Market Overview

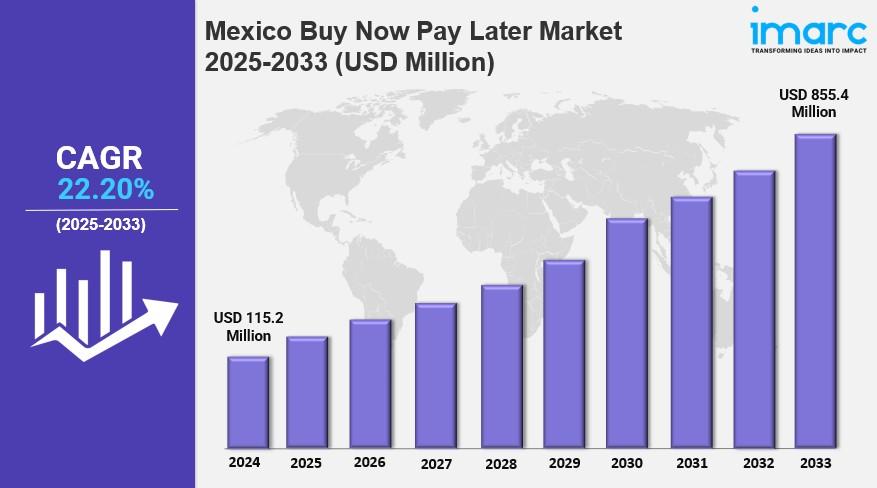

The Mexico buy now pay later market size reached USD 115.2 Million in 2024 and is projected to grow to USD 855.4 Million by 2033. The market is expected to expand at a CAGR of 22.20% between 2025 and 2033, driven by rising demand for flexible and accessible credit solutions. Fintech innovations like Booya and Plata are improving financial inclusion by offering fast, digital lending to underbanked consumers, fueling the buy now pay later ecosystem's growth.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

Mexico Buy Now Pay Later Market Key Takeaways

● Current Market Size (2024): USD 115.2 Million

● CAGR (2025-2033): 22.20%

● Forecast Period: 2025-2033

● The market is rapidly expanding due to increased demand for flexible credit solutions, especially among the underbanked.

● Fintech platforms, such as Booya and Plata, play a significant role in enhancing financial inclusion by offering quick and accessible digital loans.

● Plata raised USD 160 Million in Series A funding in March 2025, reaching a valuation of USD 1.5 Billion, highlighting investor confidence.

● Booya offers micro installment loans with a quick application process and flexible repayment terms, supporting consumers in financial emergencies.

● The growing fintech presence is transforming Mexico's financial services by addressing the credit needs of traditionally excluded populations.

Sample Request Link: https://www.imarcgroup.com/mexico-buy-now-pay-later-market/requestsample

Market Growth Factors

In Mexico, the buy now pay later market is expected to grow greatly in the years ahead according to the increasing demand for flexible and accessible credit options. In 2024 the Mexican buy now pay later market had a USD 115.2 Million valuation and should reach USD 855.4 Million by 2033. From 2025 to 2033, a 22.20% CAGR is expected. This fast expansion is attributed to the demand from consumers, which include the underbanked, for alternative sources of credit other than what is customarily offered by the banking system.

The buy now pay later space has also benefitted from the rise of fintechs. Booya, a micro installment lending platform, was launched by Creo Solutions in March 2025, and allows customers to apply through a fully digital and streamlined process. Booya enables fast disbursement of flexible, unsecured cash loans to bridge financial emergencies. The platform's use of mobile-first digital distribution and user-friendly applications helps improve financial inclusion for many Mexican consumers facing barriers to credit. These innovations are helping increase access to credit in Mexico and improving financial outcomes for millions.

Consumer credit products, such as BNPL are also driving the market growth. In March 2025, Plata, a consumer credit and BNPL fintech, raised USD 160 Million in its Series A round at a valuation of USD 1.5 Billion. With Plata becoming a fully licensed digital bank in December 2024, it can now offer additional services for cashback, top-ups, and credit cards, all built around Mastercard technologies. Plata's technological shift is seen as a sign of growing investor interest into the fintech space and the potential fintech plays in changing the landscape of financial services in Mexico, including expanded human capital access.

Market Segmentation

Channel Insights

● Online: Includes digital platforms providing buy now pay later services through online channels, facilitating convenient and fast credit access.

● Point of Sale (POS): Involves buy now pay later offerings integrated at physical points of sale, allowing consumers flexible payment options during purchase.

Enterprise Size Insights

● Large Enterprises: Major business entities adopting buy now pay later solutions for broad consumer bases and high transaction volumes.

● Small and Medium Enterprises: Smaller businesses leveraging BNPL to enhance customer purchasing power and sales.

End Use Insights

● Consumer Electronics: Buy now pay later applications facilitating purchase of electronic devices and related gadgets.

● Fashion and Garment: BNPL used extensively in apparel and fashion retail sectors.

● Healthcare: Services and products in healthcare accessed through flexible pay later options.

● Leisure and Entertainment: Payment solutions for entertainment and recreational activities using BNPL.

● Retail: Broad retail sector application of buy now pay later financial services.

● Others

Regional Insights

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=32412&flag=C

Recent Developments & News

● April 2025: Kueski appointed BNPL expert Yumi Hosaka Clark to its Board of Directors to accelerate growth and enhance financial inclusion.

● May 2024: Aplazo, a Mexican fintech, raised USD 45 Million in its Series B funding round to expand BNPL services, resulting in revenue tripling and growth in merchant transactions.

Key Players

● Booya

● Plata

● Kueski

● Aplazo

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!