IMARC Group has recently released a new research study titled “South Korea Automotive HMI Market Size, Share, Trends and Forecast by Product, Access Type, Technology, Vehicle Type, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Automotive HMI Market Overview

Market Overview

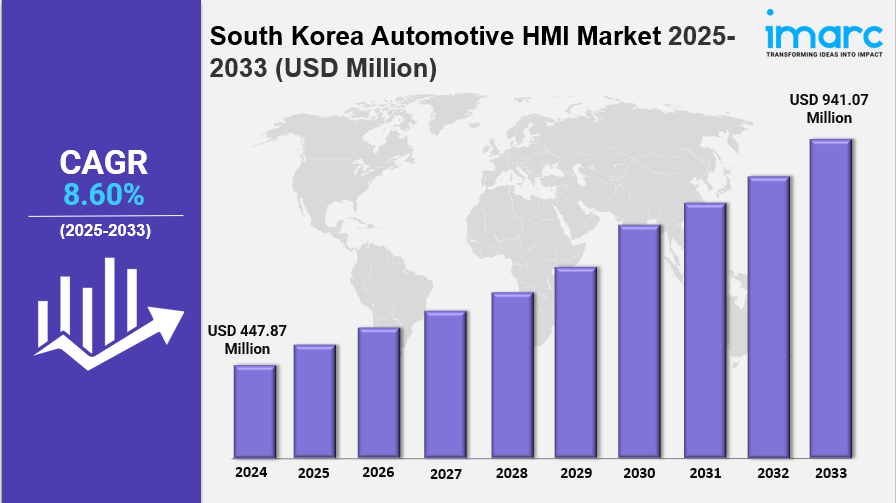

The South Korea automotive HMI market size reached USD 447.87 Million in 2024 and is projected to reach USD 941.07 Million by 2033, growing at a CAGR of 8.60% during 2025-2033. This growth is driven by increasing demand for advanced in-car technologies enhancing user experience and driver safety. Additionally, expanding connectivity options like touchscreens, voice command, and gesture control are boosting market expansion. Regulatory policies promoting environmentally friendly transport also support the adoption of advanced HMI solutions.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

South Korea Automotive HMI Market Key Takeaways

- Current Market Size: USD 447.87 Million in 2024

- CAGR: 8.60% (2025-2033)

- Forecast Period: 2025-2033

- The market growth is fueled by rising demand for innovative in-car technologies that improve driver safety and user experience.

- Expanding customer demand for connectivity options including touchscreens, voice command, and gesture control is key.

- Government regulatory policies enhance environmentally friendly transportation and encourage advanced HMI adoption.

- Integration of AI-powered voice assistants by companies like Hyundai Motor Group is driving new innovations.

- Personalization and UX customization in HMIs are gaining traction, with OEMs introducing user profiles and interactive features.

Sample Request Link: https://www.imarcgroup.com/south-korea-automotive-hmi-market/requestsample

Market Growth Factors

The South Korea automotive HMI market is growing significantly due to the rising demand for cutting-edge in-car technologies. These technologies are designed to enhance the overall user experience and improve driver safety. The increasing adoption of touchscreens, voice command, and gesture control systems is allowing consumers easier and safer access to vehicle functions, especially in dense urban traffic environments where distractions must be minimized. This demand for advanced connectivity options is a strong market driver enabling seamless integration with smart home platforms and cloud-based services.

Another notable growth factor is the increasing integration of AI-powered voice assistants. Supported by advancements in natural language processing and Korean-language AI development, these voice-based controls enable hands-free operation of infotainment, navigation, and climate controls. Hyundai Motor Group, for instance, plans to launch its AI-powered infotainment system PLeOS Connect in Q2 2026, which can process complex driver commands and offers tailored experiences recognizing regional dialects and behavior patterns. The proliferation of 5G networks further boosts this trend by enabling fast, reliable cloud-based voice processing.

Personalization and UX customization are gaining rapid importance as consumers expect digital vehicle interfaces that adapt to individual habits and preferences. OEMs are introducing user profiles storing settings such as seating position, climate, music preferences, and navigation history transferable across vehicles. Hyundai's UX Studio Seoul opened in July 2025 facilitates customer co-creation of software-defined vehicle features using VR testing and real-time feedback. Machine learning enables dynamic system adjustment based on user behavior, improving infotainment suggestions and route planning. Such personalized HMIs also accommodate accessibility needs, allowing interface modifications for drivers with vision or mobility impairments, making vehicles connected hubs within the broader IoT ecosystem.

Market Segmentation

#### Product Insights

- Instrument Cluster: Displays critical driving information such as speed and warnings, essential for driver awareness.

- Central Display: Provides an interactive interface for infotainment, navigation, and vehicle settings.

- Head-Up Display: Projects important data onto the windshield, enabling drivers to view information without looking away from the road.

- Others: Includes additional HMI components supporting enhanced interaction within the vehicle.

#### Access Type Insights

- Standard: Conventional methods of interaction with the HMI including tactile and button-based controls.

- Multimodal: Integration of multiple input methods, such as voice, gesture, and touch, for a more intuitive user experience.

#### Technology Insights

- Visual Interface: Display and graphical technologies used to present information to the driver.

- Acoustic: Voice commands and auditory feedback technologies enabling hands-free control.

- Mechanical: Physical controls and switches involved in HMI.

- Others: Additional technology-based interaction methods beyond the main types.

#### Vehicle Type Insights

- Passenger Cars: HMIs designed for personal vehicles focusing on comfort, connectivity, and safety.

- Commercial Vehicles: Systems tailored for the needs of commercial transport, emphasizing operational efficiency and driver assistance.

Regional Insights

The reported regional segmentation includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others. However, the source does not specify which region dominates or detailed regional market shares or CAGR values. Thus, precise leading regional data is Not provided in source.

Recent Developments & News

Hyundai Motor Group announced plans to integrate its AI-powered infotainment system, PLeOS Connect, developed with Naver, into vehicles starting Q2 2026. This system supports complex voice commands such as managing navigation, weather, news, and schedules simultaneously, driving innovation in voice-assisted HMIs. Hyundai also inaugurated its UX Studio Seoul in July 2025, a cutting-edge facility enabling customers to co-create software-defined vehicle features using VR and real-time feedback, highlighting a strong push towards personalized user experience development in the automotive HMI market.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!