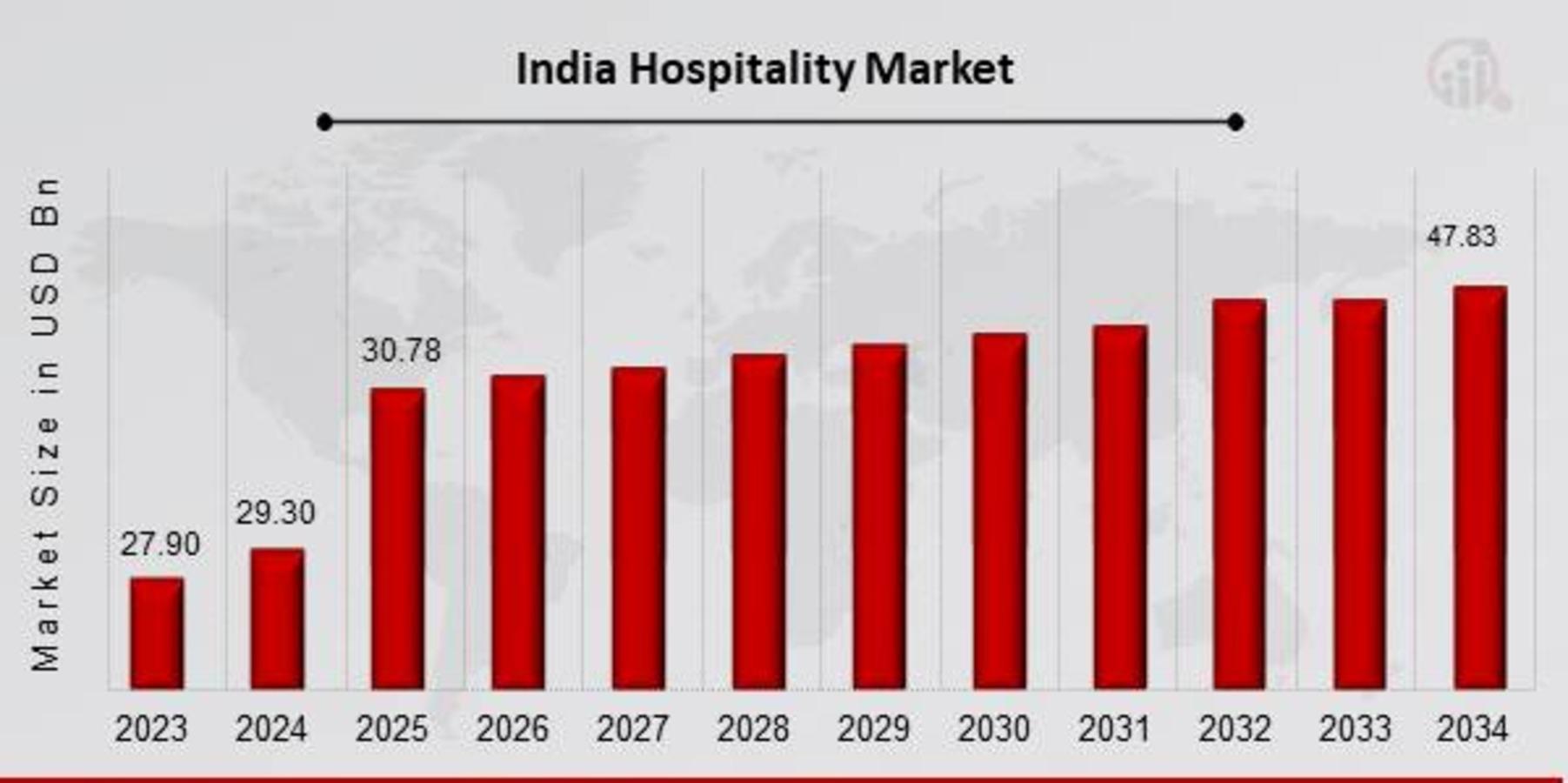

The India Hospitality Market is entering a multi-year expansion driven by domestic travel depth, infrastructure upgrades, and diversified demand across leisure, business, and MICE segments. After a resilient rebound, operators are focusing on yield management, targeted brand architecture, and localized experiences that translate into higher occupancy, ADR resilience, and stronger RevPAR cycles. At the same time, asset-light growth via management and franchise models is accelerating, enabling faster scale without balance-sheet strain.

Connectivity is a durable tailwind: new airports, improved highways, and premium rail corridors broaden access to secondary and tertiary destinations, bringing fresh supply and experiential tourism into focus. Operators are reshaping portfolios to include boutique heritage conversions, eco-resorts, and smart midscale properties that tap into rising middle-class travel. Meanwhile, urban business hubs are adding lifestyle hotels with coworking zones, wellness-led amenities, and event-ready spaces that serve the “bleisure” pivot.

Capital discipline is central. Developers are embracing modular construction, adaptive reuse of commercial assets, and conversion strategies to compress timelines and reduce capex. ESG alignment is no longer optional; energy-efficient HVAC, water reuse, and waste minimization programs cut operating costs while meeting corporate travel procurement standards. Owners increasingly require transparent benchmarking, granular cost control, and centralized procurement to protect margins.

Digital and data maturity differentiate winners. Direct booking engines with membership pricing, mobile-first check-in, and dynamic packaging (rooms + F&B + experiences) enhance conversion and upsell. Personalization is moving beyond names to preference learning—pillow types, dietary cues, and itinerary recommendations—delivered consistently through CRM and PMS integration. Reputation management, quick service-recovery loops, and proactive guest communication anchor trust.

Workforce strategy is a competitive advantage. Cross-training, performance incentives, and tech-enabled training raise productivity and guest satisfaction while curbing attrition. Partnerships with hospitality institutes and skilling programs help expand the talent pipeline in emerging destinations where new supply is ramping up.

For stakeholders, the playbook is clear: deploy capital where connectivity, demand diversity, and brand fit intersect; run hotels with ESG-positive, tech-enabled efficiency; and curate hyperlocal experiences guests cannot replicate elsewhere. With disciplined execution, the India Hospitality Market is positioned to translate cyclical recovery into structural growth.

Join our community to interact with posts!