United States Chillers Market Size and Forecast 2025–2033

The United States chillers market is poised for steady and sustained expansion over the coming decade. According to Renub Research, the market is projected to grow from US$ 3.48 billion in 2024 to approximately US$ 4.95 billion by 2033, registering a compound annual growth rate (CAGR) of 3.98% between 2025 and 2033.

This growth reflects increasing industrialization, expanding commercial real estate development, and a rising demand for energy-efficient cooling technologies. As sustainability goals tighten and digital infrastructure expands, chillers are becoming critical components of modern HVAC and industrial systems across the United States.

United States Chillers Industry Overview

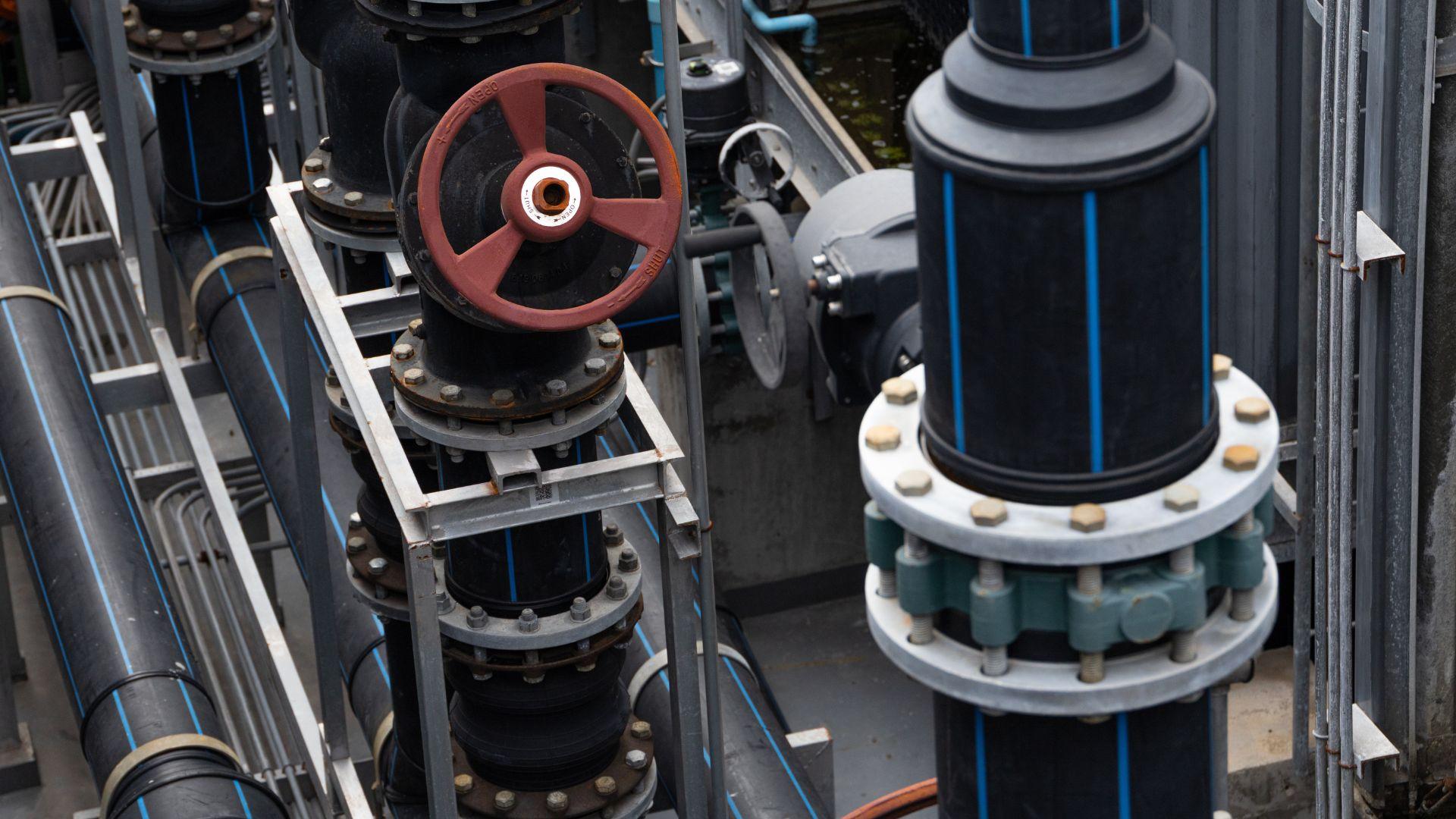

Chillers play an essential role in providing thermal management across commercial, industrial, and institutional applications. These systems remove heat from liquids through vapor-compression or absorption refrigeration cycles, ensuring optimal temperature control in buildings and industrial processes.

Across the United States, demand is rising in office complexes, shopping malls, hospitals, educational institutions, and manufacturing facilities. In addition, rapid expansion in data centers and pharmaceutical production has amplified the need for precision cooling systems.

Technological innovation is reshaping the industry. Modern chillers now incorporate variable-speed compressors, advanced heat exchangers, and intelligent control systems that optimize performance and reduce operational costs. Integration with building management systems allows real-time monitoring and predictive maintenance, minimizing downtime.

Furthermore, compliance with environmental regulations—particularly regarding refrigerant emissions and energy efficiency standards—has accelerated the transition toward eco-friendly and high-performance cooling systems.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=united-states-chillers-market-p.php

Key Factors Driving Market Growth

Rising Demand for Energy-Efficient Cooling Systems

Energy conservation has become a national priority across industries and commercial sectors. Increasing electricity costs and environmental regulations are prompting businesses to adopt chillers that offer higher efficiency and lower carbon footprints.

Advanced compressor technologies, low-global-warming-potential refrigerants, and intelligent load management systems are helping reduce energy consumption significantly. Organizations pursuing green building certifications increasingly prefer modern chiller systems aligned with sustainability objectives.

The shift toward environmentally responsible HVAC solutions is expected to remain a strong growth catalyst through 2033.

Expanding Commercial Infrastructure and Data Centers

The resurgence of commercial construction and renovation activities across the United States is fueling chiller demand. High-rise office towers, healthcare facilities, hospitality complexes, and retail centers require centralized cooling systems capable of handling large-scale thermal loads.

Simultaneously, the rapid growth of data centers—driven by cloud computing, artificial intelligence, and digital services—has created new opportunities. Data centers depend heavily on industrial-grade chillers to maintain stable temperatures and protect mission-critical equipment.

The intersection of digital expansion and real estate modernization is providing sustained momentum to the chiller market.

Technological Advancements and Smart HVAC Integration

The integration of Internet of Things (IoT) technologies and artificial intelligence into HVAC systems has transformed the chiller industry. Modern systems now include smart sensors, automated diagnostics, and predictive maintenance tools.

Digital twins and real-time analytics allow facility managers to monitor performance remotely, detect inefficiencies, and optimize energy usage. These innovations improve system reliability while lowering lifecycle costs.

As industries accelerate digital transformation, demand for adaptive and intelligent chiller systems is expected to rise steadily.

Challenges Facing the Market

High Initial Installation and Maintenance Costs

Chiller systems require significant upfront investment. Installation involves complex mechanical components, refrigerant systems, and customized integration into building infrastructure.

Although energy-efficient systems offer long-term savings, their higher capital cost may deter small and medium-sized enterprises. Additionally, skilled technicians are required for installation and maintenance, adding to operational expenses.

Cost considerations remain a short-term barrier to widespread adoption, particularly in budget-constrained sectors.

Stringent Environmental and Energy Regulations

The industry must comply with evolving environmental standards, particularly regarding refrigerant usage and greenhouse gas emissions. Regulations phasing out high global warming potential (GWP) refrigerants require manufacturers to redesign systems and adopt alternative technologies.

While these regulations promote sustainability, they also increase research, development, and compliance costs. Smaller manufacturers may face challenges adapting to regulatory transitions.

Nonetheless, long-term environmental commitments are expected to strengthen industry resilience and innovation.

State-Level Market Overview

California

California remains a leading market due to strict environmental regulations and strong adoption of green building standards. The state’s commitment to sustainability encourages the deployment of high-efficiency chillers using low-emission refrigerants.

Growing investments in healthcare infrastructure, technology hubs, and data centers further boost demand. California’s emphasis on renewable energy integration and smart building systems positions it as a frontrunner in chiller modernization.

Texas

Texas benefits from a rapidly expanding industrial base and consistently high cooling requirements due to its climate. Oil and gas facilities, manufacturing plants, and food processing industries rely heavily on industrial chillers.

The state’s growing data center footprint and commercial real estate development further strengthen demand. Energy-efficient and durable systems remain particularly attractive in this region.

New York

New York’s dense urban environment drives significant demand for centralized air conditioning systems in commercial and residential high-rises. Retrofitting and modernization of aging HVAC infrastructure contribute to replacement chiller installations.

Strict building codes and sustainability initiatives encourage adoption of advanced, low-emission cooling technologies. The healthcare and financial sectors also support steady demand.

Florida

Florida’s warm and humid climate makes cooling infrastructure essential year-round. Hospitality resorts, commercial complexes, and healthcare facilities depend heavily on efficient chiller systems.

The state’s tourism-driven economy ensures consistent infrastructure investment. Energy optimization initiatives and sustainable building practices further stimulate adoption of advanced chillers.

Recent Industry Developments

In May 2025, Modine Manufacturing Company announced an investment of over US$ 38 million to expand its data center chiller manufacturing capacity. This development reflects the growing importance of digital infrastructure cooling solutions in the U.S. market.

Market Segmentation

By Product

· Water-Cooled Chillers

· Air-Cooled Chillers

By Compressor Type

· Screw

· Centrifugal

· Absorption

· Scroll

· Reciprocating

By End User

· Chemicals and Petrochemicals

· Food and Beverages

· Medical

· Others

By States

California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona, Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky, and the Rest of the United States.

Competitive Landscape

The U.S. chillers market includes global HVAC leaders and specialized thermal management companies. Key players include:

· Mitsubishi Electric Corporation

· Daikin Industries Ltd.

· Dimplex Thermal Solutions

· LG Electronics

· Johnson Controls International Plc.

· Polyscience Inc.

· Smardt Chiller Group

· Thermax Ltd.

· Trane Technologies Plc

These companies are evaluated across comprehensive dimensions, including company overview, executive leadership, recent developments, SWOT analysis, sustainability initiatives, and revenue performance.

Market & Forecast Analysis

Historical Trends

The U.S. chillers market has evolved from conventional cooling systems toward high-efficiency, digitally integrated solutions. Industrial expansion and modernization of commercial spaces have consistently supported growth.

Forecast Outlook

With projected growth to US$ 4.95 billion by 2033, the industry is expected to benefit from increased digital infrastructure, stricter energy efficiency standards, and broader adoption of smart HVAC technologies.

Market Share Dynamics

Large multinational HVAC manufacturers dominate through technological innovation, global supply chains, and established service networks. However, niche players specializing in precision cooling and customized industrial solutions also maintain competitive positions.

Final Thoughts

The United States chillers market is navigating a transformative era marked by technological advancement, sustainability mandates, and digital infrastructure expansion. With expected growth from US$ 3.48 billion in 2024 to US$ 4.95 billion by 2033, the sector reflects stable and strategic expansion.

Energy efficiency, smart integration, and regulatory compliance are reshaping competitive strategies. While high installation costs and environmental transitions present short-term challenges, long-term prospects remain strong.

As industries modernize facilities and prioritize operational efficiency, chillers will remain indispensable to America’s commercial, industrial, and digital infrastructure landscape—cooling not just buildings, but the engines of economic growth.

Join our community to interact with posts!