IMARC Group has recently released a new research study titled “Mexico Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Summary

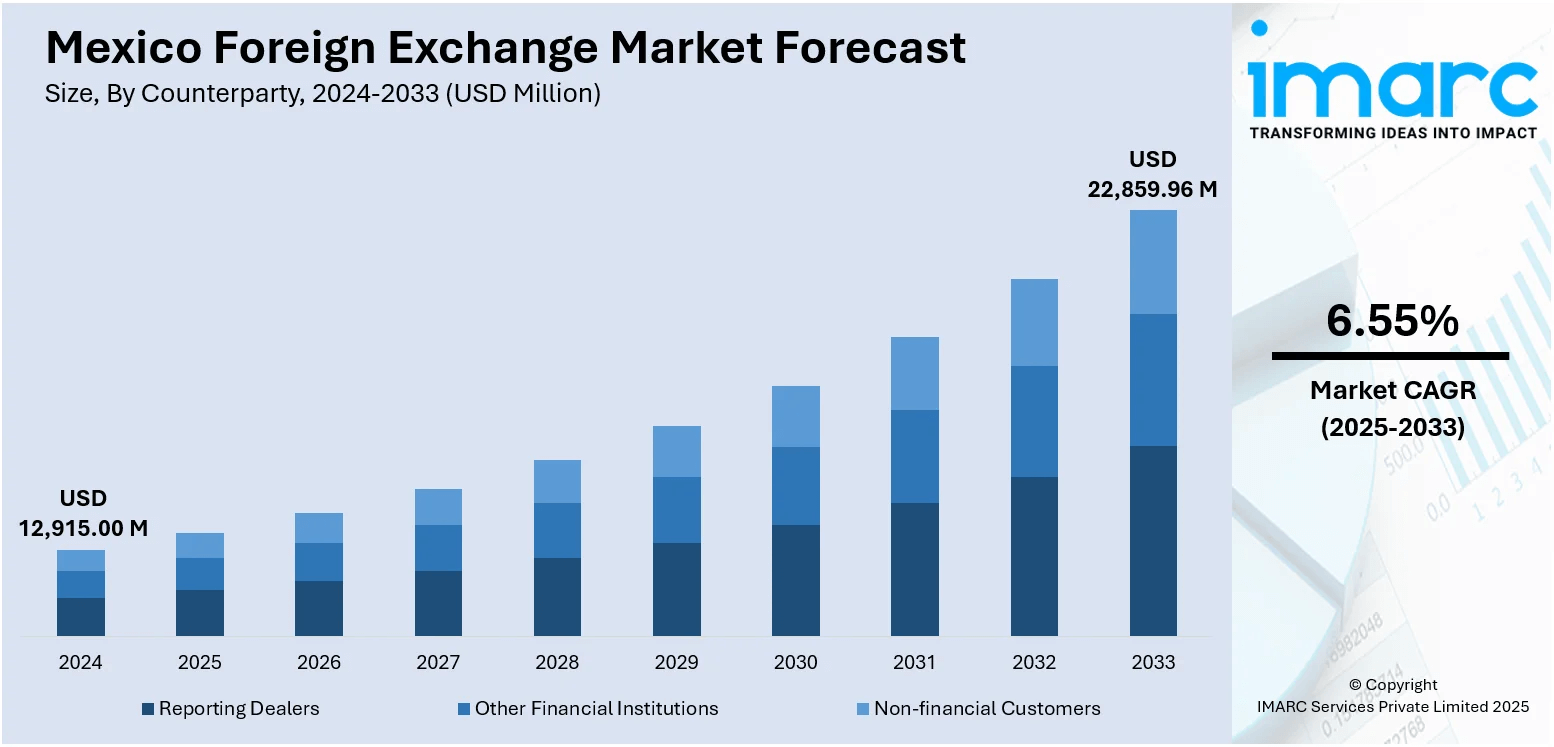

The Mexico foreign exchange market size reached USD 12,915.00 Million in 2024. The market is projected to reach USD 22,859.96 Million by 2033, exhibiting a growth rate (CAGR) of 6.55% during 2025-2033. The market is primarily driven by Mexico’s robust trade relationships, particularly with the United States, which generate substantial cross-border transactions and foreign currency inflows. Growing remittance inflows are further strengthening foreign exchange liquidity, increasing demand for currency conversion services, and supporting peso stability. Additionally, active participation from institutional investors and continued efforts by the Bank of Mexico to maintain monetary stability are significantly augmenting the Mexico foreign exchange market share.

Key Takeaways

-

Market Size (2024): USD 12,915.00 Million

-

Forecast Value (2033): USD 22,859.96 Million

-

CAGR (2025-2033): 6.55%

-

Strong trade ties with the United States drive forex activity

-

Remittance inflows contribute to currency liquidity and peso stability

-

Central bank interventions enhance investor confidence

-

Institutional and non-financial participants support market depth

Sample Request Link: https://www.imarcgroup.com/mexico-foreign-exchange-market/requestsample

Mexico Foreign Exchange Market Growth Factors

The Mexico foreign exchange market is significantly influenced by rising remittance-driven currency flows. Mexico consistently ranks among the leading global recipients of remittances, particularly from the United States. Industry estimates indicate that remittance growth is anticipated to reach 5.8% in 2024, compared to 1.2% in 2023, contributing meaningfully to foreign exchange reserves and liquidity. These inflows, increasingly processed through digital platforms and formal banking channels, have improved transaction transparency and efficiency. The surge in app-based transfer services has facilitated faster and cost-effective exchanges, raising both transaction volume and frequency. Remittances also help offset current account deficits, thereby enhancing macroeconomic stability and investor confidence. Currency traders and financial institutions are increasingly factoring remittance seasonality into hedging and trading strategies, reinforcing structured market participation.

Trade dynamics under the United States–Mexico–Canada Agreement (USMCA) represent another critical growth driver. As Mexico’s largest trading partner, the United States significantly influences peso-dollar exchange rate movements. Fluctuations in tariffs, trade regulations, and cross-border supply chain conditions often result in short-term volatility within the forex market. Export-driven industries such as automotive, electronics, and agriculture require continuous foreign exchange transactions, intensifying demand for currency services. Furthermore, exporters and importers are employing sophisticated hedging instruments such as forwards and swaps to mitigate trade-related currency risks. This interconnected trade environment underscores the peso’s role as a proxy currency for broader Latin American market exposure among global investors.

Central bank interventions and exchange rate management policies also play a pivotal role in shaping market stability. Although Mexico operates under a floating exchange rate regime, the Bank of Mexico (Banxico) occasionally intervenes to manage excessive volatility triggered by geopolitical developments, inflationary pressures, or capital flow fluctuations. Banxico’s inflation-targeting framework and disciplined monetary policy have strengthened the peso’s attractiveness among foreign investors seeking competitive yields. Transparent policy communication, prudent reserve management, and coordination with financial authorities contribute to predictable exchange rate movements and reduced systemic risks. The inclusion of the Mexican peso in major global currency indices further reflects its growing credibility and integration within international financial markets.

Mexico Foreign Exchange Market Segmentation

Breakup by Counterparty

-

Reporting Dealers

-

Other Financial Institutions

-

Non-financial Customers

Breakup by Type

-

Currency Swap

-

Outright Forward and FX Swaps

-

FX Options

Breakup by Region

-

Northern Mexico

-

Central Mexico

-

Southern Mexico

-

Others

Regional Insights

The Mexico foreign exchange market exhibits diverse regional activity influenced by industrial concentration, trade hubs, and remittance flows. Northern Mexico, with its proximity to the United States and strong manufacturing base, experiences substantial forex transactions related to export-oriented industries. Central Mexico, as the country’s financial and administrative hub, plays a critical role in institutional forex trading and banking activities. Southern Mexico benefits significantly from remittance inflows, which enhance local liquidity and stimulate currency exchange services.

Regional disparities in trade exposure, investment flows, and economic development contribute to varying forex participation levels. As infrastructure improvements and digital banking adoption expand nationwide, forex services are becoming more accessible across regions, strengthening overall market depth and integration.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=41369&flag=C

Competitive Landscape

The Mexico foreign exchange market is characterized by the presence of domestic banks, international financial institutions, forex brokers, and digital trading platforms. Market participants focus on technological integration, enhanced trading platforms, compliance adherence, and diversified financial instruments to maintain competitiveness. Continuous investments in risk management tools, digital transaction security, and algorithmic trading solutions are strengthening operational capabilities. Strategic expansions and partnerships further support liquidity enhancement and broaden access to institutional and retail participants.

Some of the key players include:

-

ATFX

-

BBVA México

-

Banco Santander México

-

Citibanamex

-

HSBC México

-

Banorte

-

Scotiabank México

-

Interactive Brokers

-

FXCM

-

OANDA

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive benchmarking, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel: +91 120 433 0800

United States: +1-201-971-6302

Join our community to interact with posts!