IMARC Group, a leading market research company, has recently released a report titled "Air Traffic Management Market Size, Share, Trends and Forecast by Domain, Component, Application, End User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global air traffic management market size, share, trends, growth and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Market Overview

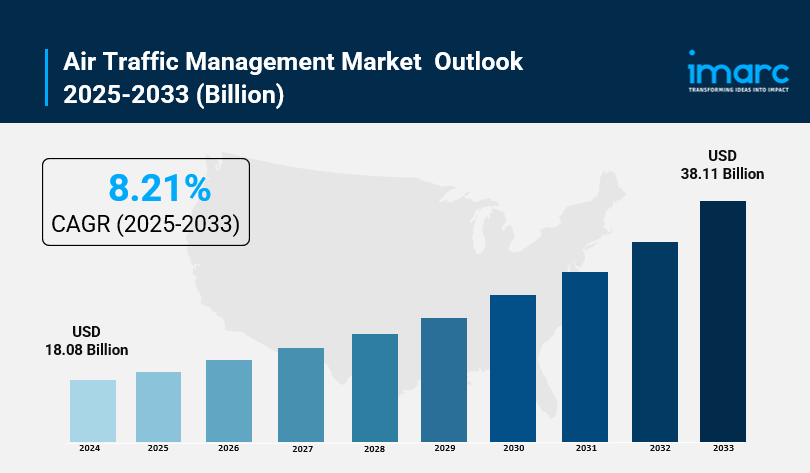

The global air traffic management market was valued at USD 18.08 billion in 2024 and is projected to reach USD 38.11 billion by 2033, registering a CAGR of 8.21% during the forecast period 2025-2033. Asia Pacific leads with a 33.7% market share, driven by economic growth and increased air travel demand. Investments in sophisticated ATM technologies enhance safety, efficiency, and sustainability across the aviation sector.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Air Traffic Management Market Key Takeaways

- Current Market Size: USD 18.08 Billion in 2024

- CAGR: 8.21%

- Forecast Period: 2025-2033

- Asia Pacific dominates with 33.7% market share, attributed to fast economic growth and urbanization.

- Air traffic control holds the largest domain share at 35.7%, due to its critical role in safety and traffic management.

- Hardware is the dominant component segment with 59.7% share, essential for reliable ATM operations.

- Communication is the largest application segment at 33.2%, supporting crucial controller-pilot interaction.

- Commercial end users lead with 70.6% share, driven by increasing global air travel demand.

Request Your Free “Air Traffic Management Market” Insights Sample PDF: https://www.imarcgroup.com/air-traffic-management-market/requestsample

Market Growth Factors

The rise in air passenger traffic in recent years has been one of the major factors affecting the growth of the air traffic management market. The IATA reports revenue passenger kilometers and available seat kilometers increased in 2024. The increases are 10.4% and 8.7%. The load factor climbed to 83.5% thereby which is a record high. This congests in the skies, delaying and making inefficient. Airports and airlines around the world are seeking ATM systems that will allow increased capacity to be managed safely.

Technological advancements also drive market growth as AI, ML and big data analytical tools are used to optimize ATM such as flight scheduling. Additionally, automated ATM reduces human error and maximizes safety and operational efficiency. The aviation system includes cybersecurity upgrades. In 2024, Indra signed a contract to upgrade the ATM system in Vietnam using its ManagAir solution, which covers two-thirds of Vietnam's airspace, increasing safety, efficiency, and cybersecurity.

The need for dedicated ATM capabilities for drones is growing to accommodate their use in commercial, industrial and logistics transport in existing airspace. In 2025 Anra Technologies became the first company to be certified by the European Union Aviation Safety Agency (EASA) as a U-space service provider to perform safe and secure BVLOS operations, a sign of the rapid maturity of the drone traffic management market.

Market Segmentation

Analysis by Domain:

- Air Traffic Control: Dominates with 35.7% share, crucial for safe and efficient aircraft movement coordination using real-time data and satellite communications.

- Air Traffic Flow Management:

- Aeronautical Information Management:

Analysis by Component:

- Hardware: Largest segment with 59.7% share, encompassing radar systems, communication devices, navigation aids, and surveillance technologies essential for ATM operation reliability.

- Software: Supporting systems that complement hardware to ensure efficient air traffic control, though not emphasized as dominant.

Analysis by Application:

- Communication: Largest application at 33.2%, enabling vital controller-pilot transmissions of instructions, weather, and emergency information.

- Navigation

- Surveillance

- Automation

Analysis by End User:

- Commercial: Dominates with 70.6% market share, driven by expanding global air travel and need for efficient flight management.

- Military

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific is the dominant region, holding a 33.7% market share in 2024. The region benefits from rapid economic growth, urban development, higher disposable incomes, and significant rise in domestic and international air travel. According to IBEF, Indian airports forecast a 13.5% increase in domestic passenger traffic and 22.3% rise in international passengers for FY24. Governments increasingly invest in advanced ATM technologies such as AI, automation, and data analytics, driving improved safety and airspace efficiency.

Recent Developments & News

- May 2025: The US Department of Transportation announced plans to develop an advanced air traffic management and control system to modernize FAA infrastructure, improving safety and reducing delays.

- February 2025: Nokia planned to upgrade Vietnam’s Air Traffic Management Corporation network by replacing the SDH system with an advanced IP/MPLS network, enhancing security and scalability.

- February 2025: DataBeacon introduced Tango5, an interactive ATM training software enhancing user engagement and practical learning.

- February 2025: Thales signed a long-term contract with Sopra Steria to digitally transform Europe’s ATM sector via the Thales OpenSky Platform, supporting sustainable aviation.

Key Players

- Adacel Technologies Limited

- Advanced Navigation and Positioning Corporation

- Airbus SE

- Honeywell International Inc.

- Indra Sistemas S.A.

- L3Harris Technologies Inc.

- Leidos

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Saab AB

- Thales Group

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=4656&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

Join our community to interact with posts!