IMARC Group, a leading market research company, has recently released a report titled "Hot Sauce Market Share, size, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the Hot Sauce market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Hot Sauce Market Overview

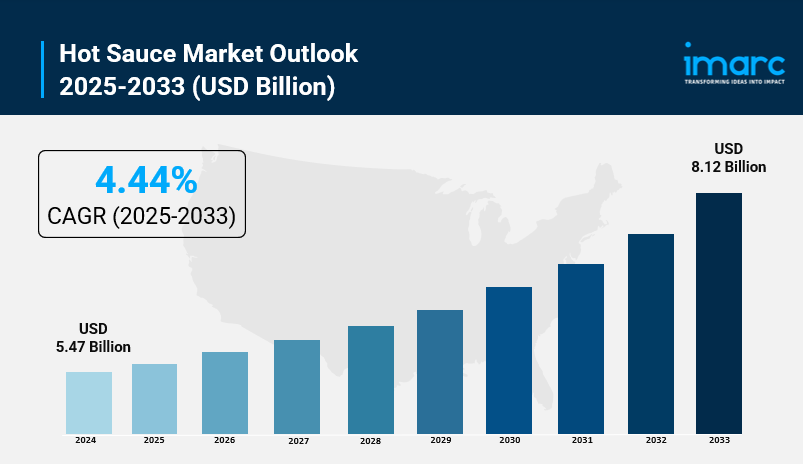

The global Hot Sauce Market was valued at USD 5.47 Billion in 2024 and is projected to reach USD 8.12 Billion by 2033, growing at a CAGR of 4.44% during the forecast period of 2025-2033. This growth is driven by increasing consumer preferences for spicy foods, expanding international cuisine popularity, and the rise of innovative hot sauce products. The market also benefits from healthier eating trends and broader availability through supermarkets and online platforms.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

Hot Sauce Market Key Takeaways

● Current Market Size: USD 5.47 Billion in 2024

● CAGR: 4.44% from 2025 to 2033

● Forecast Period: 2025-2033

● North America dominates with a 44.2% market share in 2024, attributed to cultural preferences and varied culinary scenes.

● Mild hot sauce leads product types, holding 42.7% of the market due to its broad consumer appeal.

● Cooking sauce application accounts for 60.6% share, favored for its versatility in dishes.

● Commercial end-use holds the largest share at 55.9%, driven by demand from restaurants and foodservice.

● Jars are the dominant packaging format, selected for practicality and product preservation.

Claim Your Free "Hot Sauce" Insights Sample PDF: https://www.imarcgroup.com/hot-sauce-market/requestsample

Market Growth Factors

Increasing Consumer Demand for Spicy Flavors and International Cuisines

The hot sauce market is propelled by an escalating consumer preference for bold and spicy flavors. This trend is fueled by a growing interest in international cuisines, including Mexican, Asian, and Caribbean dishes. North America, leading with a 44.2% market share in 2024, exemplifies this rise as consumers increasingly seek authentic and adventurous taste experiences. Moreover, the introduction of premium, artisanal, and gourmet hot sauces that emphasize unique ingredients and small-batch production is fueling the market’s growth. The expanding ethnic population, particularly the Hispanic community in the US accounting for 19.5% of the total population as of 2023, contributes to the demand for hot sauces in everyday cooking.

Health and Wellness Trends Boosting Hot Sauce Popularity

Health-conscious consumers are gravitating towards hot sauces made with natural ingredients such as chili peppers, vinegar, and spices. Many hot sauces promote attributes like gluten-free, sugar-free, and vegan-friendly compositions, broadening their appeal among individuals with specific dietary preferences. Hot sauces are considered flavorful, low-calorie alternatives to other condiments and offer health benefits including pain relief and anti-inflammatory properties. This aligns well with the global wellness economy projected to reach nearly USD 9.0 Trillion by 2028. The rising shift towards clean-label products and home cooking further drives this demand, as consumers seek greater control over ingredients.

Distribution Expansion and Innovation Driving Market Demand

The availability of hot sauces through supermarkets, hypermarkets, and online shopping platforms is broadening the market reach. Supermarkets and hypermarkets held 44.8% of distribution channels in 2024 due to their convenience and variety offerings. Moreover, innovations in flavor profiles and packaging, such as the incorporation of fruit flavors (mango, pineapple), and the rise of gourmet and artisanal brands, enhance consumer interest. Fast food and foodservice sectors are also supporting growth, with foodservice industry sales forecast to reach USD 1.5 Trillion by 2025. Customizable meals using a variety of hot sauces are meeting consumer demand for flavor diversity.

Market Segmentation

Product Type:

● Mild Hot Sauce: Leading category with 42.7% share, appealing due to subtle heat and flavor complexity.

● Medium Hot Sauce: Not provided in source.

● Very Hot Sauce: Not provided in source.

Application:

● Cooking Sauce: Largest segment with 60.6% market share, used for adding heat and richness during cooking.

● Table Sauce: Not provided in source.

End-Use:

● Commercial: Largest share at 55.9%, driven by restaurants and foodservice chains.

● Household: Not provided in source.

Packaging:

● Jars: Dominant segment for practicality, preservation, and sustainability.

● Bottles: Not provided in source.

● Others: Not provided in source.

Distribution Channel:

● Supermarkets and Hypermarkets: Largest channel at 44.8%, offering accessibility and variety.

● Traditional Grocery Retailers: Not provided in source.

● Online Stores: Not provided in source.

● Others: Not provided in source.

Regional Insights

North America leads the global hot sauce market with a share of 44.2% in 2024. This dominance stems from strong consumer demand for spicy foods, a rich cultural taste diversity, and the presence of major hot sauce manufacturers innovating in product varieties. The region’s robust retail infrastructure, including supermarkets, hypermarkets, and online platforms, ensures wide availability. Increasing interest in ethnic and international cuisines further supports North America’s leading position.

Recent Developments & News

● October 2024: Brooklyn Beckham launched Cloud 23, a luxury hot sauce with Hot Habanero and Sweet Jalapeño, following other celebrity brands.

● September 2024: Taco Bell introduced Disha Hot™, a limited-time sauce inspired by Omar Apollo’s Mexican American heritage.

● August 2024: McIlhenny Company launched TABASCO® Salsa Picante, its first Mexican-style hot sauce, vegan-friendly and preservative-free.

● January 2024: TRUFF introduced Jalapeño Lime Hot Sauce combining green jalapeño peppers, lime, and black winter truffle.

● March 2024: Frank’s Red Hot launched Dip’n Sauce and Squeeze Sauce product lines, catering to dipping and drizzling preferences.

Key Players

● McIlhenny Company

● McCormick & Company, Inc.

● Huy Fong Food

● Baumer Foods

● Garner Foods

● B&G Foods

● The Kraft Heinz Company

● SALSA TAMAZULA SA DE CV

● Bruce Foods

● Schwartz

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!