Silica Sand Market Overview:

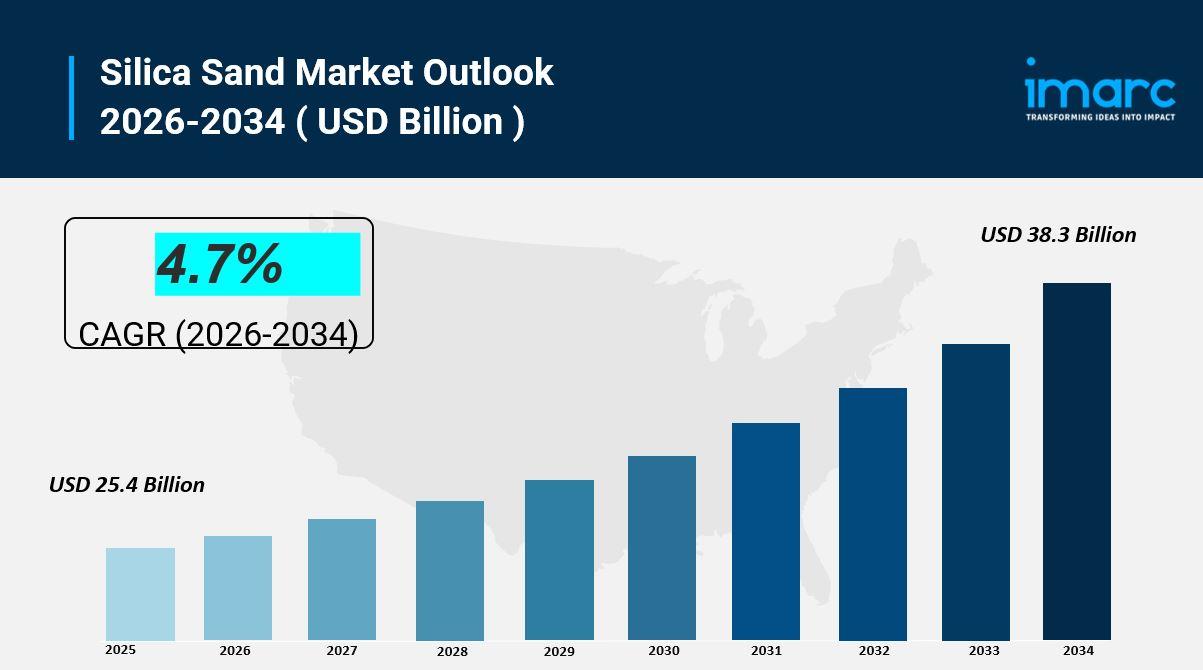

The global Silica Sand Market was valued at USD 25.4 Billion in 2025 and is forecast to reach USD 38.3 Billion by 2034, growing at a CAGR of 4.7% during 2026-2034. This growth is driven by increasing demand from the construction and glass manufacturing industries, continual advancements in hydraulic fracturing technology in oil and gas extraction, and rapid changes in environmental and regulatory landscapes.

The silica sand market is expanding steadily driven by rising demand for high-quality sand in glass manufacturing, construction materials, hydraulic fracturing operations, water filtration systems, and industrial foundries. Growing adoption in specialty applications including electronics manufacturing, solar panel production, chemical processing, and advanced ceramics is accelerating commercial deployment. Advancements in mining efficiency, processing technologies, high-purity sand extraction, sustainable mining practices, and integration with automated sorting and grading systems are driving product innovation. The growth of infrastructure development, renewable energy projects, unconventional oil and gas exploration, and affordable industrial-grade sand products is boosting mass market adoption. Increasing focus on environmental sustainability and land reclamation further supports future global market expansion.

Study Assumption Years

- Base Year: 2025

- Historical Years: 2020-2025

- Forecast Years: 2026-2034

Silica Sand Market Key Takeaways

- Current Market Size (2025): USD 25.4 Billion

- CAGR (2026-2034): 4.7%

- Forecast Period: 2026-2034

- The market is propelled by the growing need for silica sand in glass manufacturing and construction industries.

- Increasing adoption in hydraulic fracturing for oil and gas extraction is driving product usage.

- Technological advancements such as improved mining efficiency and processing quality are enhancing production.

- Expansion into sectors including water filtration, foundries, and specialty glass is broadening market horizons.

- Environmental regulations and sustainable mining practices present both challenges and opportunities.

Access Detailed Sample Report: https://www.imarcgroup.com/silica-sand-manufacturing-plant/requestsample

Market Growth Factors

The silica sand market is significantly driven by the escalating demand from the construction industry for producing glass, concrete, and mortar. The global rise in infrastructure and construction projects, fueled by elevating levels of urbanization and industrialization, especially in emerging economies, is contributing substantially to market growth. China's construction sector, the largest in the world, is projected to maintain a 6% share of the country's GDP through 2025, with significant investments in affordable residential colonies and government-subsidized rental homes expected to accommodate millions of people. The shift towards sustainable and energy-efficient buildings is further increasing the use of silica sand in architectural glass and other construction applications.

Advancements in hydraulic fracturing technology represent another major growth factor for the market. Silica sand serves as a key proppant in hydraulic fracturing operations, keeping fractures open to facilitate the extraction of oil and natural gas. Global oil consumption is projected to reach 104.1 million barrels per day by 2026, representing a 4.4 million barrel per day increase over current levels. The United States is emerging as one of the leading countries globally in the exploration of unconventional crude oil reserves, with crude oil production reaching significant levels. As the global energy sector continues to invest in and adopt hydraulic fracturing technology, the demand for high-quality silica sand variants is expected to rise substantially.

Technological innovations in water filtration systems are also fueling market expansion. Natural silica sand is gaining interest from researchers because of its low cost, eco-friendliness, bioactivity, and availability for treating contaminated water. With an estimated six billion people worldwide expected to endure acute water resource depletion by 2050 according to the United Nations World Water Development Report, new green reactive adsorbents synthesized from silica sand have been developed to effectively remove antibiotics and pollutants from contaminated water. Such advancements have significant potential to impact the silica sand industry positively.

Environmental and regulatory policies are increasingly shaping the market landscape. Stricter regulations regarding sand mining and processing, aimed at reducing environmental impact and ensuring worker safety, influence production costs and supply chains. Federal regulations under the Clean Water Act and Clean Air Act require mining companies to obtain permits ensuring their operations do not harm the environment. State governments have also imposed regulations requiring companies to reclaim mined land and conduct environmental impact assessments. Conversely, policies encouraging the use of environmentally friendly materials in construction and manufacturing can substantially augment demand for silica sand.

Market Segmentation

End-Use:

- Glass Industry: Dominates the market as the largest segment, heavily relying on high-quality silica sand for manufacturing flat glass, container glass, and specialty glass. Silica sand is an essential component of glass manufacturing, accounting for more than 50% of raw materials used. The clarity, strength, and chemical purity make it ideal for glass production. Growing use of specialty glass in electronics, energy-efficient buildings, and lightweight vehicles drives this segment's expansion.

- Foundry: Utilizes silica sand for metal casting processes and mold production in automotive and industrial manufacturing.

- Hydraulic Fracturing: Represents a significant segment where silica sand serves as a proppant in oil and gas extraction operations.

- Filtration: Growing application in water treatment plants and industrial filtration systems.

- Abrasives: Used in sandblasting, grinding, and surface preparation applications.

- Others: Including ceramics, chemical production, and specialty industrial applications.

Region:

- China: Leads the market, accounting for the largest silica sand market share, driven by thriving construction, manufacturing, and automotive sectors. Various players in glass production are sourcing silica sand from China due to the availability of sand with silicon dioxide content exceeding 99%. China's rapidly expanding infrastructure, coupled with a flourishing automotive industry and significant push towards renewable energy projects, makes it a pivotal player in the global market.

- United States: Significant market presence driven by hydraulic fracturing industry and construction sector demand.

- Italy: Important European market with advanced glass manufacturing capabilities.

- Germany: Contributing to market growth through industrial applications and specialty glass production.

- Turkey: Emerging market with growing construction and manufacturing sectors.

- Australia: Key exporter with high-quality silica sand deposits.

- Others: Including various Asia-Pacific, European, and Middle Eastern countries.

Regional Insights

China dominates the global silica sand market as the largest regional segment, driven by its massive construction, manufacturing, and automotive sectors which extensively utilize silica sand for glass production and concrete manufacturing. The availability of high-quality silica sand with silicon dioxide content exceeding 99% in the Asia-Pacific region makes it an attractive sourcing destination. Companies like VRX Silica Ltd. are focusing on developing silica sand projects in Western Australia, targeting the export market to Asia, primarily China, while also exploring opportunities for local glass manufacturing. China's large-scale industrial activities, supported by government policies promoting urbanization and industrialization, combined with expanding infrastructure and a flourishing automotive industry, cement its position as a pivotal player in the global silica sand market.

Recent Developments & News

In February 2024, Manitoba greenlighted a silica sand mining project in Hollow Water First Nation expected to generate $200 million per year in provincial taxes and nearly 300 jobs, most of them in Selkirk. In August 2023, Chongqing Changjiang River Moulding Material Group Co., Ltd. (CCRMM) successfully transformed waste sand, previously discarded, into usable "new sand" after multiple processes. The new sand shows reduced scorch, less gas generation, and a diminished expansion coefficient, thereby cutting foundry production costs and promoting sustainable practices in the industry.

Key Players

- Badger Mining Corporation

- Cairo minerals

- Cape Flattery Silica Mines Pty., Ltd (Mitsubishi Corporation)

- Covia Holdings LLC

- Euroquarz GmbH

- Holcim AG

- JFE Mineral & Alloy Company, Ltd.

- Quarzwerke GmbH

- Sibelco

- Sil Industrial Minerals

- Source Energy Services

- Tochu Corporation

- U.S. Silica

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Expert Insights Available - Connect With Our Analysts: https://www.imarcgroup.com/request?type=report&id=529&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302

Join our community to interact with posts!