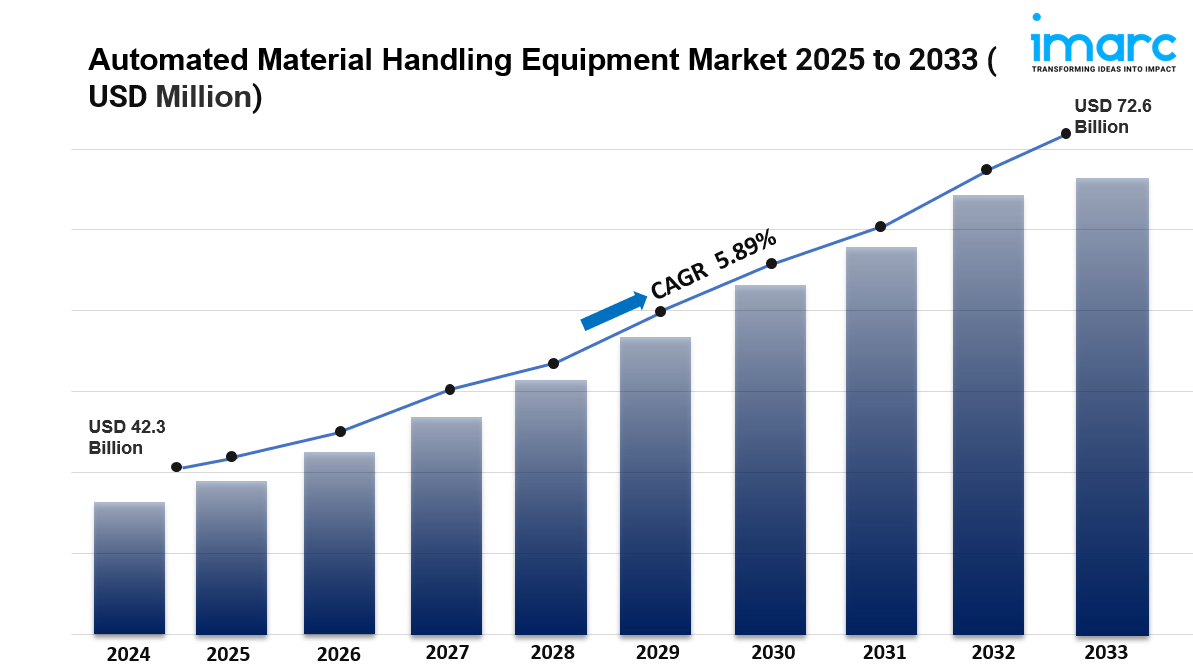

The global automated material handling equipment market Trends was valued at USD 42.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 72.61 Billion by 2033, exhibiting a CAGR of 5.89% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 39.3% in 2024. The market is experiencing steady growth driven by the escalating demand for industrial automation, cost optimization of labor, improved operational efficiency, widespread adoption of Industry 4.0 and smart manufacturing technologies, and the explosive growth of e-commerce and omnichannel retail operations.

Key Stats for Automated Material Handling Equipment Market:

- Automated Material Handling Equipment Market Value (2024): USD 42.26 Billion

- Automated Material Handling Equipment Market Value (2033): USD 72.61 Billion

- Automated Material Handling Equipment Market Forecast CAGR: 5.89%

- Leading Segment in Automated Material Handling Equipment Market in 2024: Hardware (65.0% by Component)

- Key Regions in Automated Material Handling Equipment Market: Asia Pacific, North America, Europe, Latin America, Middle East and Africa

- Top companies in Automated Material Handling Equipment Market: BEUMER Group GmbH & Co. KG, Daifuku Co. Ltd., Honeywell International Inc., JBT Corporation, Kion Group AG, KNAPP AG, KUKA Aktiengesellschaft (Midea Group Co. Ltd.), Murata Machinery Ltd., TGW Logistics Group GmbH, Toyota Industries Corporation, Viastore Systems GmbH, etc.

Request to Get the Sample Report: https://www.imarcgroup.com/automated-material-handling-equipment-market/requestsample

Why is the Automated Material Handling Equipment Market Growing?

The automated material handling equipment market is experiencing robust momentum as businesses worldwide grapple with fundamental operational challenges that technology is uniquely positioned to solve. This isn't just about modernization for its own sake—it's about survival and competitiveness in an era where speed, accuracy, and efficiency directly determine market success.

E-commerce and omnichannel retail operations are growing at all-time high pace, creating unprecedented demands on logistics and fulfillment infrastructure. Online shopping has fundamentally transformed customer expectations. People expect next-day or same-day delivery, precise order accuracy, and seamless experiences across multiple channels. Traditional manual warehouse operations simply cannot meet these expectations at scale. Fulfillment centers are responding by implementing automated systems like conveyors, sorters, automated storage and retrieval systems (AS/RS), and robotics-based picking systems to handle enormous inventory volumes efficiently. Warehouses are being redesigned with automation-centric methods to minimize human error and accelerate operations dramatically.

The challenge of labor costs and workforce shortages represents one of the most compelling drivers of market growth. According to the U.S. Bureau of Labor Statistics, wages and salaries increased 1% and benefit expenses increased 0.7% from March 2025. Manufacturing, logistics, and warehousing industries face particularly acute labor challenges where backbreaking and repetitive work is difficult to fill and retain. Companies are turning to robotic arms, automated guided vehicles (AGVs), and autonomous mobile robots (AMRs) to minimize reliance on manual labor while improving productivity and workplace safety. Automation enables businesses to sustain output levels even with shrinking labor pools, particularly in regions where demographic trends and skill shortages constrain workforce availability. The economic logic is compelling—when labor is scarce and expensive, automation becomes not just desirable but essential.

Industry 4.0 and smart manufacturing technologies are revolutionizing how material handling systems operate. Modern AMHE systems are engineered with embedded sensors, real-time monitoring capabilities, and machine learning software that enables predictive maintenance, adaptive routing, and continuous performance optimization. These intelligent systems progressively enhance warehouse and production line performance through reduced downtime and superior decision-making. Cloud-based platforms combined with digital twins enable companies to model, test, and control automated systems remotely, unlocking capabilities that weren't feasible even a few years ago. This technological convergence enables increased customization and flexibility, allowing facilities to accommodate market shifts at high speed. IMARC Group predicts the global Industry 4.0 market will attain USD 570.5 Billion by 2033, reflecting the massive investments flowing into connected, intelligent manufacturing.

Operational efficiency improvements justify automation investments regardless of labor considerations. Advanced hardware components expand throughput by handling monotonous and time-consuming tasks automatically. Conveyors, automatic sorters, and AS/RS units operate round-the-clock with minimal downtime, enabling much faster goods handling. Hardware automation eliminates human error in operations like sorting, picking, and conveying materials. Advanced positioning systems and sensors guarantee precise movement and product placement, resulting in enhanced order fill rates and inventory accuracy. This consistency is critical in industries requiring high quality control and regulatory compliance. Modern equipment is designed to be modular and scalable, allowing companies to adjust systems as business requirements expand or evolve. Mobile robots and reconfigurable conveyor systems enable facilities to expand capacity during peak demand without extensive infrastructure changes.

Space utilization improvements drive adoption particularly in high-density urban areas where real estate costs are extraordinary. Automated storage and retrieval systems maximize vertical space utilization, allowing companies to store dramatically more inventory in existing footprints. This reduces real estate expenses while enabling higher inventory density—crucial advantages as logistics networks intensify.

Sustainability pressures are promoting investments in low-energy and space-saving AMHE solutions. Corporate sustainability mandates, regulatory requirements, and consumer preferences increasingly favor automation that reduces environmental footprints. Energy-efficient equipment, reduced packaging waste through optimized processes, and smaller facility footprints all contribute to sustainability goals while delivering operational benefits.

AI Impact on the Automated Material Handling Equipment Market:

Artificial intelligence is beginning to transform automated material handling in ways that amplify the capabilities of existing automation while enabling entirely new operational possibilities. While AI applications are still evolving in this sector, the trajectory is clear—intelligent systems will become fundamental to competitive advantage.

Predictive maintenance powered by machine learning is preventing costly equipment failures before they occur. AI algorithms analyze sensor data from material handling systems to identify subtle patterns indicating approaching failures—worn bearings, degrading motors, misaligned components. By predicting failures before they happen, operations teams can schedule maintenance during planned downtime rather than experiencing catastrophic failures that shut down entire facilities. This capability is invaluable for businesses where unplanned downtime represents enormous financial losses.

Dynamic routing optimization uses AI to continuously improve how materials flow through facilities. Rather than static programmed routes, AI systems analyze real-time conditions—equipment status, order priorities, demand patterns, congestion—to dynamically direct materials through the most efficient paths. These routing decisions happen continuously, adapting to changing conditions and progressively improving throughput and efficiency.

Demand forecasting enhanced by AI helps operations teams optimize inventory positioning and equipment deployment. By analyzing historical data, seasonal patterns, market trends, and external signals, AI systems predict demand patterns with remarkable accuracy. This predictive capability allows facilities to pre-position inventory, allocate equipment efficiently, and avoid both stockouts and overstocking situations that plague manual operations.

Vision-based quality control powered by computer vision detects defects, damage, or misplacement in handled materials. Cameras combined with AI algorithms inspect items as they move through automated systems, identifying problems that human inspectors might miss or noticing patterns that indicate systematic issues. This automated inspection maintains quality standards while preventing defective products from progressing through the supply chain.

Autonomous mobile robots increasingly navigate complex facility layouts using AI-powered navigation. Technologies like SLAM (simultaneous localization and mapping) combined with AI enable robots to understand their environment, plan optimal routes, and interact safely with other equipment and people. These capabilities are expanding where autonomous robots can operate and the complexity of tasks they can handle.

Segmental Analysis:

Analysis by Component:

- Hardware

- Software

- Services

Hardware dominated the market in 2024 with 65.0% share, consisting of physical equipment—conveyors, automatic sorters, AS/RS units, robots, and control systems. Advanced hardware components expand throughput by handling monotonous and time-consuming tasks automatically. Devices operate round-the-clock with minimal downtime, enabling much faster goods handling. Hardware systems' accuracy eliminates bottlenecks from warehouses and production lines, smoothing workflows and decreasing cycle times. Automation eliminates human error in operations like sorting, picking, and conveying materials. Advanced positioning systems and sensors guarantee accurate movement and product placement, resulting in enhanced order fill rates and inventory accuracy.

Modern AMHE hardware is designed to be modular and scalable, allowing companies to adjust systems as requirements expand. Mobile robots and reconfigurable conveyor systems enable facilities to expand during peak demand without extensive infrastructure changes. The reliability and consistency of hardware automation make it the foundation upon which modern logistics operates.

Software is emerging as the fastest-growing component as operations become increasingly intelligent. Warehouse management systems, fleet management platforms, predictive analytics engines, and digital twin simulations are becoming central to material handling operations. These software solutions transform raw data into actionable insights that drive operational excellence.

Services—including installation, maintenance, training, and support—complete the ecosystem. As equipment becomes more sophisticated, professional services ensuring proper deployment and optimal ongoing operation become increasingly important and valuable.

Analysis by Product:

- Automated Storage and Retrieval Systems (AS/RS)

- Conveyors and Sorting Systems

- Robots (Robotic Arms, AMRs, AGVs)

- Automated Guided Vehicles (AGVs)

- Others

Automated storage and retrieval systems led the market with 32.2% share in 2024. AS/RS systems maximize space use, increase precision, and make operations far more efficient in warehouses and factories. They automatically place and retrieve products in prearranged storage locations with very high accuracy. Companies use AS/RS to maximize vertical storage space, holding greater inventory in the same footprint. This reduces real estate expenses and increases inventory density—critical advantages in high-cost urban areas.

AS/RS improves order accuracy through reduced human error and consistent picking processes. Through real-time tracking integrated with warehouse management systems, firms achieve enhanced visibility and control over inventory levels. AS/RS boosts throughput and minimizes retrieval times—essential in high-demand applications. With labor shortages continuing, these systems prove invaluable in maintaining productivity during operations.

Conveyors and sorting systems represent another major product category, handling the continuous movement of goods through facilities. Robotic solutions—including robotic arms for picking and packing, autonomous mobile robots (AMRs) for delivery, and automated guided vehicles (AGVs) for transportation—are increasingly sophisticated and flexible in their applications.

Analysis by Function:

- Storage

- Transportation

- Packaging

- Assembling

- Distribution

- Others

Storage dominates with 36.8% market share in 2024, reflecting the critical importance of efficient inventory management. Companies increasingly adopt automated storage solutions including vertical lift modules, carousel systems, and pallet racking with AS/RS to store products more efficiently and safely. These systems enhance inventory organization by classifying and storing items according to demand frequency, size, and handling characteristics.

Automation reduces manual intervention through accurate, real-time monitoring and retrieval. This reduces picking errors, minimizes search time, and improves inventory accuracy. Storage systems facilitate improved space utilization by leveraging vertical space and minimizing floor space needed for inventory. As supply chains grow more complex and responsive, automated storage aids quicker order fulfillment, better stock rotation, and improved safety.

Transportation functions move materials between locations—from receiving to storage to fulfillment. Packaging functions prepare items for shipment. Assembling functions combine components into finished products. Distribution functions manage final-stage inventory and order preparation. Each function benefits from automation as complexity and volume grow.

Analysis by System Type:

- Unit Load

- Bulk Load

Unit load systems dominated with 53.7% market share in 2024, simplifying goods movement and storage by collecting items into standardized loads. Companies embrace unit load practices using pallets, containers, or totes to aggregate products, reducing the number of individual handling operations and enhancing workflow. Automated equipment like conveyors, AGVs, and robotic palletizers move these unit loads with accuracy and reliability.

This approach reduces product damage and provides safe handling throughout supply chains. Space utilization and throughput improve as companies design storage systems specifically for unit load dimensions. In distribution and manufacturing facilities, unit load automation facilitates increased processing speed, reduces labor dependency, and improves inventory visibility. Unit load systems are becoming critical to ensuring efficiency, accuracy, and reliability in high-volume operations.

Analysis by End Use Industry:

- Automotive

- E-Commerce

- Food and Beverages

- Electronics and Semiconductors

- Healthcare

- Aviation

- Chemicals

- Others

Automotive leads the market, increasingly using AMHE systems to enhance production efficiency, improve safety, and streamline logistics. Manufacturers implement AGVs, conveyors, and robotic arms to transport components with precision. Systems support just-in-time (JIT) and just-in-sequence (JIS) manufacturing by delivering parts exactly when needed, reducing inventory and minimizing downtime. AS/RS systems store components and finished products in organized, space-efficient manner. Automation improves worker safety and reduces handling injuries. Real-time data integration enhances operational visibility and control.

E-commerce is a rapidly growing segment driven by explosive online shopping growth. Fulfillment centers require sophisticated automation to handle enormous order volumes efficiently. Food and beverages benefit from automation that maintains temperature control, supports hygiene standards, and enables rapid throughput. Electronics and semiconductors value precision and contamination prevention. Healthcare requires careful handling and tracking of sensitive materials. Each industry vertical has specialized requirements that modern AMHE addresses.

Analysis by Region:

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

Asia Pacific dominated with 39.3% market share in 2024, benefiting from heightened industrial automation and high-speed e-commerce growth. Companies implement cutting-edge robots, conveyor belts, and AS/RS systems to improve efficiency and decrease labor costs. Logistics businesses incorporate smart technologies like AI and ML into handling systems to maximize inventory management and accelerate order fulfillment. Third-party logistics firms and retailers expand warehouse space and deploy autonomous mobile robots to keep pace with rapid delivery demands. Automotive and electronics sectors invest in AMHE for high-volume production lines.

North America, led by the United States which holds 83.80% of North American share, experiences notable surge in AMHE adoption driven by increased industrial automation investments. Companies across manufacturing, logistics, and warehousing integrate advanced systems to optimize efficiency and reduce labor costs. Faster order fulfillment demands, precision inventory requirements, and scalable operations drive this trend. Businesses leverage automation to enhance workplace safety and minimize human error. The combined effect of technological advancement, strategic investments, and operational efficiency goals accelerates adoption.

Europe sees rising AMHE adoption fueled by Industry 4.0 initiatives and growth in food processing. Advanced manufacturing sectors, stringent labor safety regulations, and sophisticated logistics networks drive investment. Germany, UK, France, and Italy have robust manufacturing and logistics sectors creating strong AMHE demand.

Latin America experiences increased automation as e-commerce surges. Fulfillment centers must handle higher order volumes efficiently and accurately. Automation supports fast picking, sorting, and processing essential to meet customer expectations for rapid delivery.

Middle East and Africa adopt AMHE driven by Industry 4.0 implementation and infrastructure development. The United Arab Emirates hosts 107 Industry 4.0 startups including Verofax, Maxbyte, Restrata, IQ Fulfilment, and Flotilla IoT. Advanced technologies integrate into manufacturing and logistics environments to enhance transparency and productivity.

What are the Drivers, Restraints, and Key Trends of the Automated Material Handling Equipment Market?

Market Drivers:

The AMHE market benefits from powerful interconnected drivers creating sustained momentum. The fundamental economics of labor—rising costs and worker scarcity—create compelling financial cases for automation investment. When labor is expensive and difficult to find, automation moves from being desirable to necessary for operational viability.

E-commerce expansion represents perhaps the single most powerful growth driver. As online shopping penetrates deeper into global markets and customer expectations for speed intensify, logistics infrastructure must evolve. Automation is the only viable path to meeting these demands at acceptable cost levels.

Operational efficiency drives continuous adoption. Automation improves throughput, reduces errors, enhances safety, and enables scalability. These benefits compound over time as organizations discover new ways to leverage automated capabilities.

Industry 4.0 adoption creates momentum as manufacturers recognize that connected, intelligent systems unlock capabilities impossible with isolated equipment. Integration of IoT, analytics, and AI creates synergies that justify entire system upgrades.

Supply chain resilience considerations post-pandemic have elevated automation priority. Businesses want flexibility to respond to disruptions, and automation provides both speed and reduced dependency on vulnerable human resources.

Market Restraints:

Despite strong drivers, the market faces significant constraints. High capital costs represent barriers for smaller operations. Comprehensive warehouse automation requires USD 2–4 million investment—a substantial hurdle for mid-market firms. Brownfield sites face added complexity as operations continue during installation, inflating custom-interface expenses.

Technical complexity and skills gaps challenge implementation. Deploying sophisticated AMHE requires expertise in robotics, controls engineering, software integration, and system management—skills that are in short supply. This expertise gap slows adoption and increases implementation costs.

Integration challenges with existing systems frustrate many organizations. Legacy equipment and systems often don't communicate easily with modern automation. Creating seamless integration requires custom development that adds time and cost.

Regulatory and safety concerns arise when introducing robotics into existing facilities. Ensuring safe operation around human workers, meeting safety standards, and obtaining proper certifications all require careful planning and can delay deployments.

Economic cyclicality affects capital spending on major automation projects. During economic downturns, businesses defer discretionary capital investments, creating demand volatility.

Market Key Trends:

Several compelling trends are reshaping the AMHE landscape. Robotics-as-a-Service models are emerging as alternatives to capital ownership. Services like BALYO's reduce capital outlays and promise opex savings through performance-based pricing. This model makes automation accessible to organizations lacking capital for major equipment purchases.

AI-powered autonomous systems are advancing rapidly. Mobile robots using SLAM technology combined with AI navigate complex environments, recognize obstacles, and optimize routes autonomously. These capabilities are expanding where and how automation can be deployed.

Sustainability integration is moving from niche to mainstream. Equipment vendors design for recyclability and circular economy principles. Energy-efficient motors and solar-integrated warehouses reduce environmental impact while cutting operating costs. The Corporate Sustainability Reporting Directive compels firms to factor carbon metrics into automation investments, driving selection toward sustainable solutions.

Hybrid automation approaches combine legacy and new systems. Cyber-physical systems layer onto existing assets, creating hybrid workflows that lift efficiency dramatically while cutting labor costs significantly. Digital twin simulations reduce downtime risk and sharpen capital allocation. These brownfield approaches allow mature plants to unlock Industry 4.0 benefits without dismantling existing operations.

Specialized applications expand as AMHE technology matures. Temperature-controlled sites adopt robotics to eliminate human exposure limits while enhancing safety. Food processing facilities implement specialized handling for perishable goods. Pharmaceutical facilities expand storage while maintaining GMP compliance and temperature integrity.

Software and analytics are growing faster than hardware. As hardware becomes commoditized, competitive differentiation increasingly derives from software platforms, data analytics, and decision support systems that unlock equipment value. Companies transitioning from equipment vendors to solutions providers reflect this trend.

Leading Players of Automated Material Handling Equipment Market:

According to IMARC Group's latest analysis, prominent companies shaping the global AMHE landscape include:

- BEUMER Group GmbH & Co. KG

- Daifuku Co. Ltd.

- Honeywell International Inc.

- JBT Corporation

- Kion Group AG

- KNAPP AG

- KUKA Aktiengesellschaft (Midea Group Co. Ltd.)

- Murata Machinery Ltd.

- TGW Logistics Group GmbH

- Toyota Industries Corporation

- Viastore Systems GmbH

These leading providers aggressively pursue strategic initiatives including mergers and acquisitions to consolidate global presence and diversify product offerings. Companies focus on research and development to launch sophisticated technologies like AI-based robotics, autonomous mobile robots, and IoT-based systems. Top players concentrate on providing integrated solutions that drive warehouse automation, optimize inventory management, and lower operational expenses.

Market leaders target high-growth industries like e-commerce, automobiles, and electronics by developing solutions addressing specific industry requirements. Geographic expansion in emerging markets and smart factory development represent major strategies reflecting increased focus on digital transformation and supply chain effectiveness. Companies are also developing specialized capabilities—Kao Corporation in partnership with Toyota Industries introduced Japan's first fully automated truck loading system using AI-driven forklifts at its Toyohashi Plant, launched in October 2024, showcasing technological leadership.

Key Developments in Automated Material Handling Equipment Market:

- 2025: Ranpak Holdings Corp., a worldwide leader in eco-friendly paper-based packaging automation solutions for e-commerce and industrial supply chains, is impacting ProMat 2025 (March 17-20 at McCormick Place in Chicago). The company is introducing three innovative product releases, hosting industry expert sessions, and is a finalist for an MHI Innovation Award. This demonstrates how innovation continues driving market evolution as companies address sustainability while improving operational efficiency.

- October 2024: Kao Corporation in partnership with Toyota Industries introduced Japan's first fully automated truck loading system using AI-driven forklifts at its Toyohashi Plant. The system streamlines operations from product reception to truck loading, representing a significant step toward automation adoption. This collaborative innovation showcases how partnerships accelerate implementation of cutting-edge technologies.

- 2024: Manhattan Associates Inc. announced successful deployment of Manhattan Active® Warehouse Management by Giant Eagle, one of the largest food retailers and distributors in the nation. Giant Eagle effectively migrated three distribution centers from on-premises systems to this cloud-native warehouse management solution, with plans to migrate remaining facilities by August 2025. This represents the type of technology modernization sweep occurring across the industry.

- 2025: Labor market pressures intensify adoption. According to the U.S. Bureau of Labor Statistics, wages and salaries increased 1% and benefit expenses increased 0.7% from March 2025. These rising labor costs and persistent worker shortages push companies toward automation investments to maintain competitiveness and operational capacity.

- Ongoing: Industry 4.0 integration accelerates with vendors embedding AI, IoT, and advanced analytics into AMHE systems. Connected, intelligent equipment enables real-time optimization, predictive maintenance, and autonomous operations. Software solutions increasingly become more valuable than hardware itself as competitive differentiation derives from data insights and decision support capabilities.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=3678&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Join our community to interact with posts!