Introduction

When I help clients start their nonprofit journey, I always explain why 12A registration plays a crucial role in long-term sustainability. At NGO Experts, I guide organizations step by step so they not only complete the legal process but also build a strong compliance foundation. Moreover, I ensure that every client understands how 12A connects with the overall ngo procedure for registration and darpan ngo registration.

What is 12A Registration?

12A registration allows an NGO to claim income tax exemption under the Income Tax Act. In simple terms, once you secure this registration, your organization does not pay tax on surplus income used for charitable purposes. Therefore, it directly supports your mission and improves financial credibility.

In addition, donors and funding agencies prefer NGOs that hold valid 12A certification. Consequently, your organization gains trust and attracts more contributions.

Why 12A Registration Matters for NGOs ?

First of all, tax exemption reduces your financial burden. As a result, you can reinvest funds into welfare projects. Furthermore, it strengthens your legal standing and improves transparency.

At NGO Experts, I have seen that NGOs without 12A registration often struggle to secure grants. On the other hand, registered organizations confidently approach CSR donors and institutions. Thus, completing this process early makes a significant difference.

NGO Procedure for Registration Before 12A

Before applying for 12A, I always ensure that the basic ngo procedure for registration is completed correctly. This step forms the legal identity of your organization.

Step 1: Choose the Type of NGO

You can register as:

- Trust

- Society

- Section 8 Company

Each structure has its own compliance requirements. However, I help you select the most suitable option based on your goals.

Step 2: Obtain Registration Certificate

After selecting the structure, I prepare documents such as:

- Trust Deed or MOA

- Identity and address proof of members

- Registered office proof

Once approved, the authority issues your registration certificate. Only then can you proceed toward 12A.

Role of Darpan NGO Registration

Many clients ask me whether darpan ngo registration is mandatory. Although it does not replace 12A, it plays an important role in government funding.

Darpan registration, completed on the NITI Aayog portal, provides a unique ID to NGOs. Consequently, it becomes easier to apply for government grants and schemes. Therefore, I recommend completing darpan ngo registration alongside your 12A process for better credibility.

Documents Required for 12A

When I prepare an application for 12A, I collect and verify the following documents:

- NGO registration certificate

- PAN card of the NGO

- Trust deed or MOA

- Details of trustees or directors

- Financial statements (if applicable)

- Activity report

After that, I filed Form 10A online through the Income Tax portal. Additionally, I ensure that every document matches compliance standards to avoid delays.

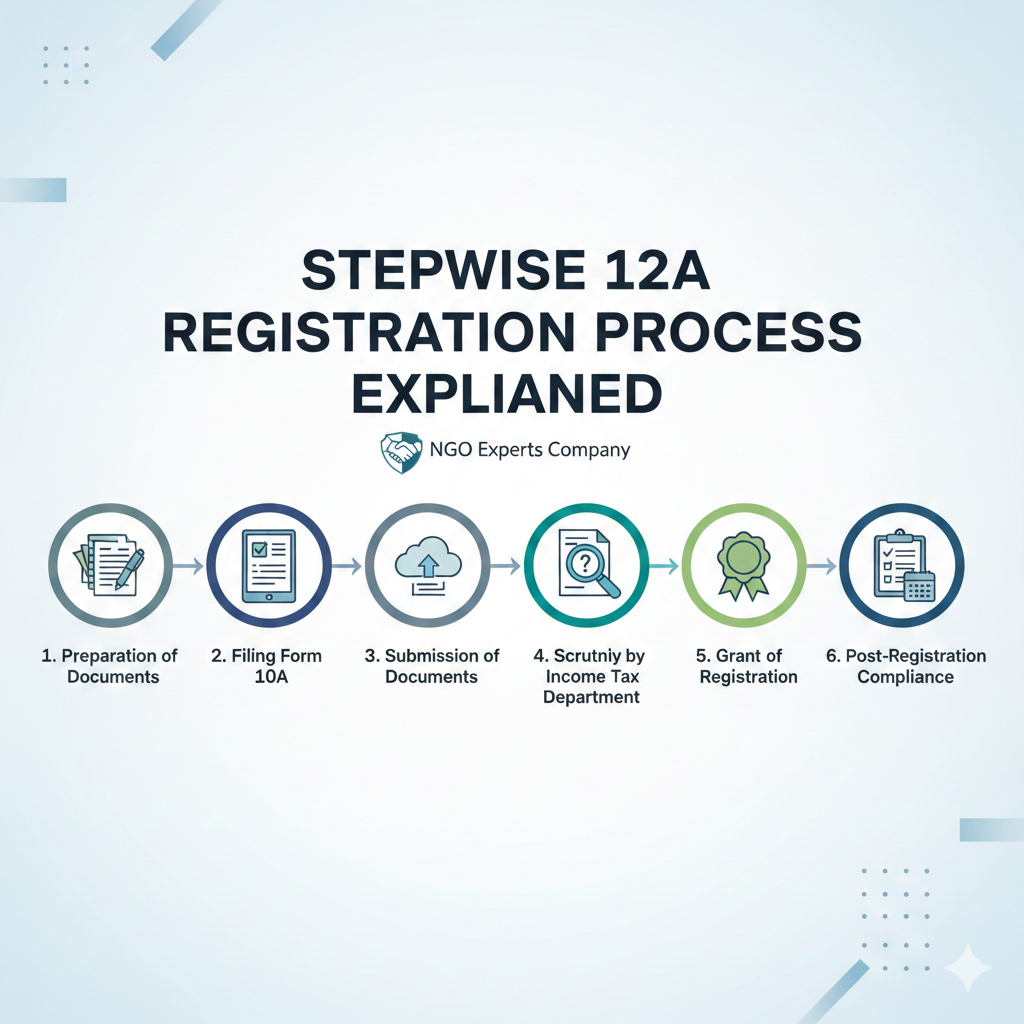

Step-by-Step Process of 12A Registration

1. Document Preparation

First, I review your legal structure and financial records. Then, I organize the required documents carefully.

2. Online Application Filing

Next, I submit Form 10A digitally using DSC or EVC verification. Accuracy at this stage prevents rejection.

3. Department Review

After submission, the Income Tax Department may request clarification. Therefore, I stay proactive and respond quickly.

4. Approval Certificate

Once approved, you receive the 12A certificate. From that point onward, your NGO becomes eligible for tax exemption benefits.

Common Mistakes to Avoid

Many NGOs delay their 12A, assuming they can apply later. However, this delay often causes funding setbacks. Moreover, incomplete documentation leads to unnecessary notices.

I always advise clients to maintain transparent records, update objectives clearly, and complete darpan ngo registration simultaneously. As a result, compliance remains smooth and stress-free.

How Do I Help NGO Experts ?

At NGO Experts, I do more than just file forms. Instead, I provide complete support from ngo procedure for registration to darpan ngo registration and finally 12A.

Furthermore, I offer personalized consultation to understand your NGO’s mission. Then, I design a structured compliance plan so you avoid legal risks. In addition, I assist with related registrations like 80G and CSR-1, ensuring long-term operational growth.

Conclusion

If you want your NGO to grow legally and financially, 12A registration should be your priority. Not only does it provide tax exemption, but it also strengthens donor confidence. Meanwhile, completing the ngo procedure for registration and darpan ngo registration builds a solid compliance base.

At NGO Experts, I make the entire process clear, structured, and efficient. Therefore, you can focus on your social mission while I handle the legal framework professionally.

Join our community to interact with posts!