purchases. Their widespread presence and easy accessibility make them ideal points of sale for cones, cups, and sticks. Brands invest heavily in freezer visibility, branding, and stock rotation to ensure consistent availability during peak demand periods.

Urban and semi-urban convenience stores are especially important during summer, when footfall and spontaneous consumption are high.

India Ice Cream Specialty Stores Market

Specialty ice cream parlors cater to the premium and experiential segment of the market. These outlets focus on artisanal flavors, live preparation, customized sundaes, and premium ingredients. Urban millennials and families are key consumers of this segment, attracted by novelty and experiential dining.

Located primarily in malls and high-street areas of major cities, specialty stores command higher margins and play a vital role in shaping premium ice cream consumption trends.

West Bengal Ice Cream Market

West Bengal’s ice cream market benefits from high summer temperatures and strong demand for fruit-based and traditional flavors. Urban centers such as Kolkata drive consumption through supermarkets, convenience stores, and online platforms. While national brands dominate organized retail, local players remain competitive through pricing and regional flavors.

Maharashtra Ice Cream Market

Maharashtra represents one of the largest ice cream markets in India, led by metropolitan areas like Mumbai and Pune. High disposable incomes, exposure to global flavors, and a strong retail ecosystem support demand for premium and impulse ice creams. Online delivery platforms and modern trade ensure year-round availability and growth.

Andhra Pradesh Ice Cream Market

Andhra Pradesh’s warm climate and growing urbanization contribute to rising ice cream consumption. Cities such as Visakhapatnam and Vijayawada drive demand, particularly for sticks and cones. Regional brands compete actively with national players, while modern retail and e-commerce expand reach across the state.

Uttar Pradesh Ice Cream Market

Uttar Pradesh’s large population base and increasing urbanization make it a high-potential ice cream market. Value-for-money products dominate smaller cities, while premium and novelty offerings are gaining traction in urban centers. Expansion of organized retail and freezer penetration supports steady market growth.

Competitive Landscape and Key Players Analysis

The India ice cream market is highly competitive, with companies focusing on brand strength, distribution reach, and product innovation. Key players include Britannia Industries, Vadilal, Kwality Wall's, Hindustan Unilever, Cremica, Naturals Ice Cream, Amul, Nestle, Patanjali Ayurved, and Mother Dairy. These players compete through pricing strategies, regional expansion, flavor innovation, and investments in cold-chain and digital distribution, shaping the future trajectory of India’s rapidly growing ice cream market.

Join our community to interact with posts!