Regional Overview of Executive Summary Business Travel Accident Insurance Market by Size and Share

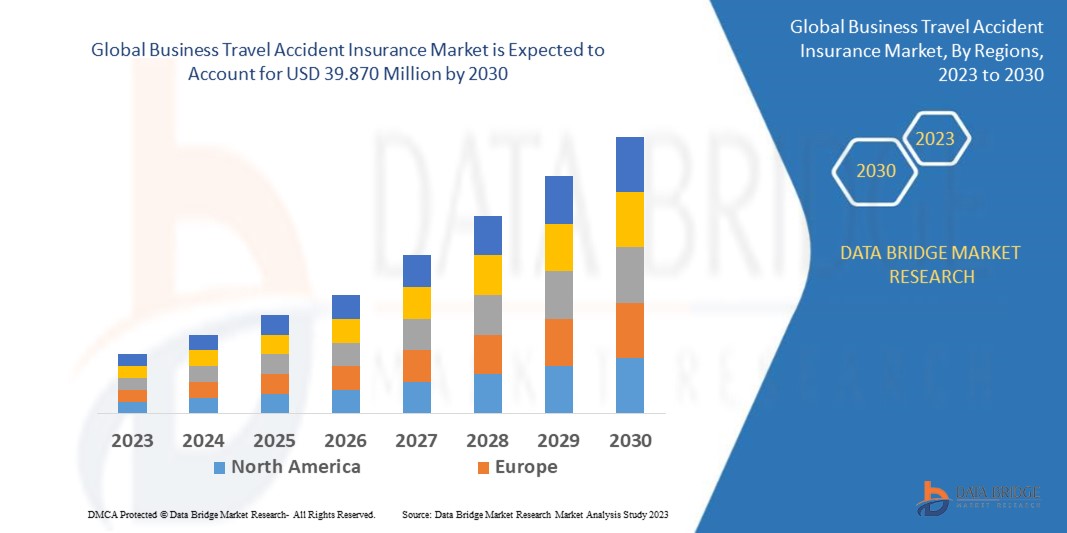

CAGR Value: Data Bridge Market Research analyses that the global business travel accident insurance market which was USD 3.970 million in 2022, is expected to reach USD 39.870 million by 2030, and is expected to undergo a CAGR of 9.90% during the forecast period 2023-2030.

With the superior Business Travel Accident Insurance Market report, get knowledge about the industry which explains what market definition, classifications, applications, engagements and market trends are. This report reveals the general market conditions, market trends, customer preferences, key players, current and future opportunities, geographical analysis and many other parameters that help drive the business into the right direction. The parameters of winning Business Travel Accident Insurance Market research report range from industry outlook, market analysis, currency and pricing, value chain analysis, market overview, premium insights, key insights to the company profile of the key market players.

Besides, with the help of an influential Business Travel Accident Insurance Market report, businesses can make out the reaction of the consumers to an already existing product in the market. This Business Travel Accident Insurance Market research report gives details about the market definition, market drivers, market restraints, market segmentation with respect to product usage and geographical conditions, key developments taking place in the market, competitor analysis, and the research methodology. The analysis and estimations carried out via Business Travel Accident Insurance Market research report assist to get the details about the product launches, future products, joint ventures, Market strategy, developments, mergers and acquisitions and effect of the same on sales, Market, promotions, revenue, import, export, and CAGR values.

Learn how the Business Travel Accident Insurance Market is evolving—insights, trends, and opportunities await. Download report:

https://www.databridgemarketresearch.com/reports/global-business-travel-accident-insurance-market

Business Travel Accident Insurance Market Introduction

**Segments**

- By Type: The business travel accident insurance market can be segmented into individual coverage and group coverage. Individual coverage provides insurance protection to a single individual, typically for a specific trip or period. Group coverage, on the other hand, offers insurance to a group of individuals traveling together for business purposes, often as part of a corporate policy.

- By Application: This market segment can be further divided into small and medium-sized enterprises (SMEs), large enterprises, government organizations, and others. Different sizes and types of businesses have varying insurance needs and requirements based on the scale of their operations and the number of employees traveling for business purposes.

**Market Players**

- AIG: A leading provider of business travel accident insurance, AIG offers a range of insurance products designed to meet the specific needs of business travelers. With a global network and a reputation for excellence, AIG is a key player in this market.

- Allianz: Another prominent player in the business travel accident insurance market, Allianz offers comprehensive insurance solutions for corporate clients and business travelers. With a focus on innovation and customer service, Allianz is a trusted partner for many companies worldwide.

- Chubb: Chubb is known for its tailored insurance solutions for businesses of all sizes, including business travel accident insurance. With a strong emphasis on risk management and customer satisfaction, Chubb is a reliable choice for companies looking to protect their employees during business travel.

The business travel accident insurance market is a dynamic and competitive industry with several key players vying for market share. These market players are continuously innovating their products and services to meet the evolving needs of businesses and travelers. As globalization and international business travel continue to grow, the demand for business travel accident insurance is also on the rise. Companies are increasingly recognizing the importance of protecting their employees during travel, leading to a growing adoption of insurance solutions in this market.

Overall, the business travel accident insurance market is expected to witness significant growth in the coming years as businesses prioritize the safety and well-being of their employees. With a diverse range of market players offering innovative insurance solutions, businesses have a wide selection of options to choose from based on their specific needs and requirements.

The business travel accident insurance market is experiencing a significant shift driven by changing dynamics in the global business landscape. One emerging trend in the market is the increasing focus on customization and flexibility in insurance solutions. As businesses become more diverse in terms of size, operations, and travel requirements, there is a growing demand for tailored insurance products that can address the specific needs of each company. Market players are responding to this trend by offering a wider range of coverage options and policy features that can be customized to suit individual business requirements.

Another key development in the business travel accident insurance market is the integration of technology and data analytics into insurance solutions. With the rise of digital platforms and advanced analytics tools, insurance providers are leveraging technology to enhance their underwriting processes, streamline claims management, and improve the overall customer experience. By harnessing the power of data, insurers can gain valuable insights into risk factors, customer behaviors, and market trends, allowing them to develop more effective and efficient insurance solutions for business travelers.

Moreover, sustainability and social responsibility are becoming increasingly important considerations for businesses when choosing insurance providers. As corporate social responsibility initiatives gain traction across industries, businesses are looking for insurance partners that demonstrate a commitment to environmental sustainability, ethical practices, and social impact. Insurance providers that prioritize sustainability and corporate responsibility in their operations are likely to gain a competitive edge in the market and attract businesses that share similar values.

Furthermore, the business travel accident insurance market is witnessing a growing emphasis on employee wellness and holistic risk management. In addition to providing financial protection in the event of accidents or emergencies during business travel, insurance providers are expanding their offerings to include value-added services such as wellness programs, mental health support, and travel safety resources. By taking a more comprehensive approach to risk management, insurers can help businesses safeguard the health and well-being of their employees while enhancing overall travel security and resilience.

In conclusion, the business travel accident insurance market is undergoing a period of transformation driven by evolving customer preferences, technological advancements, and changing industry dynamics. As businesses continue to prioritize employee safety and well-being during travel, insurance providers are adapting their offerings to meet the evolving needs of the market. By focusing on customization, technology integration, sustainability, and holistic risk management, market players can differentiate themselves in a competitive landscape and position themselves as trusted partners for businesses seeking comprehensive insurance solutions for their travelers.The business travel accident insurance market is constantly evolving to meet the changing needs and preferences of businesses and travelers. One key trend shaping the market is the increasing demand for customization and flexibility in insurance solutions. Companies are seeking tailored products that can cater to their unique requirements based on their size, operations, and travel patterns. This trend has led market players to offer a diverse range of coverage options and policy features that can be personalized to address specific business needs effectively.

Furthermore, the integration of technology and data analytics is playing a crucial role in transforming the business travel accident insurance market. Insurance providers are leveraging digital platforms and advanced analytics tools to enhance underwriting processes, streamline claims management, and elevate the overall customer experience. By harnessing data-driven insights, insurers can gain a deeper understanding of risk factors, customer behaviors, and market dynamics, enabling them to develop more efficient and effective insurance solutions for business travelers.

Sustainability and social responsibility have also emerged as significant considerations for businesses when selecting insurance partners. Corporate social responsibility initiatives are gaining prominence, leading companies to seek insurance providers that demonstrate a commitment to environmental sustainability, ethical practices, and social impact. Insurers that prioritize sustainability and corporate responsibility stand to gain a competitive advantage in the market by aligning with businesses that share similar values and priorities.

Moreover, there is a growing emphasis on employee wellness and holistic risk management in the business travel accident insurance market. In addition to financial protection for accidents and emergencies during travel, insurance providers are expanding their offerings to include value-added services such as wellness programs, mental health support, and travel safety resources. By taking a comprehensive approach to risk management, insurers can help businesses enhance the health and well-being of their employees while strengthening overall travel security and resilience.

In conclusion, the business travel accident insurance market is undergoing a transformative phase driven by evolving industry trends and customer expectations. Market players that focus on customization, technology integration, sustainability, and holistic risk management are well-positioned to differentiate themselves in a competitive landscape and establish themselves as trusted partners for businesses seeking comprehensive insurance solutions for their travelers. As the market continues to evolve, innovation and adaptability will be key to success for insurance providers looking to capture the rising demand for business travel accident insurance.

Gain insights into the firm’s market contribution

https://www.databridgemarketresearch.com/reports/global-business-travel-accident-insurance-market/companies

Business Travel Accident Insurance Market – Analyst-Ready Question Batches

- What is the global market size of the Business Travel Accident Insurance Market in 2025?

- What is the expected Business Travel Accident Insurance Market value in 2032?

- What segmentation is used in the Business Travel Accident Insurance Market analysis?

- Which brands are top contenders in this space?

- What new launches gained the most attention recently?

- Which regions are included in the global Business Travel Accident Insurance Market map?

- Which geographic Business Travel Accident Insurance Market is growing the fastest?

- Which countries are emerging as high-growth zones?

- What region leads in terms of profit contribution?

- What are the key challenges the Business Travel Accident Insurance Market faces?

Browse More Reports:

Global Optical Frequency Domain Reflectometry (OFDR) Market

Global Organic Peroxide Market

Global Orthopedic Devices Market

Global Password Based Authentication Market

Global Perlite Market

Global Pet Beds Market

Global Photosensitive Glass Market

Global Polybutylene Adipate Terephthalate (PBAT) Market

Global Polyester Fiber Market

Global Position Sensor Market

Global Preimplantation Genetic Screening (PGS) Technology Market

Global Protein Hydrolysates for Animal Feed Application Market

Global Pruritus Drug Market

Global Reconstructive Surgery Market

Global Reinforced Concrete Floor Market

Middle East and Africa Menstrual Cramp Treatment Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

Join our community to interact with posts!