IMARC Group has recently released a new research study titled “United States Tobacco Market Size, Share, Trends and Forecast by Type, and Region, 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

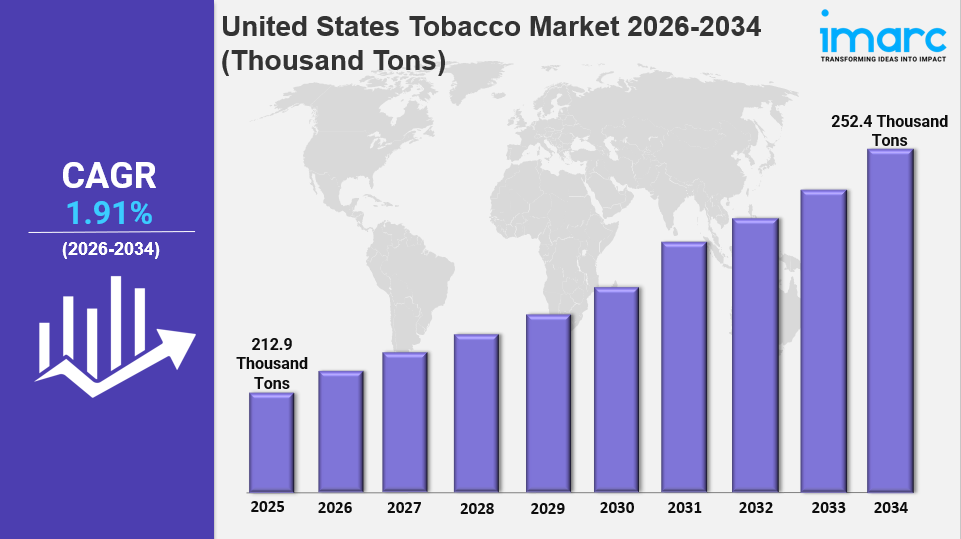

The United States tobacco market was estimated at 212.9 Thousand Tons in 2025. It is projected to reach 252.4 Thousand Tons by 2034, growing at a CAGR of 1.91% during the forecast period from 2026 to 2034. The market is driven by expanding alternative products including e-cigarettes and nicotine pouches, steady menthol cigarette sales, rising premium tobacco usage, increasing online sales channels, and innovation by key players.

Study Assumption Years

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

United States Tobacco Market Key Takeaways

● Current Market Size: 212.9 Thousand Tons in 2025

● CAGR: 1.91% (2026-2034)

● Forecast Period: 2026-2034

● The market is expanding with strong growth in alternative products such as e-cigarettes and nicotine pouches.

● Over 2.25 million high school and middle school students reported smoking tobacco products in 2024.

● The e-cigarettes market in the US is expected to reach US$ 43.6 billion by 2032, growing at 14.75% CAGR between 2024 and 2032.

● Marketing strategies include portraying e-cigarettes and nicotine pouches as lifestyle items and leveraging social media influencers.

● FDA regulations have introduced criteria for entry of alternative products, including flavor varieties like mint, fruits, and menthol.

Sample Request Link: https://www.imarcgroup.com/united-states-tobacco-market/requestsample

United States Tobacco Market Growth Factors

The United States tobacco market growth is fueled by the increasing adoption of alternative tobacco products such as nicotine pouches, heated tobacco devices, and e-cigarettes. Young adults aged 18 to 35 are a significant demographic driving this trend. In 2024, over 2.25 million high school and middle school students reported tobacco use, indicating a market segment influenced by product innovation and marketing campaigns targeting tech-savvy consumers through social media and influencer promotions.

Disposable income increase also contributes positively to market expansion. With a 5.9% rise in disposable personal expenditure in 2023 compared to 2022, consumers are spending more on discretionary items like tobacco products. This has led to rising demand for premium cigars, heated tobacco products, and vaping devices; for example, premium cigar imports increased from 464 million units in 2022 to 467 million in 2023.

The expansion of online tobacco sales via e-commerce facilitates access to specialized tobacco products such as nicotine pouches and premium cigars. By the end of 2024, e-commerce sales in the US are projected to rise by 8.7% to approximately $1.2 trillion, comprising 16.2% of total retail sales. Regulatory frameworks support responsible sales through age verification, enabling companies to leverage personalized subscriptions and exclusive product releases targeting tech-savvy consumers.

United States Tobacco Market Segmentation

Breakup by Type:

● Cigarettes: Attract mainly older consumers with strong brand loyalty and stable menthol variant demand.

● Roll Your Own: Appeals to budget-conscious consumers seeking organic or additive-free tobacco, popular with environmentally sensitive and younger users.

● Cigars: Expanding due to perception as occasional luxury items, with premium cigars seeing increased demand from wealthier consumers.

● Cigarillos: Affordable, smaller cigars favored by younger adults and urban customers, available in fruity and sweet flavors.

● Smokeless Tobacco: Includes moist snuff, chewing tobacco, and nicotine pouches; fast-growing with significant share, especially in rural areas.

● Others

Regional Insights

The Northeast region of the US leads demand for premium cigars and smokeless tobacco alternatives, particularly in urban centers like New York and Boston. It also shows rising markets for e-cigarettes and nicotine pouches, catering to a health-conscious and urban population seeking alternatives to traditional tobacco. This regional preference supports the market's transition toward new and smokeless products.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=9499&flag=C

Recent Developments & News

In July 2024, Philip Morris International announced a $600 million investment to establish a manufacturing facility in Colorado for Zyn nicotine pouches, expected to create 500 jobs by 2025. In June 2024, Altria Group, Inc. submitted Premarket Tobacco Product Applications to the FDA for its on! PLUS oral nicotine pouch products, featuring a proprietary soft-feel material for enhanced user comfort.

Key Players

● Pyxus International Inc.

● Swedish Match AB

● Vector Tobacco

● Korea Tobacco & Ginseng Corporation

● Imperial Brands

● Philip Morris International

● Universal Corporation

● Japan Tobacco Inc.

● Scandinavian Tobacco Group

● Vector Group LTD

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

Join our community to interact with posts!