Rise of Payroll Automation in Indian HR

As businesses across India accelerate their digital transformation, payroll automation has become a strategic necessity. Manual payroll processes are not only error-prone and time-consuming but also pose compliance risks due to frequent updates in tax and labour laws. This has led to a surge in demand for robust, reliable, and scalable payroll software solutions.

In 2025, Indian businesses are increasingly seeking HR Payroll Software that offers a seamless blend of automation, compliance, employee self-service, and integration with existing HR systems. Whether you're a startup scaling operations or an established enterprise managing thousands of employees, choosing the best payroll software in India is crucial for operational efficiency.

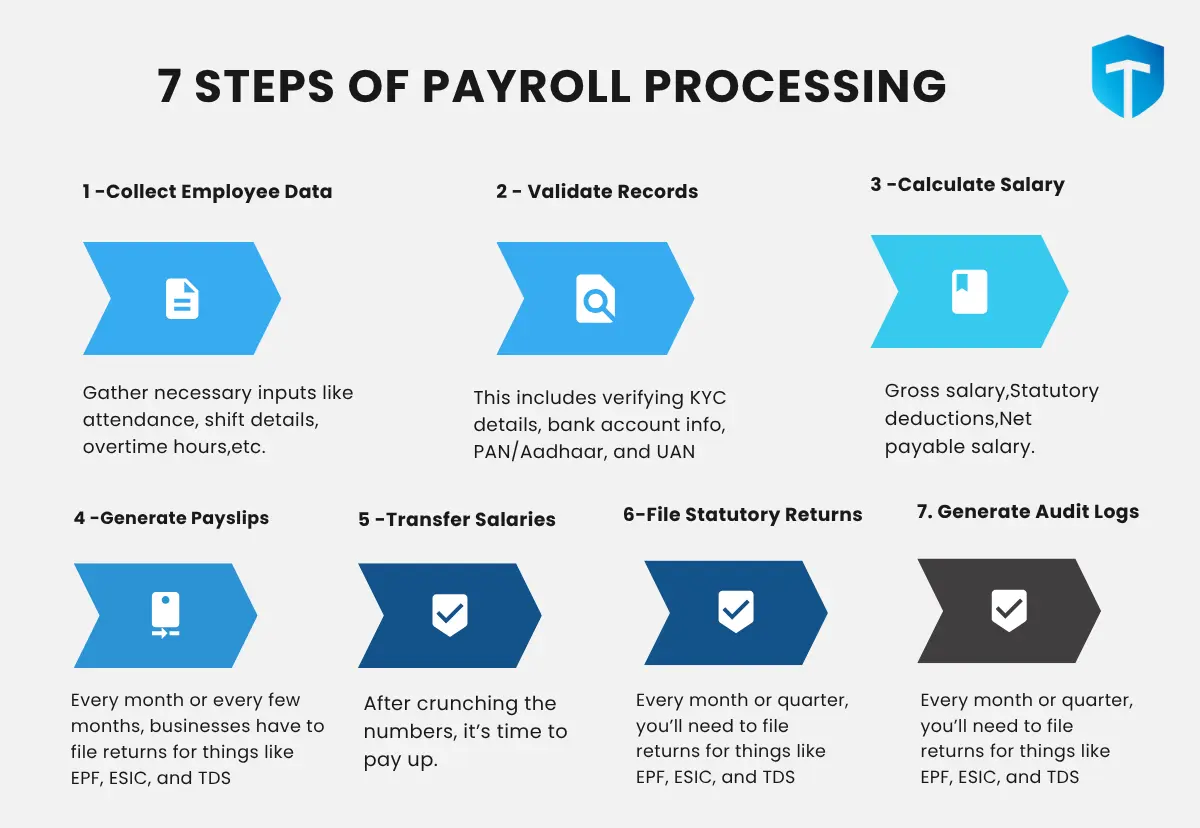

What Makes Great HR Payroll Software in 2025?

With evolving workforce dynamics, the parameters for choosing the right software have also changed. Here’s what businesses look for in 2025:

-

Automated compliance with EPF, ESI, TDS, and PT regulations

-

User-friendly interfaces with employee self-service portals

-

Cloud-based access for remote or hybrid work models

-

Scalable architecture suitable for startups to large enterprises

-

Integrated HRMS tools such as leave, attendance, and performance tracking

-

Real-time payroll processing and payslip generation

-

Mobile app support for HR and employee access

Must-Have Features for Indian Businesses

The top payroll software in India now comes with advanced features that address both regulatory requirements and modern workforce needs:

-

Auto calculation of salaries, bonuses, deductions, and taxes

-

Direct bank transfers and payslip generation

-

Compliance-ready reports (Form 16, TDS returns, etc.)

-

Multi-location and multi-state employee management

-

Attendance and leave tracking integration

-

Customizable salary structures and benefits

-

Multi-user access with role-based permissions

-

Secure data encryption and audit trails

Top 10 HR Payroll Software in India – Overview & Highlights

Here are the most recommended HR payroll software in India for 2025:

1. TankhaPay

-

Best for: Blue-collar, gig, and contractual workforce

-

Highlights: End-to-end compliance automation, easy onboarding, payslip access via app, social security integration (EPF/ESI)

-

USP: Focuses on informal sector and MSMEs, with auto-compliance and mobile-first features

2. Keka

-

Best for: Mid-sized IT and service-based firms

-

Highlights: Powerful HRMS integration, real-time payroll, leave & attendance sync

-

USP: Intuitive interface and advanced reporting

3. GreytHR

-

Best for: SMEs and educational institutions

-

Highlights: Compliance-ready reports, ESS portal, scalable modules

-

USP: Trusted brand with reliable customer service

4. RazorpayX Payroll

-

Best for: Startups and fintechs

-

Highlights: Zero-touch salary payments, automated filings

-

USP: Integrated with Razorpay suite for payments

5. Zoho Payroll

-

Best for: Businesses already using Zoho ecosystem

-

Highlights: Integration with Zoho Books, TDS calculations

-

USP: Budget-friendly for SMEs

6. QuickBooks Payroll

-

Best for: Accounting-driven payroll management

-

Highlights: GST & tax sync, multi-user permissions

-

USP: Seamless with QuickBooks accounting software

7. HRMantra

-

Best for: Enterprises with complex HR policies

-

Highlights: Extensive customization, advanced HR analytics

-

USP: Full HRMS with payroll capabilities

8. ZingHR

-

Best for: Companies with distributed teams

-

Highlights: Geo-fencing attendance, mobile payroll access

-

USP: Designed for remote and hybrid environments

9. SumoPayroll

-

Best for: Budget-conscious startups

-

Highlights: Cloud-based, automated payslips, basic HRIS

-

USP: Freemium model available

10. PeopleStrong

-

Best for: Large enterprises and MNCs

-

Highlights: AI-driven analytics, compliance dashboard, flexible integration

-

USP: Enterprise-grade security and scalability

Pricing Comparison: Budget vs Premium Tools

| Software | Pricing (Monthly) | Free Trial | Suitable For |

| TankhaPay | ₹49/user | Yes | MSMEs, Gig Workforce |

| Keka | From ₹60/user | Yes | SMEs & Enterprises |

| GreytHR | From ₹1000/org | Yes | SMEs & Schools |

| RazorpayX | From ₹750/org | Yes | Startups |

| Zoho Payroll | From ₹50/org | Yes | Zoho Users |

| QuickBooks | Custom | Yes | Accounting-focused |

| HRMantra | Custom | No | Enterprises |

| ZingHR | Custom | No | Hybrid Teams |

| SumoPayroll | Free / Paid Plans | Yes | Startups |

| PeopleStrong | Enterprise Quote | No | Corporates/MNCs |

Industry-Wise Suitability: SMEs, Startups, Enterprises

-

Startups: RazorpayX, SumoPayroll, Zoho Payroll

-

SMEs: TankhaPay, GreytHR, Keka

-

Large Enterprises: PeopleStrong, HRMantra, ZingHR

-

Gig & Blue-collar Workforce: TankhaPay

-

Finance-led Orgs: QuickBooks Payroll

Pros & Cons of Each Software

| Software | Pros | Cons |

| TankhaPay | Strong compliance, mobile app, EPF/ESI-ready | Limited HRMS modules |

| Keka | Powerful HR tools, easy to scale | Slightly higher learning curve |

| GreytHR | Reliable, scalable, user-friendly | Basic mobile support |

| RazorpayX | Fast setup, great for fintech/startups | Less HRIS integration |

| Zoho Payroll | Budget option, clean UI | Zoho ecosystem dependency |

| QuickBooks | Tax sync, accounting focus | Pricey for small teams |

| HRMantra | Extensive HR controls, analytics | Expensive & complex |

| ZingHR | Mobile-first, geo-fencing | Needs better UI in some modules |

| SumoPayroll | Free tier, ideal for trials | Limited scalability |

| PeopleStrong | Enterprise-grade features, scalable | No transparency on pricing |

Compliance and Legal Integrations

Compliance in India includes handling:

-

Employee Provident Fund (EPF)

-

Employee State Insurance (ESI)

-

Income Tax (TDS)

-

Professional Tax (PT)

-

Labour Welfare Fund (LWF)

The best payroll software in India must stay updated with government mandates. Tools like TankhaPay, GreytHR, and PeopleStrong provide real-time tax compliance, audit logs, and easy report generation—ideal for avoiding penalties.

Choosing the Best Fit for Your Business Size

-

Small Businesses (Under 50 employees): Focus on cost-effective, ready-to-use tools like Zoho Payroll, SumoPayroll

-

Mid-size Companies (50-500 employees): Need scalability, attendance sync—choose Keka, GreytHR

-

Enterprises (500+ employees): Require deep integration, automation, analytics—PeopleStrong, HRMantra are ideal

-

Gig Workforce or Multi-State Teams: TankhaPay is optimized for diverse compliance landscapes

Conclusion: Moving from Manual to Strategic HR Payroll

Indian businesses in 2025 can no longer afford outdated or manual payroll practices. As labour laws evolve and remote work expands, selecting the right payroll software in India becomes a strategic move, not just an operational one.

Whether you're seeking affordability, compliance, scalability, or integrations, there’s a tool that fits your needs. From TankhaPay for MSMEs to PeopleStrong for enterprises, the future of payroll is digital, automated, and intelligent.

Invest in the right payroll management software now and unlock smoother HR operations, happier employees, and complete regulatory peace of mind.

Join our community to interact with posts!